Question

You are engaged as an analyst with an Investment company and your job is to evaluate the performance of two portfolio managers (A and B).

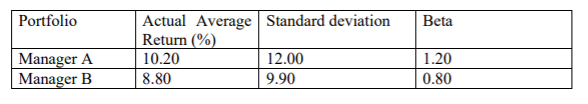

You are engaged as an analyst with an Investment company and your job is to evaluate the performance of two portfolio managers (A and B). You are given the following information regarding the performance of these two portfolio managers:

You also know that the risk premium for the market portfolio over this period was 5.00% and the risk-free rate is 4.50%

a) Calculate for managers A and B the expected return using CAPM

b) Estimate each managers alpha over the period and use that to conclude on each managers performance

c) Using the information found above find whether (i) any of the managers outperformed each other on a risk-adjusted basis and (ii) whether any manager outperformed market expectations in general

d) What additional information, would be needed to be able to conclude whether the managers performance was due to luck or skill

e) What would be the expected change in the standard deviation of a portfolio if the number of stocks increased from 4 to 10 stocks, from 10 to 20 stocks, and from 50 to 100 stocks? Besides the change in the number of stocks in the portfolio, what other information is needed to evaluate the expected change in the standard deviation of the portfolio?

Portfolio Beta Actual Average Standard deviation Return (%) 10.20 12.00 8.80 Manager A Manager B 9.90 1.20 0.80

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started