Question

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life

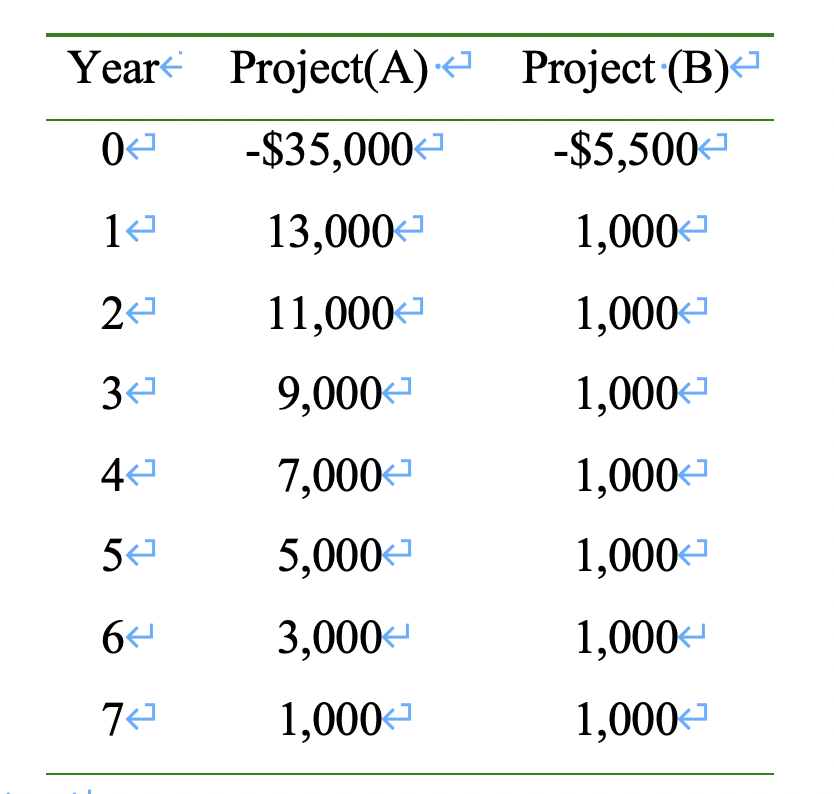

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.

The required rate of return is 10%.

a. What is the NPV for each of the projects? Which project should be accepted if NPV method is applied? Explain why.

b. What is the IRR for each of the projects? Which project should be accepted if IRR method is applied? Explain why.

c. What is the payback period for each of the projects? Which project should be accepted if payback period method is applied? Assume that the target payback period is 4 years. Explain why.

d. What is the discounted payback period for each of the projects? Which project should be accepted if discounted payback period method is applied? Assume that the target discounted payback period is 4 years. Explain why.

Explain why.

e. What is the profitability index for each of the projects? Which project should be accepted if profitability index method is applied? Explain why.

f. What is the average accounting return (AAR) for each of the projects, assuming that cash flows occurring after year 0 are net income? Which project should be accepted if AAR method is applied? Also, assume that the target AAR is 40%.

g. Define and find the crossover rate.

h. Sketch the NPV profile. Plot all the relevant coordinates (i.e., the points on the x and y axis; and the cross-over rate) on the graph.

Year Project(A) Project (B) 04 -$35,000 -$5,500 16 13,000 1,000 24 11,000 1,000 34 9,000 1,000 44 7,000 1,000 54 5,000 1,000 6 3,000 1,000+ 72 1,000 1,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started