Question

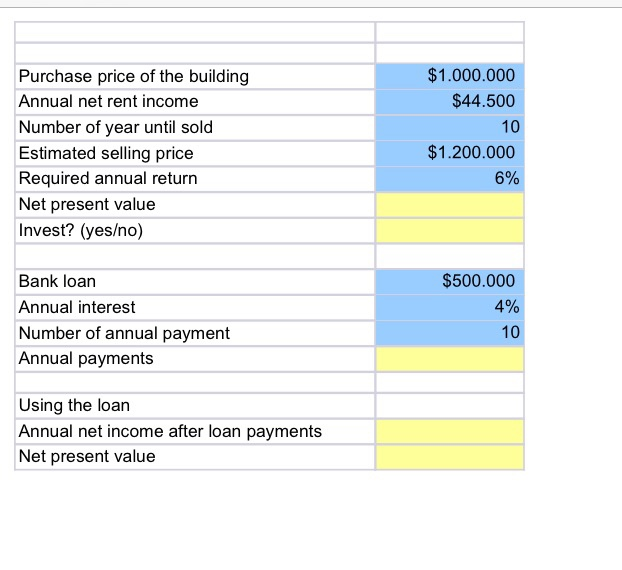

You are considering purchasing an office building that costs $1,000,000. After operating expenses you estimate that the building will generate $44,500 rent income. You plan

You are considering purchasing an office building that costs $1,000,000. After operating expenses you estimate that the building will generate $44,500 rent income. You plan to keep the building for 10 years, at the end of which you will sell it at an estimated price of $1,200,000.

a) Assuming that you want a minimum return of 6% per year, calculate the net present value of this investment. Should you invest?

You have talked to a banker who is willing to give you a loan of $500,000 which you will pay back over 10 years at an annual interest rate of 4%. Assume you will pay back your loan with annual payments at the end of each year.

b) Calculate the annual loan payments to the bank.

c) Assuming you take the loan, calculate the net present value of the investment. Enter formulas ONLY to CELLS B17 and B18 for calculation. Do not use any cells other than already provided in the worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started