Question

. You are considering the purchase of a retail shopping center in the Inland Empire County with 60,000 square feet of rentable area. It currently

. You are considering the purchase of a retail shopping center in the Inland Empire County with 60,000 square feet of rentable area. It currently has four tenants: one large anchor tenant that rents 36,000 square feet and three smaller in-line tenants that split 24,000 square feet equally. The anchor tenants parent company has just filed for bankruptcy. You expect them to vacate the space within the next 12 months, and if the shopping center doesnt have a strong anchor tenant, the in-line tenants will want to leave too. Youre not surprised to learn that the landlord wants to get rid of the property, especially when you visit the site for yourself and discover that it needs a serious makeover. If you buy it, you will have to invest in significant maintenance and renovation, especially to meet the demands of the new generation of young consumers. You ask to see the current operating statement, and it reveals that the shopping center earned an NOI of $420,000 over the past year. You and the landlord agree to classify it as a Class B property. To calculate her asking price, the landlord goes to the CBRE cap rate survey, where she discovers that the average Class B property has a cap rate of approximately 7% in the Inland Empire.

1. Using this information, what price does she ask for the property?

You check the CBRE survey yourself, and you notice that the cap rate goes up to 8% for developers who buy depreciated properties and add value through renovations, which is obviously needed here. You argue that this cap rate is a more reasonable assumption to counter her offer.

2. Using this new information, what price do you offer instead?

The landlord agrees to your offer. You go to the bank to get financing for the acquisition. They offer a 70% LTV loan with monthly mortgage payments of $26,965.85 and a balloon payment of $3,493,817 at the end of year 5, but they will foreclose on the property if the DCR drops below 1.2 in any of the first four years. You accept the deal.

3. How large is the loan? How large is your initial equity investment?

4. How low is your NOI allowed to fall in the first four years before the bank will foreclose?

5. Assuming the rents and operating expenses dont change over the next year, how much can you afford to spend on CAPEX without getting foreclosed on?

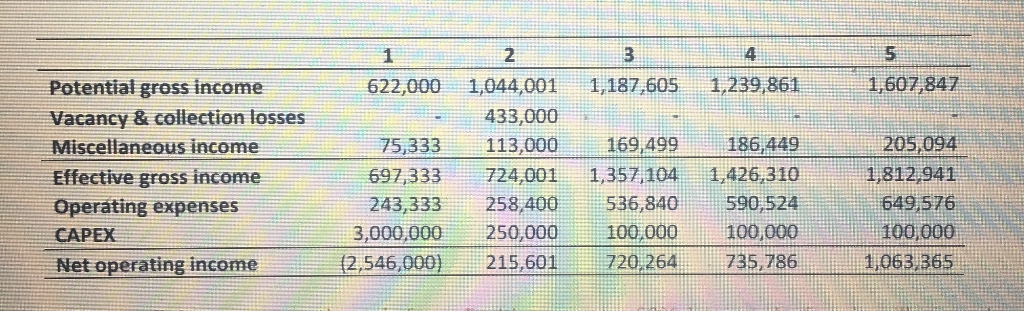

You realize that this budget isnt enough for your bold redevelopment plans. Youll need to partner with another investor who has the extra capital. You prepare the following pro forma operating statement to show investors your projections for the next five years:

6. If you sell the property at the end of year 5 with a cap rate of 9%, how much of a gain will you and your partner have to split after paying the balloon payment on the loan?

7. Calculate the before-tax cash flows for all years.

8. If your partner receives 40% of the BTCFs in years 2, 3, 4, and 5, what is the IRR on his $3 million investment in year 1?

5 4 622,000 1,044,001 1,187,605 1,239,8611,607,847 Potential gross income Vacancy & collection losses Miscellaneous income Effective gross income Operating expenses CAPEX 433,000 75,333 113,000169,499 186,449205,094 1812 941 697,333724,001 1,357 104 1,426,3101 243,333 258400 536,840590,524 3,000,000 250,000 100000 100,000 Net operating income(2,546,000) 215,601720.264735,786 649576 100,000 11063 1365 5 4 622,000 1,044,001 1,187,605 1,239,8611,607,847 Potential gross income Vacancy & collection losses Miscellaneous income Effective gross income Operating expenses CAPEX 433,000 75,333 113,000169,499 186,449205,094 1812 941 697,333724,001 1,357 104 1,426,3101 243,333 258400 536,840590,524 3,000,000 250,000 100000 100,000 Net operating income(2,546,000) 215,601720.264735,786 649576 100,000 11063 1365Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started