Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are contacted by the business named Speedo Cycle seeking another accounting consultation. They would like to gain a better idea of which areas

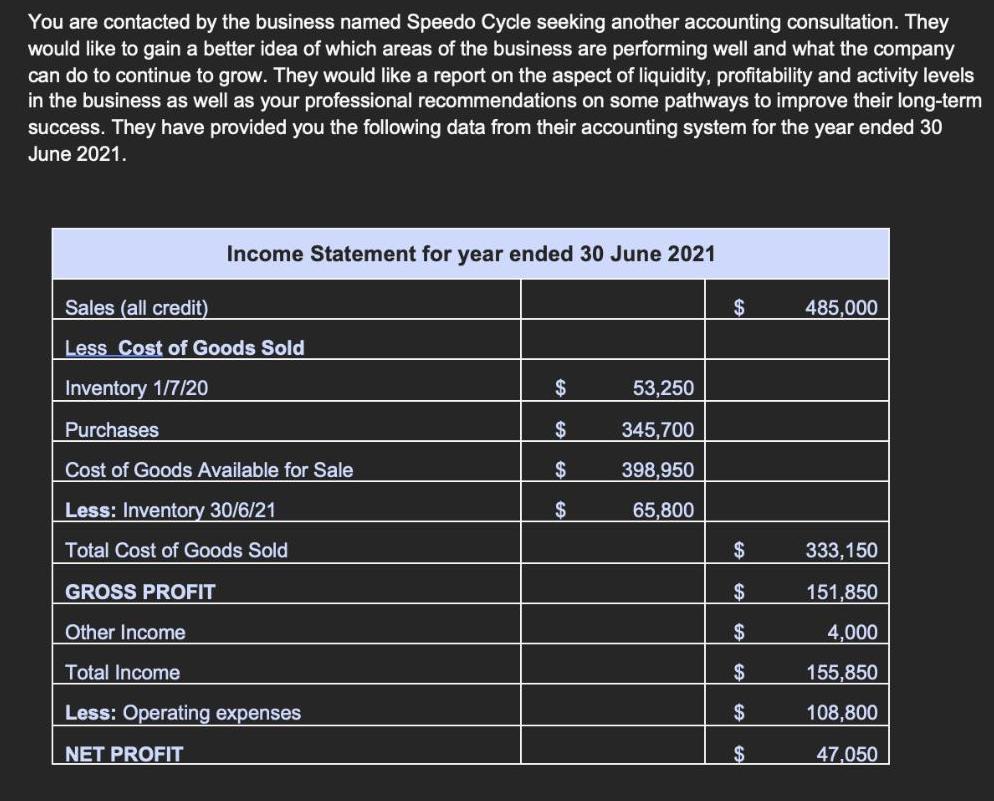

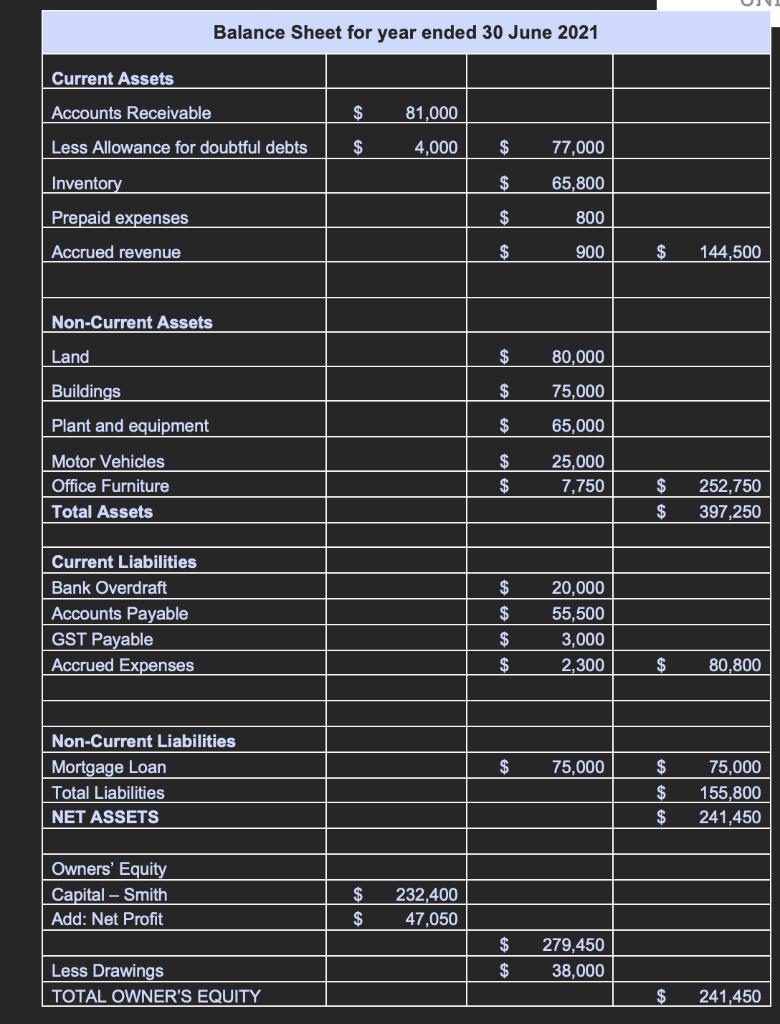

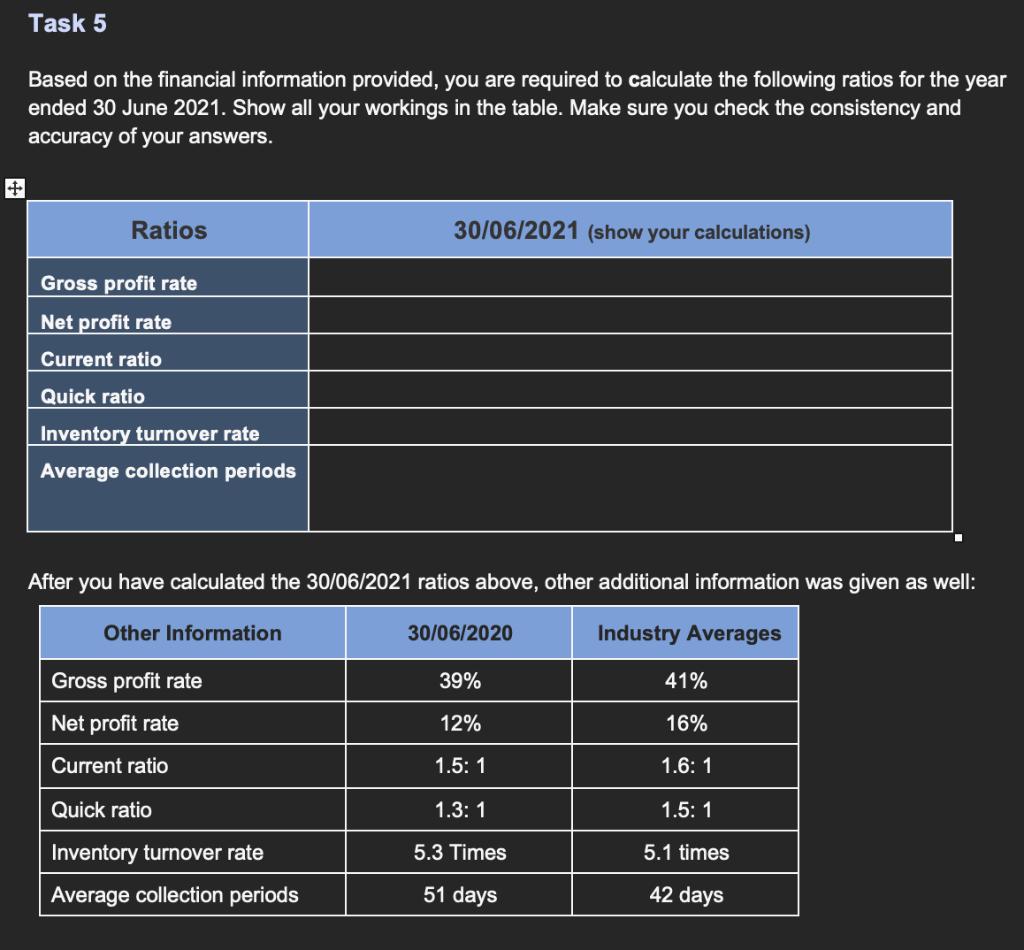

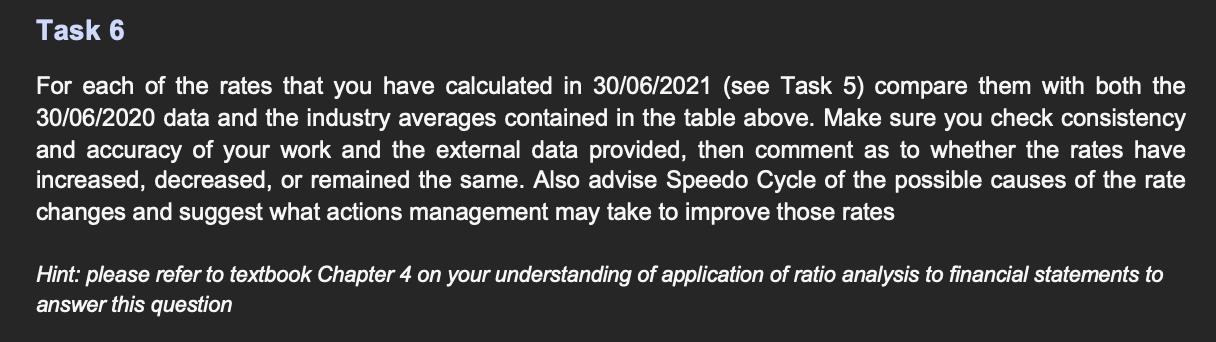

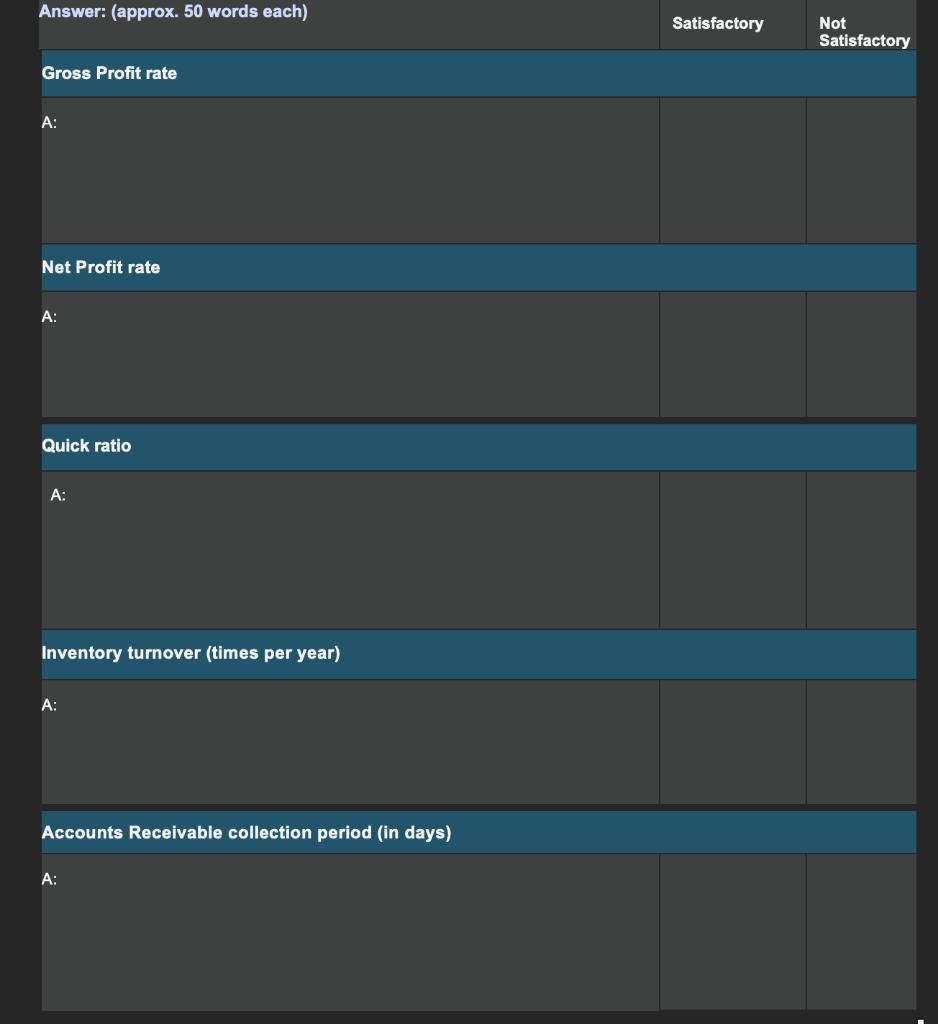

You are contacted by the business named Speedo Cycle seeking another accounting consultation. They would like to gain a better idea of which areas of the business are performing well and what the company can do to continue to grow. They would like a report on the aspect of liquidity, profitability and activity levels in the business as well as your professional recommendations on some pathways to improve their long-term success. They have provided you the following data from their accounting system for the year ended 30 June 2021. Income Statement for year ended 30 June 2021 Sales (all credit) Less Cost of Goods Sold Inventory 1/7/20 Purchases Cost of Goods Available for Sale Less: Inventory 30/6/21 Total Cost of Goods Sold GROSS PROFIT Other Income Total Income Less: Operating expenses NET PROFIT $ $ $ $ 53,250 345,700 398,950 65,800 $ $ $ $ $ $ $ 485,000 333,150 151,850 4,000 155,850 108,800 47,050 Current Assets Accounts Receivable Less Allowance for doubtful debts Inventory Prepaid expenses Accrued revenue Non-Current Assets Land Buildings Plant and equipment Motor Vehicles Office Furniture Total Assets Current Liabilities Bank Overdraft Accounts Payable GST Payable Accrued Expenses Balance Sheet for year ended 30 June 2021 Non-Current Liabilities Mortgage Loan Total Liabilities NET ASSETS Owners' Equity Capital Smith Add: Net Profit Less Drawings TOTAL OWNER'S EQUITY $ $ 81,000 4,000 $ 232,400 $ 47,050 $ $ $ SA $ $ $ $ LA $ $ 77,000 65,800 800 900 80,000 75,000 65,000 25,000 7,750 $ 20,000 $ 55,500 $ 3,000 $ 2,300 $ $ $ 75,000 279,450 38,000 $ $ $ $ $ 6669 $ $ 144,500 252,750 397,250 80,800 75,000 155,800 241,450 $ 241,450 Task 5 Based on the financial information provided, you are required to calculate the following ratios for the year ended 30 June 2021. Show all your workings in the table. Make sure you check the consistency and accuracy of your answers. Ratios Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2021 (show your calculations) After you have calculated the 30/06/2021 ratios above, other additional information was given as well: Other Information Industry Averages Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2020 39% 12% 1.5: 1 1.3: 1 5.3 Times 51 days 41% 16% 1.6: 1 1.5: 1 5.1 times 42 days Task 6 For each of the rates that you have calculated in 30/06/2021 (see Task 5) compare them with both the 30/06/2020 data and the industry averages contained in the table above. Make sure you check consistency and accuracy of your work and the external data provided, then comment as to whether the rates have increased, decreased, or remained the same. Also advise Speedo Cycle of the possible causes of the rate changes and suggest what actions management may take to improve those rates Hint: please refer to textbook Chapter 4 on your understanding of application of ratio analysis to financial statements to answer this question Answer: (approx. 50 words each) Gross Profit rate A: Net Profit rate A: Quick ratio A: Inventory turnover (times per year) A: Accounts Receivable collection period (in days) A: Satisfactory Not Satisfactory Task 7 Satisfactory Not Satisfactory Explain the advantages and disadvantages of ratios and comparison techniques (approx. 150 words) Hint: please refer to module Management Reports & Analysis note in canvas A: You are contacted by the business named Speedo Cycle seeking another accounting consultation. They would like to gain a better idea of which areas of the business are performing well and what the company can do to continue to grow. They would like a report on the aspect of liquidity, profitability and activity levels in the business as well as your professional recommendations on some pathways to improve their long-term success. They have provided you the following data from their accounting system for the year ended 30 June 2021. Income Statement for year ended 30 June 2021 Sales (all credit) Less Cost of Goods Sold Inventory 1/7/20 Purchases Cost of Goods Available for Sale Less: Inventory 30/6/21 Total Cost of Goods Sold GROSS PROFIT Other Income Total Income Less: Operating expenses NET PROFIT $ $ $ $ 53,250 345,700 398,950 65,800 $ $ $ $ $ $ $ 485,000 333,150 151,850 4,000 155,850 108,800 47,050 Current Assets Accounts Receivable Less Allowance for doubtful debts Inventory Prepaid expenses Accrued revenue Non-Current Assets Land Buildings Plant and equipment Motor Vehicles Office Furniture Total Assets Current Liabilities Bank Overdraft Accounts Payable GST Payable Accrued Expenses Balance Sheet for year ended 30 June 2021 Non-Current Liabilities Mortgage Loan Total Liabilities NET ASSETS Owners' Equity Capital Smith Add: Net Profit Less Drawings TOTAL OWNER'S EQUITY $ $ 81,000 4,000 $ 232,400 $ 47,050 $ $ $ SA $ $ $ $ LA $ $ 77,000 65,800 800 900 80,000 75,000 65,000 25,000 7,750 $ 20,000 $ 55,500 $ 3,000 $ 2,300 $ $ $ 75,000 279,450 38,000 $ $ $ $ $ 6669 $ $ 144,500 252,750 397,250 80,800 75,000 155,800 241,450 $ 241,450 Task 5 Based on the financial information provided, you are required to calculate the following ratios for the year ended 30 June 2021. Show all your workings in the table. Make sure you check the consistency and accuracy of your answers. Ratios Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2021 (show your calculations) After you have calculated the 30/06/2021 ratios above, other additional information was given as well: Other Information Industry Averages Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2020 39% 12% 1.5: 1 1.3: 1 5.3 Times 51 days 41% 16% 1.6: 1 1.5: 1 5.1 times 42 days Task 6 For each of the rates that you have calculated in 30/06/2021 (see Task 5) compare them with both the 30/06/2020 data and the industry averages contained in the table above. Make sure you check consistency and accuracy of your work and the external data provided, then comment as to whether the rates have increased, decreased, or remained the same. Also advise Speedo Cycle of the possible causes of the rate changes and suggest what actions management may take to improve those rates Hint: please refer to textbook Chapter 4 on your understanding of application of ratio analysis to financial statements to answer this question Answer: (approx. 50 words each) Gross Profit rate A: Net Profit rate A: Quick ratio A: Inventory turnover (times per year) A: Accounts Receivable collection period (in days) A: Satisfactory Not Satisfactory Task 7 Satisfactory Not Satisfactory Explain the advantages and disadvantages of ratios and comparison techniques (approx. 150 words) Hint: please refer to module Management Reports & Analysis note in canvas A: You are contacted by the business named Speedo Cycle seeking another accounting consultation. They would like to gain a better idea of which areas of the business are performing well and what the company can do to continue to grow. They would like a report on the aspect of liquidity, profitability and activity levels in the business as well as your professional recommendations on some pathways to improve their long-term success. They have provided you the following data from their accounting system for the year ended 30 June 2021. Income Statement for year ended 30 June 2021 Sales (all credit) Less Cost of Goods Sold Inventory 1/7/20 Purchases Cost of Goods Available for Sale Less: Inventory 30/6/21 Total Cost of Goods Sold GROSS PROFIT Other Income Total Income Less: Operating expenses NET PROFIT $ $ $ $ 53,250 345,700 398,950 65,800 $ $ $ $ $ $ $ 485,000 333,150 151,850 4,000 155,850 108,800 47,050 Current Assets Accounts Receivable Less Allowance for doubtful debts Inventory Prepaid expenses Accrued revenue Non-Current Assets Land Buildings Plant and equipment Motor Vehicles Office Furniture Total Assets Current Liabilities Bank Overdraft Accounts Payable GST Payable Accrued Expenses Balance Sheet for year ended 30 June 2021 Non-Current Liabilities Mortgage Loan Total Liabilities NET ASSETS Owners' Equity Capital Smith Add: Net Profit Less Drawings TOTAL OWNER'S EQUITY $ $ 81,000 4,000 $ 232,400 $ 47,050 $ $ $ SA $ $ $ $ LA $ $ 77,000 65,800 800 900 80,000 75,000 65,000 25,000 7,750 $ 20,000 $ 55,500 $ 3,000 $ 2,300 $ $ $ 75,000 279,450 38,000 $ $ $ $ $ 6669 $ $ 144,500 252,750 397,250 80,800 75,000 155,800 241,450 $ 241,450 Task 5 Based on the financial information provided, you are required to calculate the following ratios for the year ended 30 June 2021. Show all your workings in the table. Make sure you check the consistency and accuracy of your answers. Ratios Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2021 (show your calculations) After you have calculated the 30/06/2021 ratios above, other additional information was given as well: Other Information Industry Averages Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2020 39% 12% 1.5: 1 1.3: 1 5.3 Times 51 days 41% 16% 1.6: 1 1.5: 1 5.1 times 42 days Task 6 For each of the rates that you have calculated in 30/06/2021 (see Task 5) compare them with both the 30/06/2020 data and the industry averages contained in the table above. Make sure you check consistency and accuracy of your work and the external data provided, then comment as to whether the rates have increased, decreased, or remained the same. Also advise Speedo Cycle of the possible causes of the rate changes and suggest what actions management may take to improve those rates Hint: please refer to textbook Chapter 4 on your understanding of application of ratio analysis to financial statements to answer this question Answer: (approx. 50 words each) Gross Profit rate A: Net Profit rate A: Quick ratio A: Inventory turnover (times per year) A: Accounts Receivable collection period (in days) A: Satisfactory Not Satisfactory Task 7 Satisfactory Not Satisfactory Explain the advantages and disadvantages of ratios and comparison techniques (approx. 150 words) Hint: please refer to module Management Reports & Analysis note in canvas A: You are contacted by the business named Speedo Cycle seeking another accounting consultation. They would like to gain a better idea of which areas of the business are performing well and what the company can do to continue to grow. They would like a report on the aspect of liquidity, profitability and activity levels in the business as well as your professional recommendations on some pathways to improve their long-term success. They have provided you the following data from their accounting system for the year ended 30 June 2021. Income Statement for year ended 30 June 2021 Sales (all credit) Less Cost of Goods Sold Inventory 1/7/20 Purchases Cost of Goods Available for Sale Less: Inventory 30/6/21 Total Cost of Goods Sold GROSS PROFIT Other Income Total Income Less: Operating expenses NET PROFIT $ $ $ $ 53,250 345,700 398,950 65,800 $ $ $ $ $ $ $ 485,000 333,150 151,850 4,000 155,850 108,800 47,050 Current Assets Accounts Receivable Less Allowance for doubtful debts Inventory Prepaid expenses Accrued revenue Non-Current Assets Land Buildings Plant and equipment Motor Vehicles Office Furniture Total Assets Current Liabilities Bank Overdraft Accounts Payable GST Payable Accrued Expenses Balance Sheet for year ended 30 June 2021 Non-Current Liabilities Mortgage Loan Total Liabilities NET ASSETS Owners' Equity Capital Smith Add: Net Profit Less Drawings TOTAL OWNER'S EQUITY $ $ 81,000 4,000 $ 232,400 $ 47,050 $ $ $ SA $ $ $ $ LA $ $ 77,000 65,800 800 900 80,000 75,000 65,000 25,000 7,750 $ 20,000 $ 55,500 $ 3,000 $ 2,300 $ $ $ 75,000 279,450 38,000 $ $ $ $ $ 6669 $ $ 144,500 252,750 397,250 80,800 75,000 155,800 241,450 $ 241,450 Task 5 Based on the financial information provided, you are required to calculate the following ratios for the year ended 30 June 2021. Show all your workings in the table. Make sure you check the consistency and accuracy of your answers. Ratios Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2021 (show your calculations) After you have calculated the 30/06/2021 ratios above, other additional information was given as well: Other Information Industry Averages Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2020 39% 12% 1.5: 1 1.3: 1 5.3 Times 51 days 41% 16% 1.6: 1 1.5: 1 5.1 times 42 days Task 6 For each of the rates that you have calculated in 30/06/2021 (see Task 5) compare them with both the 30/06/2020 data and the industry averages contained in the table above. Make sure you check consistency and accuracy of your work and the external data provided, then comment as to whether the rates have increased, decreased, or remained the same. Also advise Speedo Cycle of the possible causes of the rate changes and suggest what actions management may take to improve those rates Hint: please refer to textbook Chapter 4 on your understanding of application of ratio analysis to financial statements to answer this question Answer: (approx. 50 words each) Gross Profit rate A: Net Profit rate A: Quick ratio A: Inventory turnover (times per year) A: Accounts Receivable collection period (in days) A: Satisfactory Not Satisfactory Task 7 Satisfactory Not Satisfactory Explain the advantages and disadvantages of ratios and comparison techniques (approx. 150 words) Hint: please refer to module Management Reports & Analysis note in canvas A: You are contacted by the business named Speedo Cycle seeking another accounting consultation. They would like to gain a better idea of which areas of the business are performing well and what the company can do to continue to grow. They would like a report on the aspect of liquidity, profitability and activity levels in the business as well as your professional recommendations on some pathways to improve their long-term success. They have provided you the following data from their accounting system for the year ended 30 June 2021. Income Statement for year ended 30 June 2021 Sales (all credit) Less Cost of Goods Sold Inventory 1/7/20 Purchases Cost of Goods Available for Sale Less: Inventory 30/6/21 Total Cost of Goods Sold GROSS PROFIT Other Income Total Income Less: Operating expenses NET PROFIT $ $ $ $ 53,250 345,700 398,950 65,800 $ $ $ $ $ $ $ 485,000 333,150 151,850 4,000 155,850 108,800 47,050 Current Assets Accounts Receivable Less Allowance for doubtful debts Inventory Prepaid expenses Accrued revenue Non-Current Assets Land Buildings Plant and equipment Motor Vehicles Office Furniture Total Assets Current Liabilities Bank Overdraft Accounts Payable GST Payable Accrued Expenses Balance Sheet for year ended 30 June 2021 Non-Current Liabilities Mortgage Loan Total Liabilities NET ASSETS Owners' Equity Capital Smith Add: Net Profit Less Drawings TOTAL OWNER'S EQUITY $ $ 81,000 4,000 $ 232,400 $ 47,050 $ $ $ SA $ $ $ $ LA $ $ 77,000 65,800 800 900 80,000 75,000 65,000 25,000 7,750 $ 20,000 $ 55,500 $ 3,000 $ 2,300 $ $ $ 75,000 279,450 38,000 $ $ $ $ $ 6669 $ $ 144,500 252,750 397,250 80,800 75,000 155,800 241,450 $ 241,450 Task 5 Based on the financial information provided, you are required to calculate the following ratios for the year ended 30 June 2021. Show all your workings in the table. Make sure you check the consistency and accuracy of your answers. Ratios Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2021 (show your calculations) After you have calculated the 30/06/2021 ratios above, other additional information was given as well: Other Information Industry Averages Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2020 39% 12% 1.5: 1 1.3: 1 5.3 Times 51 days 41% 16% 1.6: 1 1.5: 1 5.1 times 42 days Task 6 For each of the rates that you have calculated in 30/06/2021 (see Task 5) compare them with both the 30/06/2020 data and the industry averages contained in the table above. Make sure you check consistency and accuracy of your work and the external data provided, then comment as to whether the rates have increased, decreased, or remained the same. Also advise Speedo Cycle of the possible causes of the rate changes and suggest what actions management may take to improve those rates Hint: please refer to textbook Chapter 4 on your understanding of application of ratio analysis to financial statements to answer this question Answer: (approx. 50 words each) Gross Profit rate A: Net Profit rate A: Quick ratio A: Inventory turnover (times per year) A: Accounts Receivable collection period (in days) A: Satisfactory Not Satisfactory Task 7 Satisfactory Not Satisfactory Explain the advantages and disadvantages of ratios and comparison techniques (approx. 150 words) Hint: please refer to module Management Reports & Analysis note in canvas A: You are contacted by the business named Speedo Cycle seeking another accounting consultation. They would like to gain a better idea of which areas of the business are performing well and what the company can do to continue to grow. They would like a report on the aspect of liquidity, profitability and activity levels in the business as well as your professional recommendations on some pathways to improve their long-term success. They have provided you the following data from their accounting system for the year ended 30 June 2021. Income Statement for year ended 30 June 2021 Sales (all credit) Less Cost of Goods Sold Inventory 1/7/20 Purchases Cost of Goods Available for Sale Less: Inventory 30/6/21 Total Cost of Goods Sold GROSS PROFIT Other Income Total Income Less: Operating expenses NET PROFIT $ $ $ $ 53,250 345,700 398,950 65,800 $ $ $ $ $ $ $ 485,000 333,150 151,850 4,000 155,850 108,800 47,050 Current Assets Accounts Receivable Less Allowance for doubtful debts Inventory Prepaid expenses Accrued revenue Non-Current Assets Land Buildings Plant and equipment Motor Vehicles Office Furniture Total Assets Current Liabilities Bank Overdraft Accounts Payable GST Payable Accrued Expenses Balance Sheet for year ended 30 June 2021 Non-Current Liabilities Mortgage Loan Total Liabilities NET ASSETS Owners' Equity Capital Smith Add: Net Profit Less Drawings TOTAL OWNER'S EQUITY $ $ 81,000 4,000 $ 232,400 $ 47,050 $ $ $ SA $ $ $ $ LA $ $ 77,000 65,800 800 900 80,000 75,000 65,000 25,000 7,750 $ 20,000 $ 55,500 $ 3,000 $ 2,300 $ $ $ 75,000 279,450 38,000 $ $ $ $ $ 6669 $ $ 144,500 252,750 397,250 80,800 75,000 155,800 241,450 $ 241,450 Task 5 Based on the financial information provided, you are required to calculate the following ratios for the year ended 30 June 2021. Show all your workings in the table. Make sure you check the consistency and accuracy of your answers. Ratios Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2021 (show your calculations) After you have calculated the 30/06/2021 ratios above, other additional information was given as well: Other Information Industry Averages Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2020 39% 12% 1.5: 1 1.3: 1 5.3 Times 51 days 41% 16% 1.6: 1 1.5: 1 5.1 times 42 days Task 6 For each of the rates that you have calculated in 30/06/2021 (see Task 5) compare them with both the 30/06/2020 data and the industry averages contained in the table above. Make sure you check consistency and accuracy of your work and the external data provided, then comment as to whether the rates have increased, decreased, or remained the same. Also advise Speedo Cycle of the possible causes of the rate changes and suggest what actions management may take to improve those rates Hint: please refer to textbook Chapter 4 on your understanding of application of ratio analysis to financial statements to answer this question Answer: (approx. 50 words each) Gross Profit rate A: Net Profit rate A: Quick ratio A: Inventory turnover (times per year) A: Accounts Receivable collection period (in days) A: Satisfactory Not Satisfactory Task 7 Satisfactory Not Satisfactory Explain the advantages and disadvantages of ratios and comparison techniques (approx. 150 words) Hint: please refer to module Management Reports & Analysis note in canvas A: You are contacted by the business named Speedo Cycle seeking another accounting consultation. They would like to gain a better idea of which areas of the business are performing well and what the company can do to continue to grow. They would like a report on the aspect of liquidity, profitability and activity levels in the business as well as your professional recommendations on some pathways to improve their long-term success. They have provided you the following data from their accounting system for the year ended 30 June 2021. Income Statement for year ended 30 June 2021 Sales (all credit) Less Cost of Goods Sold Inventory 1/7/20 Purchases Cost of Goods Available for Sale Less: Inventory 30/6/21 Total Cost of Goods Sold GROSS PROFIT Other Income Total Income Less: Operating expenses NET PROFIT $ $ $ $ 53,250 345,700 398,950 65,800 $ $ $ $ $ $ $ 485,000 333,150 151,850 4,000 155,850 108,800 47,050 Current Assets Accounts Receivable Less Allowance for doubtful debts Inventory Prepaid expenses Accrued revenue Non-Current Assets Land Buildings Plant and equipment Motor Vehicles Office Furniture Total Assets Current Liabilities Bank Overdraft Accounts Payable GST Payable Accrued Expenses Balance Sheet for year ended 30 June 2021 Non-Current Liabilities Mortgage Loan Total Liabilities NET ASSETS Owners' Equity Capital Smith Add: Net Profit Less Drawings TOTAL OWNER'S EQUITY $ $ 81,000 4,000 $ 232,400 $ 47,050 $ $ $ SA $ $ $ $ LA $ $ 77,000 65,800 800 900 80,000 75,000 65,000 25,000 7,750 $ 20,000 $ 55,500 $ 3,000 $ 2,300 $ $ $ 75,000 279,450 38,000 $ $ $ $ $ 6669 $ $ 144,500 252,750 397,250 80,800 75,000 155,800 241,450 $ 241,450 Task 5 Based on the financial information provided, you are required to calculate the following ratios for the year ended 30 June 2021. Show all your workings in the table. Make sure you check the consistency and accuracy of your answers. Ratios Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2021 (show your calculations) After you have calculated the 30/06/2021 ratios above, other additional information was given as well: Other Information Industry Averages Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2020 39% 12% 1.5: 1 1.3: 1 5.3 Times 51 days 41% 16% 1.6: 1 1.5: 1 5.1 times 42 days Task 6 For each of the rates that you have calculated in 30/06/2021 (see Task 5) compare them with both the 30/06/2020 data and the industry averages contained in the table above. Make sure you check consistency and accuracy of your work and the external data provided, then comment as to whether the rates have increased, decreased, or remained the same. Also advise Speedo Cycle of the possible causes of the rate changes and suggest what actions management may take to improve those rates Hint: please refer to textbook Chapter 4 on your understanding of application of ratio analysis to financial statements to answer this question Answer: (approx. 50 words each) Gross Profit rate A: Net Profit rate A: Quick ratio A: Inventory turnover (times per year) A: Accounts Receivable collection period (in days) A: Satisfactory Not Satisfactory Task 7 Satisfactory Not Satisfactory Explain the advantages and disadvantages of ratios and comparison techniques (approx. 150 words) Hint: please refer to module Management Reports & Analysis note in canvas A: You are contacted by the business named Speedo Cycle seeking another accounting consultation. They would like to gain a better idea of which areas of the business are performing well and what the company can do to continue to grow. They would like a report on the aspect of liquidity, profitability and activity levels in the business as well as your professional recommendations on some pathways to improve their long-term success. They have provided you the following data from their accounting system for the year ended 30 June 2021. Income Statement for year ended 30 June 2021 Sales (all credit) Less Cost of Goods Sold Inventory 1/7/20 Purchases Cost of Goods Available for Sale Less: Inventory 30/6/21 Total Cost of Goods Sold GROSS PROFIT Other Income Total Income Less: Operating expenses NET PROFIT $ $ $ $ 53,250 345,700 398,950 65,800 $ $ $ $ $ $ $ 485,000 333,150 151,850 4,000 155,850 108,800 47,050 Current Assets Accounts Receivable Less Allowance for doubtful debts Inventory Prepaid expenses Accrued revenue Non-Current Assets Land Buildings Plant and equipment Motor Vehicles Office Furniture Total Assets Current Liabilities Bank Overdraft Accounts Payable GST Payable Accrued Expenses Balance Sheet for year ended 30 June 2021 Non-Current Liabilities Mortgage Loan Total Liabilities NET ASSETS Owners' Equity Capital Smith Add: Net Profit Less Drawings TOTAL OWNER'S EQUITY $ $ 81,000 4,000 $ 232,400 $ 47,050 $ $ $ SA $ $ $ $ LA $ $ 77,000 65,800 800 900 80,000 75,000 65,000 25,000 7,750 $ 20,000 $ 55,500 $ 3,000 $ 2,300 $ $ $ 75,000 279,450 38,000 $ $ $ $ $ 6669 $ $ 144,500 252,750 397,250 80,800 75,000 155,800 241,450 $ 241,450 Task 5 Based on the financial information provided, you are required to calculate the following ratios for the year ended 30 June 2021. Show all your workings in the table. Make sure you check the consistency and accuracy of your answers. Ratios Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2021 (show your calculations) After you have calculated the 30/06/2021 ratios above, other additional information was given as well: Other Information Industry Averages Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2020 39% 12% 1.5: 1 1.3: 1 5.3 Times 51 days 41% 16% 1.6: 1 1.5: 1 5.1 times 42 days Task 6 For each of the rates that you have calculated in 30/06/2021 (see Task 5) compare them with both the 30/06/2020 data and the industry averages contained in the table above. Make sure you check consistency and accuracy of your work and the external data provided, then comment as to whether the rates have increased, decreased, or remained the same. Also advise Speedo Cycle of the possible causes of the rate changes and suggest what actions management may take to improve those rates Hint: please refer to textbook Chapter 4 on your understanding of application of ratio analysis to financial statements to answer this question Answer: (approx. 50 words each) Gross Profit rate A: Net Profit rate A: Quick ratio A: Inventory turnover (times per year) A: Accounts Receivable collection period (in days) A: Satisfactory Not Satisfactory Task 7 Satisfactory Not Satisfactory Explain the advantages and disadvantages of ratios and comparison techniques (approx. 150 words) Hint: please refer to module Management Reports & Analysis note in canvas A: You are contacted by the business named Speedo Cycle seeking another accounting consultation. They would like to gain a better idea of which areas of the business are performing well and what the company can do to continue to grow. They would like a report on the aspect of liquidity, profitability and activity levels in the business as well as your professional recommendations on some pathways to improve their long-term success. They have provided you the following data from their accounting system for the year ended 30 June 2021. Income Statement for year ended 30 June 2021 Sales (all credit) Less Cost of Goods Sold Inventory 1/7/20 Purchases Cost of Goods Available for Sale Less: Inventory 30/6/21 Total Cost of Goods Sold GROSS PROFIT Other Income Total Income Less: Operating expenses NET PROFIT $ $ $ $ 53,250 345,700 398,950 65,800 $ $ $ $ $ $ $ 485,000 333,150 151,850 4,000 155,850 108,800 47,050 Current Assets Accounts Receivable Less Allowance for doubtful debts Inventory Prepaid expenses Accrued revenue Non-Current Assets Land Buildings Plant and equipment Motor Vehicles Office Furniture Total Assets Current Liabilities Bank Overdraft Accounts Payable GST Payable Accrued Expenses Balance Sheet for year ended 30 June 2021 Non-Current Liabilities Mortgage Loan Total Liabilities NET ASSETS Owners' Equity Capital Smith Add: Net Profit Less Drawings TOTAL OWNER'S EQUITY $ $ 81,000 4,000 $ 232,400 $ 47,050 $ $ $ SA $ $ $ $ LA $ $ 77,000 65,800 800 900 80,000 75,000 65,000 25,000 7,750 $ 20,000 $ 55,500 $ 3,000 $ 2,300 $ $ $ 75,000 279,450 38,000 $ $ $ $ $ 6669 $ $ 144,500 252,750 397,250 80,800 75,000 155,800 241,450 $ 241,450 Task 5 Based on the financial information provided, you are required to calculate the following ratios for the year ended 30 June 2021. Show all your workings in the table. Make sure you check the consistency and accuracy of your answers. Ratios Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2021 (show your calculations) After you have calculated the 30/06/2021 ratios above, other additional information was given as well: Other Information Industry Averages Gross profit rate Net profit rate Current ratio Quick ratio Inventory turnover rate Average collection periods 30/06/2020 39% 12% 1.5: 1 1.3: 1 5.3 Times 51 days 41% 16% 1.6: 1 1.5: 1 5.1 times 42 days Task 6 For each of the rates that you have calculated in 30/06/2021 (see Task 5) compare them with both the 30/06/2020 data and the industry averages contained in the table above. Make sure you check consistency and accuracy of your work and the external data provided, then comment as to whether the rates have increased, decreased, or remained the same. Also advise Speedo Cycle of the possible causes of the rate changes and suggest what actions management may take to improve those rates Hint: please refer to textbook Chapter 4 on your understanding of application of ratio analysis to financial statements to answer this question Answer: (approx. 50 words each) Gross Profit rate A: Net Profit rate A: Quick ratio A: Inventory turnover (times per year) A: Accounts Receivable collection period (in days) A: Satisfactory Not Satisfactory Task 7 Satisfactory Not Satisfactory Explain the advantages and disadvantages of ratios and comparison techniques (approx. 150 words) Hint: please refer to module Management Reports & Analysis note in canvas A:

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer I Financial ratios are the ratio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started