Answered step by step

Verified Expert Solution

Question

1 Approved Answer

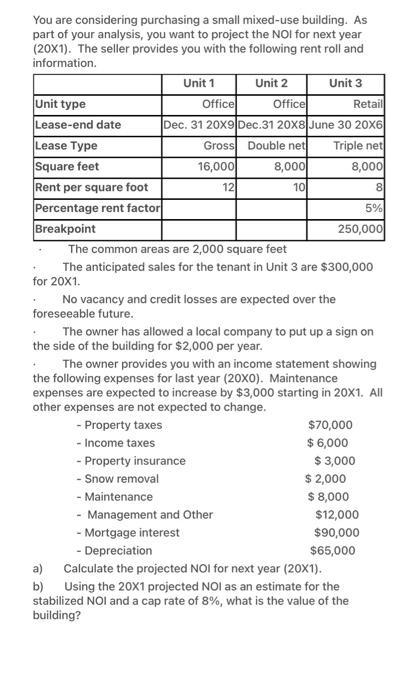

You are considering purchasing a small mixed-use building. As part of your analysis, you want to project the NOI for next year (20X1). The

You are considering purchasing a small mixed-use building. As part of your analysis, you want to project the NOI for next year (20X1). The seller provides you with the following rent roll and information. Unit type Lease-end date Lease Type Square feet Rent per square foot Percentage rent factor Breakpoint Unit 1 Unit 2 The common areas are 2,000 square feet The anticipated sales for the tenant in Unit 3 are $300,000 for 20X1. . No vacancy and credit losses are expected over the foreseeable future. - Property taxes - Income taxes a) b) Unit 3 Office Office Retail Dec. 31 20x9 Dec.31 20X8 June 30 20X6 Gross Double net Triple net 16,000 8,000 8,000 12 10 8 5% 250,000 . The owner has allowed a local company to put up a sign on the side of the building for $2,000 per year. The owner provides you with an income statement showing the following expenses for last year (20X0). Maintenance expenses are expected to increase by $3,000 starting in 20X1. All other expenses are not expected to change. - Property insurance - Snow removal $70,000 $ 6,000 $ 3,000 $ 2,000 $ 8,000 - Maintenance - Management and Other - Mortgage interest - Depreciation Calculate the projected NOI for next year (20X1). Using the 20X1 projected NOI as an estimate for the stabilized NOI and a cap rate of 8%, what is the value of the building? $12,000 $90,000 $65,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the projected Net Operating Income NOI for next year 20X1 we need to consider the renta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started