Answered step by step

Verified Expert Solution

Question

1 Approved Answer

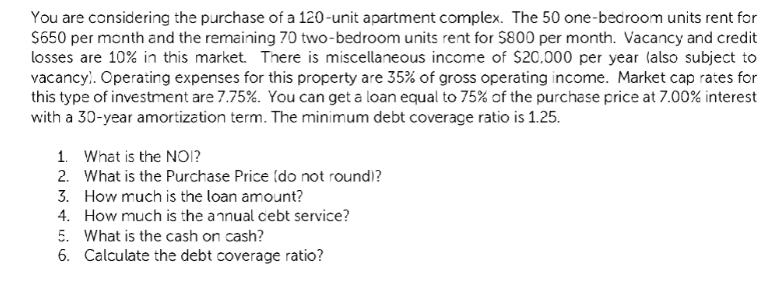

You are considering the purchase of a 120-unit apartment complex. The 50 one-bedroom units rent for $650 per month and the remaining 70 two-bedroom

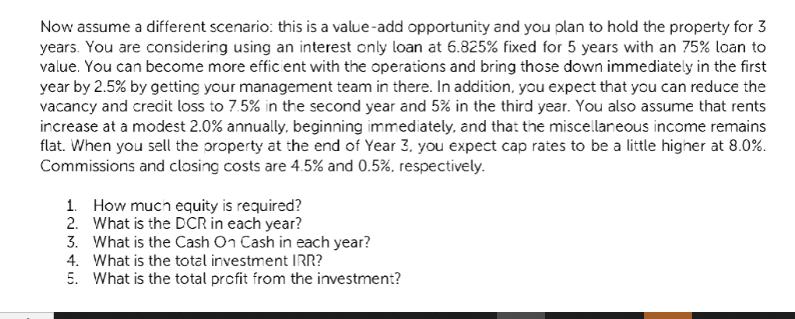

You are considering the purchase of a 120-unit apartment complex. The 50 one-bedroom units rent for $650 per month and the remaining 70 two-bedroom units rent for $800 per month. Vacancy and credit losses are 10% in this market. There is miscellaneous income of $20,000 per year (also subject to vacancy). Operating expenses for this property are 35% of gross operating income. Market cap rates for this type of investment are 7.75%. You can get a loan equal to 75% of the purchase price at 7.00% interest with a 30-year amortization term. The minimum debt coverage ratio is 1.25. 1. What is the NOI? 2. What is the Purchase Price (do not round)? 3. How much is the loan amount? 4. How much is the annual cebt service? 5. What is the cash on cash? 6. Calculate the debt coverage ratio? Now assume a different scenario: this is a value-add opportunity and you plan to hold the property for 3 years. You are considering using an interest only loan at 6.825% fixed for 5 years with an 75% loan to value. You can become more efficent with the operations and bring those down immediately in the first year by 2.5% by getting your management team in there. In addition, you expect that you can reduce the vacancy and credit loss to 7.5% in the second year and 5% in the third year. You also assume that rents increase at a modest 2.0% annually, beginning immediately, and that the miscellaneous income remains flat. When you sell the property at the end of Year 3, you expect cap rates to be a little higher at 8.0%. Commissions and closing costs are 4.5% and 0.5%, respectively. 1. How much equity is required? 2. What is the DCR in each year? 3. What is the Cash On Cash in each year? 4. What is the total investment IRR? 5. What is the total profit from the investment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started