Question

You are considering purchasing a portfolio of two stocks. XYZ has a variance of 0.04 and ABC has a variance of 0.09. If we

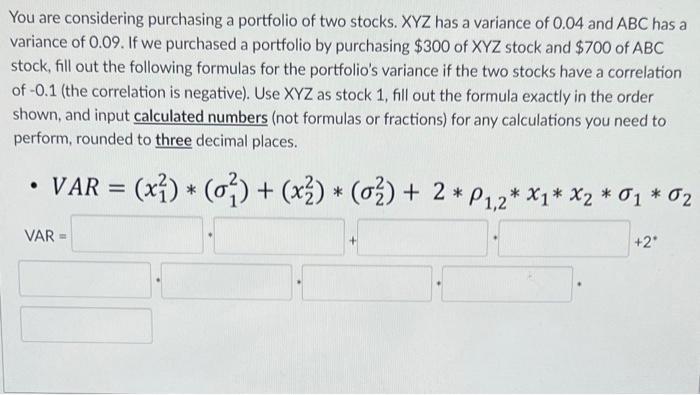

You are considering purchasing a portfolio of two stocks. XYZ has a variance of 0.04 and ABC has a variance of 0.09. If we purchased a portfolio by purchasing $300 of XYZ stock and $700 of ABC stock, fill out the following formulas for the portfolio's variance if the two stocks have a correlation of -0.1 (the correlation is negative). Use XYZ as stock 1, fill out the formula exactly in the order shown, and input calculated numbers (not formulas or fractions) for any calculations you need to perform, rounded to three decimal places. VAR = (x) * (o) + (x2) * (o2) + 2 * P1,2* x1* X2 * O1 * O2 VAR = +2*

Step by Step Solution

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

VaRExpected Weighted Return of the Portfolio zscore of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Jonathan Berk and Peter DeMarzo

3rd edition

978-0132992473, 132992477, 978-0133097894

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App