Question

You are considering the purchase of an apartment complex. The following assumptions are made: Purchase price $1 million Potential gross income for year 1 is

You are considering the purchase of an apartment complex. The following assumptions are made:

-

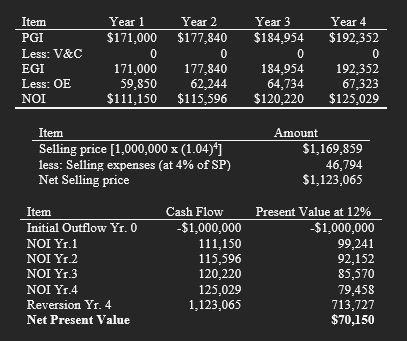

Purchase price $1 million

-

Potential gross income for year 1 is $171,000 with 4% increases per year projected.

-

No vacancies are expected

-

Operating expenses including CAPX are estimated at 35% of effective gross income

-

The market value of the investment is expected to increase 4% per year

-

Selling expenses will be 4%

-

The holding period will be 4 years

-

The appropriate unlevered return rate of return to discount projected NOIs and the projected net selling price (NSP) is 12%.

-

The required levered rate of return is 14%.

-

70% of the acquisition price can be borrowed with a 30-year, monthly payment mortgage.

-

The interest rate on the mortgage is 8% per year

-

Financing costs equal 2% of the loan amount

-

There are no prepayment penalties on the loan

Calculate the IRR of this investment assuming no mortgage debt. Should you purchase? Why or why not?

Helpful calculations:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started