Question

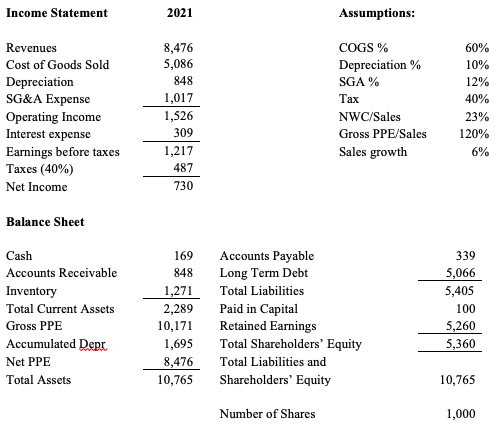

You are evaluating the value of Maxima, Inc, a privately-owned company. Maximas income statement and balance sheet are provided below. In this company, all items

You are evaluating the value of Maxima, Inc, a privately-owned company. Maximas income statement and balance sheet are provided below. In this company, all items on the income statement, all assets, and Accounts Payable will increase at the same percentage from 2021 to 2022.

A. Today is the end of 2021. Forecast free cash flows for 2022, assuming that all items on the income statement needed to calculate free cash flows, all assets, and Accounts Payable grow at the same percentage (equal to the sales growth rate) from 2021 to 2022. Please include cash as part of working capital as all of it is used for operations.

B. You need to find an appropriate discount rate with which to discount Maximas future cash flows. What weighted average cost of capital should be used to evaluate Maxima? Assume Maxima will continue to obtain debt at its 2021 average interest rate (interest expense divided by interest-bearing debt) and its target capital structure is 50% debt and 50% equity. Assume that equity holders are looking for an 11% rate of return on their equity position.

C. Assume that free cash flows will grow by 2% in 2023 and beyond. What is the value of a Maxima, Inc. share?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started