Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are engaged in the audit of the financial statements of Holman Corporation for the year ended December 31, 20X6. The accompanying analyses of the

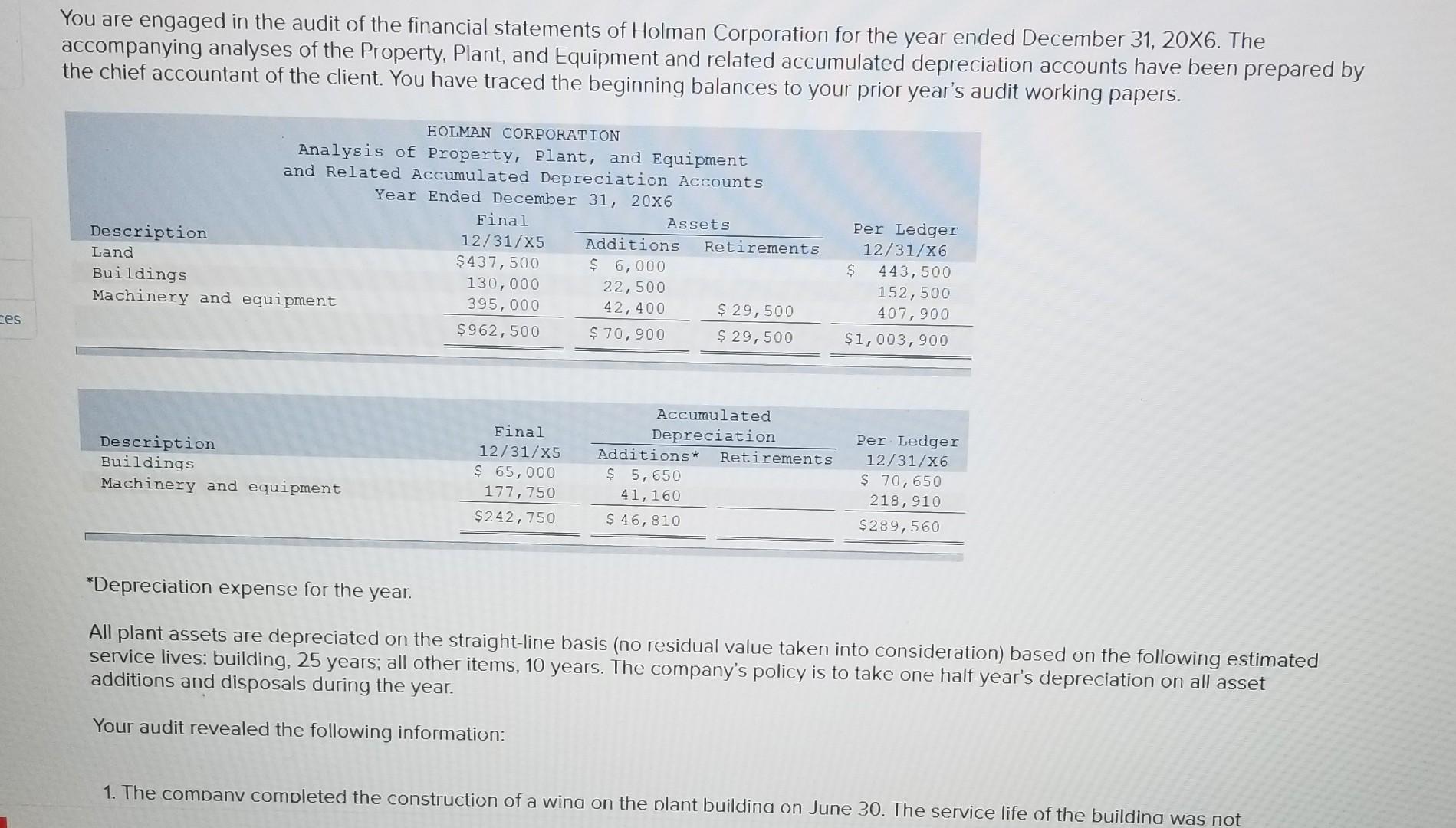

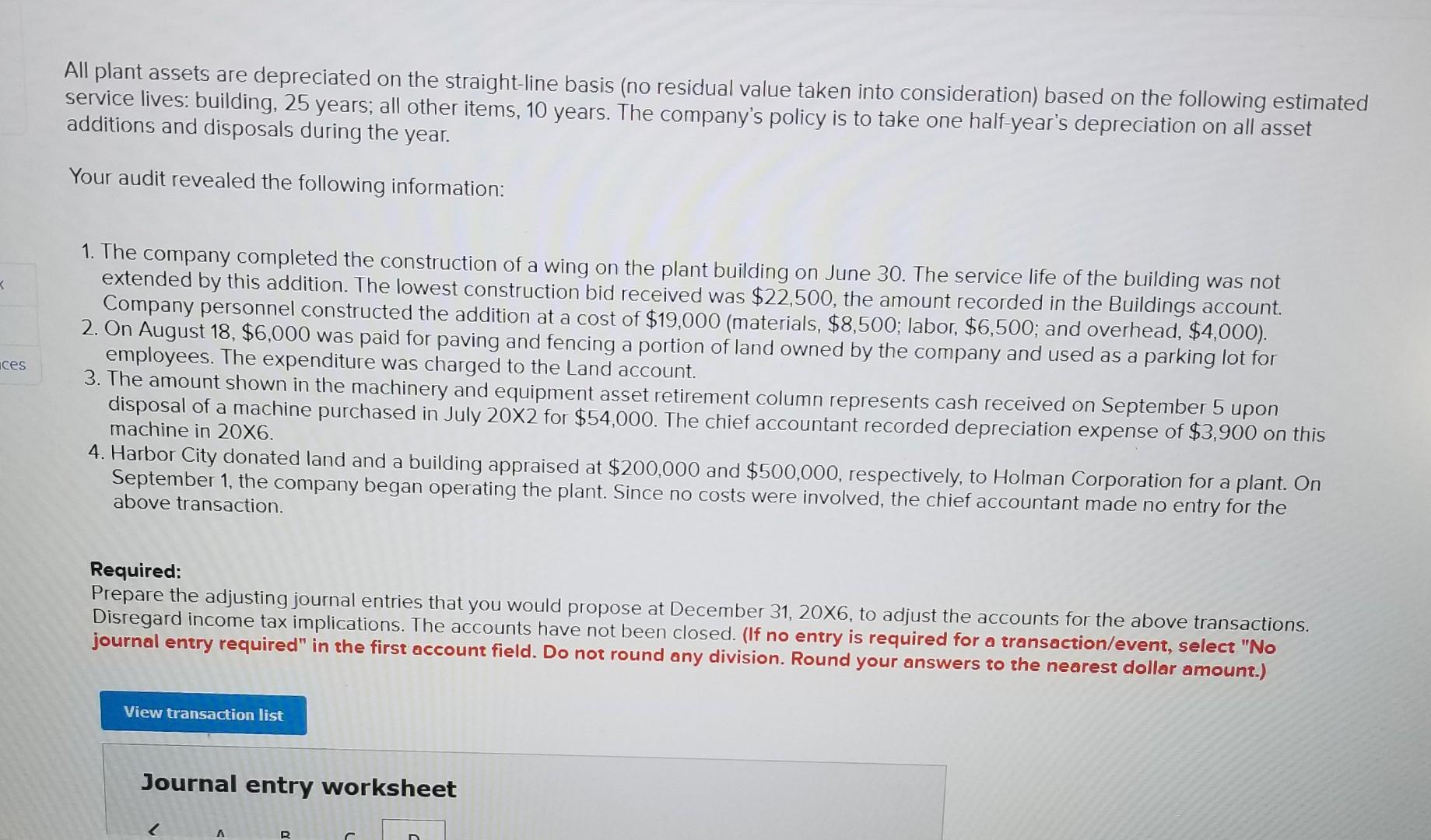

You are engaged in the audit of the financial statements of Holman Corporation for the year ended December 31, 20X6. The accompanying analyses of the Property, Plant, and Equipment and related accumulated depreciation accounts have been prepared by the chief accountant of the client. You have traced the beginning balances to your prior year's audit working papers. HOLMAN CORPORATION Analysis of property, plant, and Equipment and Related Accumulated Depreciation Accounts Year Ended December 31, 20X6 Final Assets Description 12/31/15 Additions Retirements Land $437,500 $ 6,000 Buildings 130,000 22,500 Machinery and equipment 395,000 42,400 $ 29,500 $ 962,500 $ 70,900 $ 29,500 Per Ledger 12/31/x6 $ 443,500 152,500 407,900 $1,003, 900 ces Description Buildings Machinery and equipment Final 12/31/15 $ 65,000 177,750 $242,750 Accumulated Depreciation Additions* Retirements $ 5,650 41,160 $ 46,810 Per Ledger 12/31/x6 $ 70,650 218, 910 $289,560 *Depreciation expense for the year. All plant assets are depreciated on the straight-line basis (no residual value taken into consideration) based on the following estimated service lives: building, 25 years; all other items, 10 years. The company's policy is to take one half-year's depreciation on all asset additions and disposals during the year. Your audit revealed the following information: 1. The company completed the construction of a wina on the plant buildina on June 30. The service life of the building was not All plant assets are depreciated on the straight-line basis (no residual value taken into consideration) based on the following estimated service lives: building, 25 years, all other items, 10 years. The company's policy is to take one half-year's depreciation on all asset additions and disposals during the year. Your audit revealed the following information:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started