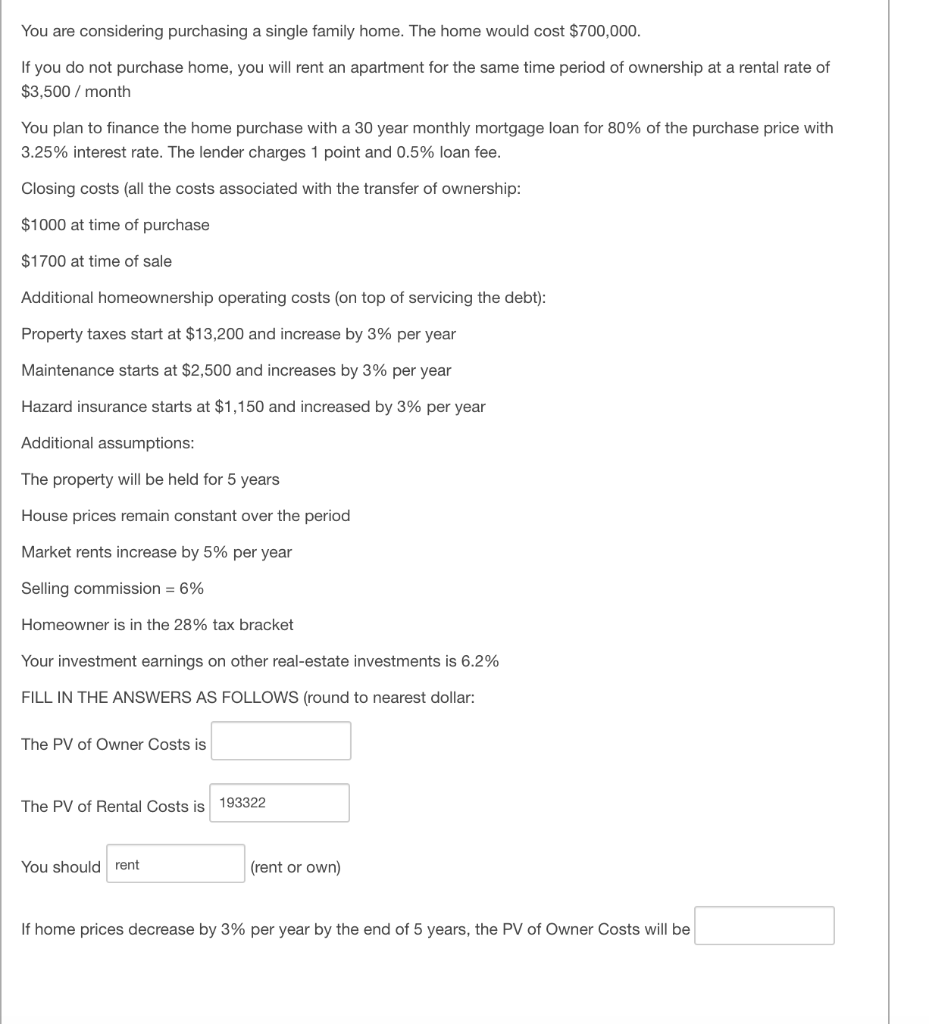

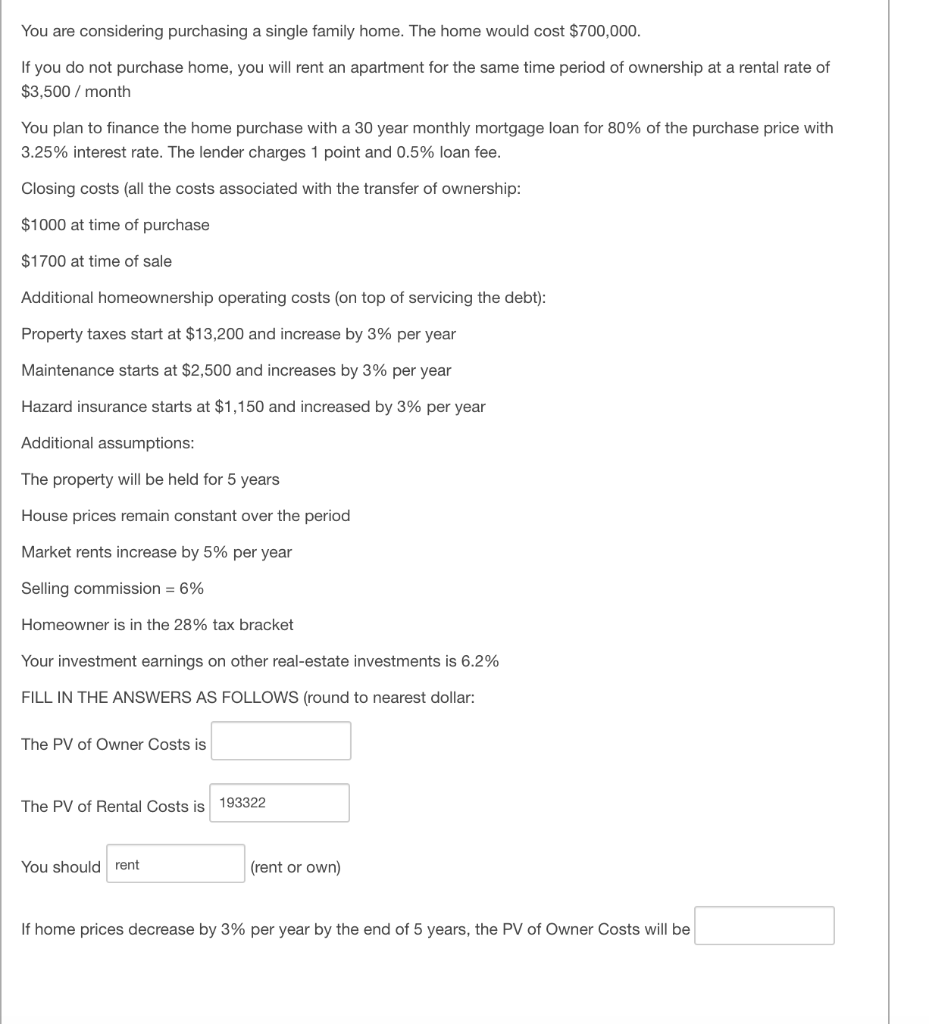

You are considering purchasing a single family home. The home would cost $700,000. If you do not purchase home, you will rent an apartment for the same time period of ownership at a rental rate of $3,500/month You plan to finance the home purchase with a 30 year monthly mortgage loan for 80% of the purchase price with 3.25% interest rate. The lender charges 1 point and 0.5% loan fee. Closing costs (all the costs associated with the transfer of ownership: $1000 at time of purchase $1700 at time of sale Additional homeownership operating costs (on top of servicing the debt): Property taxes start at $13,200 and increase by 3% per year Maintenance starts at $2,500 and increases by 3% per year Hazard insurance starts at $1,150 and increased by 3% per year Additional assumptions: The property will be held for 5 years House prices remain constant over the period Market rents increase by 5% per year Selling commission = 6% Homeowner is in the 28% tax bracket Your investment earnings on other real-estate investments is 6.2% FILL IN THE ANSWERS AS FOLLOWS (round to nearest dollar: The PV of Owner Costs is The PV of Rental Costs is 193322 You should rent (rent or own) If home prices decrease by 3% per year by the end of 5 years, the PV of Owner Costs will be You are considering purchasing a single family home. The home would cost $700,000. If you do not purchase home, you will rent an apartment for the same time period of ownership at a rental rate of $3,500/month You plan to finance the home purchase with a 30 year monthly mortgage loan for 80% of the purchase price with 3.25% interest rate. The lender charges 1 point and 0.5% loan fee. Closing costs (all the costs associated with the transfer of ownership: $1000 at time of purchase $1700 at time of sale Additional homeownership operating costs (on top of servicing the debt): Property taxes start at $13,200 and increase by 3% per year Maintenance starts at $2,500 and increases by 3% per year Hazard insurance starts at $1,150 and increased by 3% per year Additional assumptions: The property will be held for 5 years House prices remain constant over the period Market rents increase by 5% per year Selling commission = 6% Homeowner is in the 28% tax bracket Your investment earnings on other real-estate investments is 6.2% FILL IN THE ANSWERS AS FOLLOWS (round to nearest dollar: The PV of Owner Costs is The PV of Rental Costs is 193322 You should rent (rent or own) If home prices decrease by 3% per year by the end of 5 years, the PV of Owner Costs will be