Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering purchasing some shares of West Wing Inc. ( WW ) to add to your portfolio. The stock is currently quoted at $

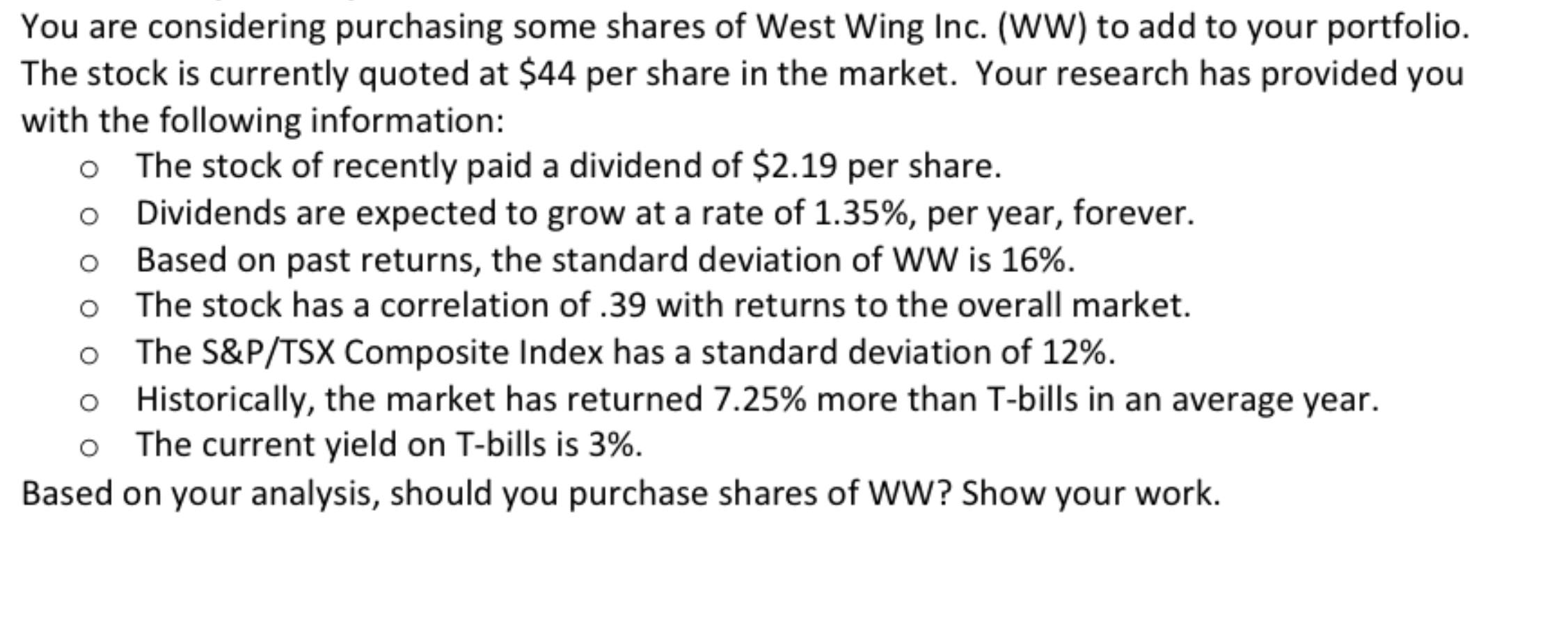

You are considering purchasing some shares of West Wing Inc. WW to add to your portfolio.

The stock is currently quoted at $ per share in the market. Your research has provided you

with the following information:

The stock of recently paid a dividend of $ per share.

Dividends are expected to grow at a rate of per year, forever.

Based on past returns, the standard deviation of WW is

The stock has a correlation of with returns to the overall market.

The S&PTSX Composite Index has a standard deviation of

Historically, the market has returned more than Tbills in an average year.

The current yield on Tbills is

Based on your analysis, should you purchase shares of WW Show your work.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started