Answered step by step

Verified Expert Solution

Question

1 Approved Answer

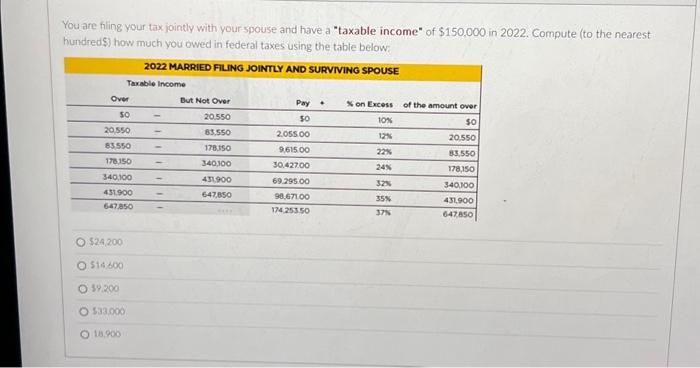

You are filing your tax jointly with your spouse and have a taxable income of $150,000 in 2022. Compute (to the nearest hundred $) how

You are filing your tax jointly with your spouse and have a "taxable income" of $150,000 in 2022. Compute (to the nearest hundred $) how much you owed in federal taxes using the table below: 2022 MARRIED FILING JOINTLY AND SURVIVING SPOUSE Over SO 20,550 83,550 178,150 340,100 431,900 647,850 O $24,200 $14,600 $9,200 Taxable Income $33,000 18,900 But Not Over 20,550 83,550 178,150 340,100 431,900 647,850 Pay $0 2,055.00 9,615.00 30,427.00 69,295.00 98,671.00 174,253.50 % on Excess 10% 12% 22% 24% 32% 35% 37% of the amount over $0 20,550 83,550 178,150 340,100 431,900 647,850

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started