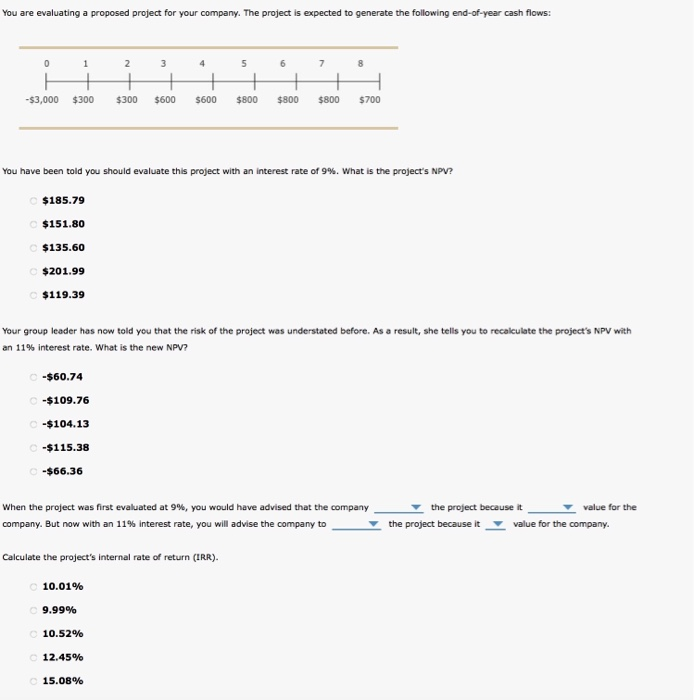

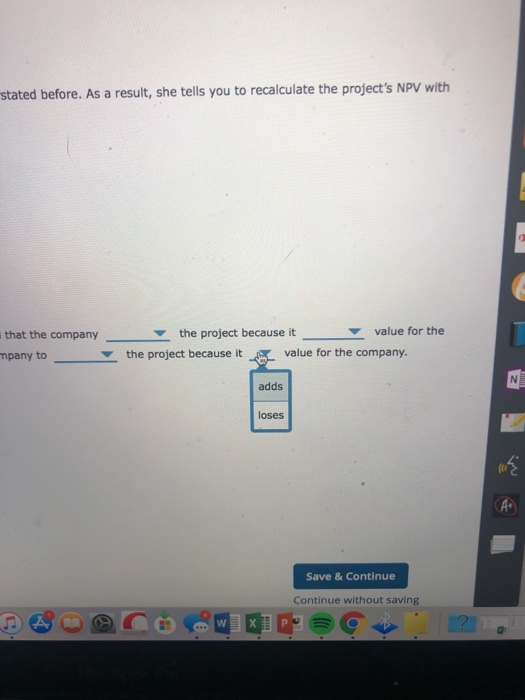

You are evaluating a proposed project for your company. The project is expected to generate the following end-of-year cash flows: 0 1 2 3 4 5 6 7 8 -$3,000 $300 $300 $600 $600 $800 $800 $800 $700 You have been told you should evaluate this project with an interest rate of 9%. What is the project's NPV? $185.79 $151.80 $135.60 $201.99 $119.39 Your group leader has now told you that the risk of the project was understated before. As a result, she tells you to recalculate the project's NPV with an 11% interest rate. What is the new NPV? -$60.74 -$109.76 -$104.13 -$115.38 -$66.36 When the project was first evaluated at 9%, you would have advised that the company company. But now with an 11% interest rate, you will advise the company to the project because it value for the the project because it value for the company. Calculate the project's Internal rate of return (IRR). 10.01% 9.99% 10.52% 12.45% 15.08% We been to $185.79 $151.80 $135.60 $201.99 $119.39 group leader has now told you that the risk of the project was understated before. As a result, she tells you to recalculate the 11% Interest rate. What is the new NPV? -$60.74 -$109.76 -$104.13 -$115.38 -$66.36 When the project was first evaluated at 9%, you would have advised that the company company. But now with an 11% Interest rate, you will advise the company to the project because it poject because it value for th reject Calculate the project's internal rate of return (IRR). accept 10.01% 9.99% 10.52% 12.45% 15.08% Save & Co Continue wit ated before. As a result, she tells you to recalculate the project's NPV with A-Z value for the hat the company bany to the project because it the project because it valy company. added lost pouze A Save & Continue Continue without saving ou that the risk of the project was understated before. As a result, she tells you to reca e new NPV? valuated at 9%, you would have advised that the company 1% interest rate, you will advise the company to the project because it the project because it valu mal rate of return (IRR). accept reject Save Contine w stated before. As a result, she tells you to recalculate the project's NPV with that the company mpany to the project because it value for the the project because it value for the company. N adds loses Save & Continue Continue without saving w