Question

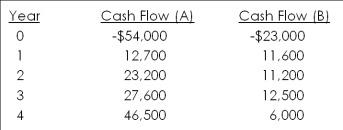

You are considering the following two mutually exclusive projects. The required return on each project is 14 percent. (i) Calculate the Payback period of both

You are considering the following two mutually exclusive projects. The required return on each project is 14 percent.

(i) Calculate the Payback period of both projects. (2 marks)

(ii) State two advantages and two disadvantages of Payback period rule? (2 marks)

(iii) Calculate the IRR of both projects. (2 marks)

(iv) Under what circumstances IRR may generate wrong decision? (3 marks)

(v) Calculate the NPV of both projects (2 marks)

(vi) Which project should you accept and what is the best reason for that decision? (2 marks)

Please show all the steps, thank you.

Year 1 2 3 4 Cash Flow (A) -$54,000 12,700 23,200 27,600 46,500 Cash Flow (B) -$23,000 11,600 11,200 12,500 6,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started