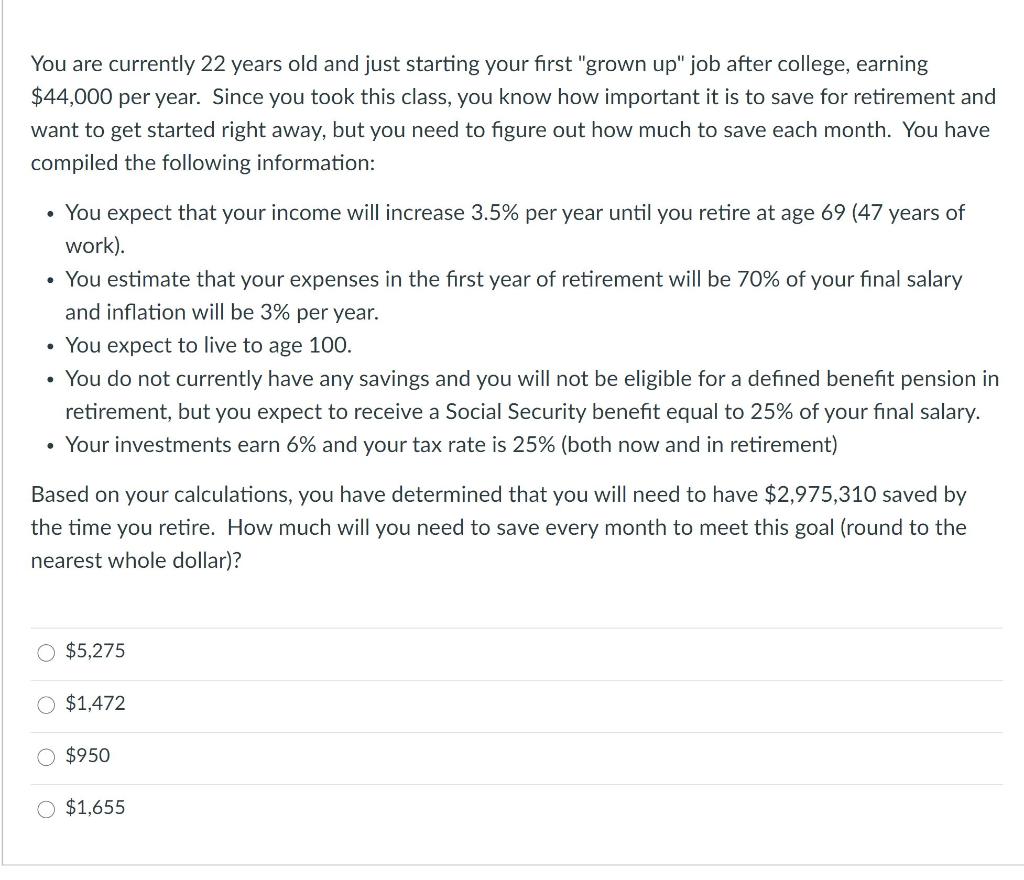

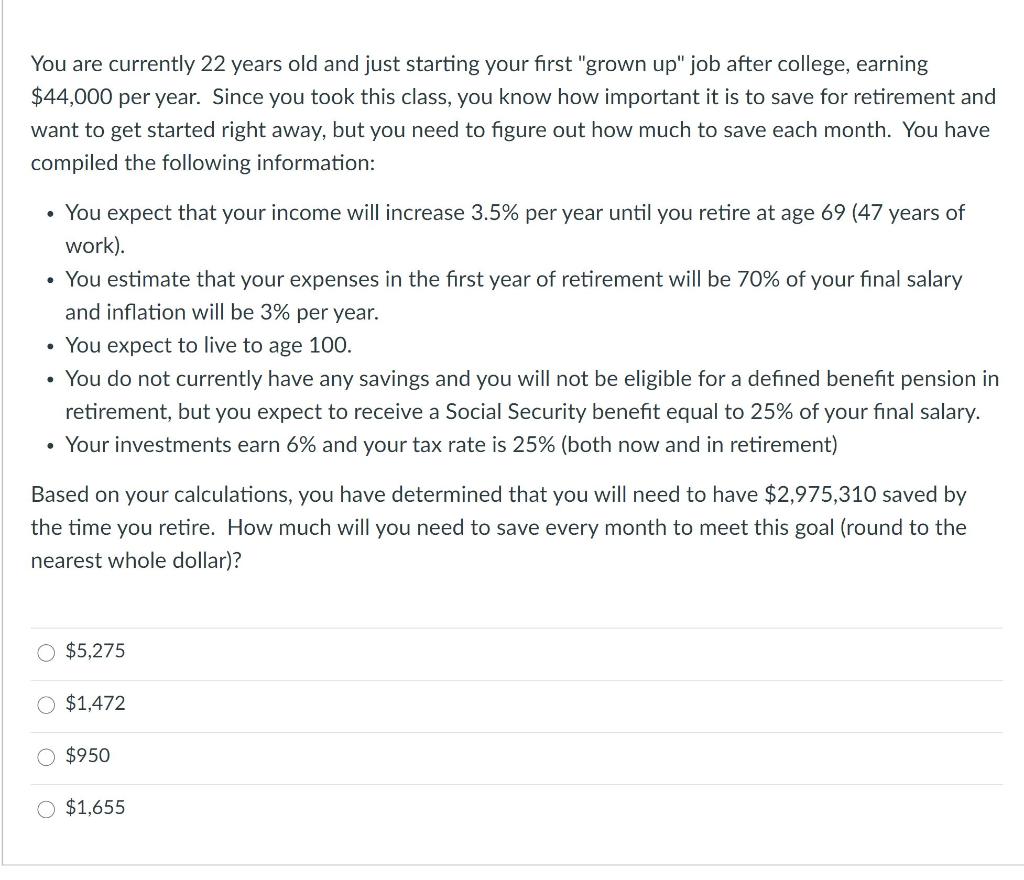

You are currently 22 years old and just starting your first "grown up" job after college, earning $44,000 per year. Since you took this class, you know how important it is to save for retirement and want to get started right away, but you need to figure out how much to save each month. You have compiled the following information: You expect that your income will increase 3.5% per year until you retire at age 69 (47 years of work). You estimate that your expenses in the first year of retirement will be 70% of your final salary and inflation will be 3% per year. You expect to live to age 100. You do not currently have any savings and you will not be eligible for a defined benefit pension in retirement, but you expect to receive a Social Security benefit equal to 25% of your final salary. Your investments earn 6% and your tax rate is 25% (both now and in retirement) Based on your calculations, you have determined that you will need to have $2,975,310 saved by the time you retire. How much will you need to save every month to meet this goal (round to the nearest whole dollar)? $5,275 $1,472 $950 $1,655 You are currently 22 years old and just starting your first "grown up" job after college, earning $44,000 per year. Since you took this class, you know how important it is to save for retirement and want to get started right away, but you need to figure out how much to save each month. You have compiled the following information: You expect that your income will increase 3.5% per year until you retire at age 69 (47 years of work). You estimate that your expenses in the first year of retirement will be 70% of your final salary and inflation will be 3% per year. You expect to live to age 100. You do not currently have any savings and you will not be eligible for a defined benefit pension in retirement, but you expect to receive a Social Security benefit equal to 25% of your final salary. Your investments earn 6% and your tax rate is 25% (both now and in retirement) Based on your calculations, you have determined that you will need to have $2,975,310 saved by the time you retire. How much will you need to save every month to meet this goal (round to the nearest whole dollar)? $5,275 $1,472 $950 $1,655