Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering purchasing a CNC machine which costs $180,000. This machine will have an estimated service life of 11 years with a net after-tax

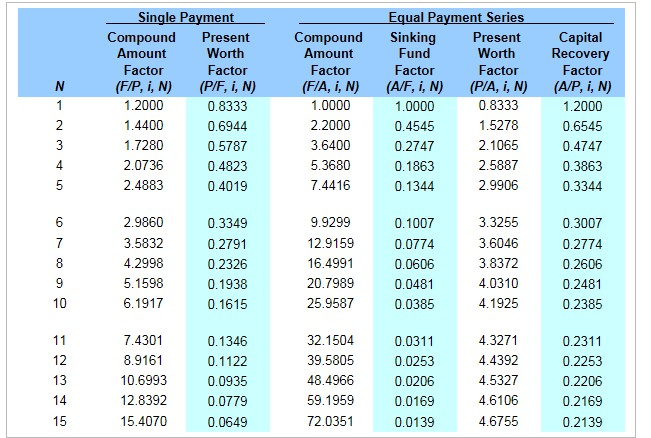

You are considering purchasing a CNC machine which costs $180,000. This machine will have an estimated service life of 11 years with a net after-tax salvage value of $18,000. Its annual after-tax operating and maintenance costs are estimated to be $43,000. To expect an 20% rate of return on investment, what would be the required minimum annual after-tax revenues?

The required minimum annual after-tax revenues would be () thousand. (Round to one decimal place.)

10 11 12 13 14 15 Single Payment Equal Payment Series Compound Present Compound Sinking Worth Amount Fund Factor Factor Factor Present Amount Worth Factor Factor (FIP, i, N) (P/F, i, N) (FA, i, N) (A/F, i, N) (PA, i, N) 2000 0.8333 0.8333 0000 1.0000 4400 0.6944 2.2000 5278 0.4545 1.7280 3.6400 0.2747 2.1065 0.5787 0.4823 2.0736 5.3680 2.5887 0.1863 2.4883 7.4416 2.9906 0.4019 0.1344 2.9860 12.9159 3.6046 0.0774 16.4991 3.8372 A 0310 20.7989 25.9587 32.1504 7.4301 4.3271 0.1346 0.0311 4.4392 8.916 39.5805 0.0253 0.11 22 10.6993 0.0935 48.4966 0.0206 4.5327 12.8392 0.0779 59.1959 4.6106 0.0169 0.0139 72.0351 15.4070 0.0649 4.6755 Capital Recovery Factor (AMP, i, N) 1.2000 0.6545 0.4747 0.3863 0.3344 0.2311 0.2253 0.2206 0.2169 0.2139

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started