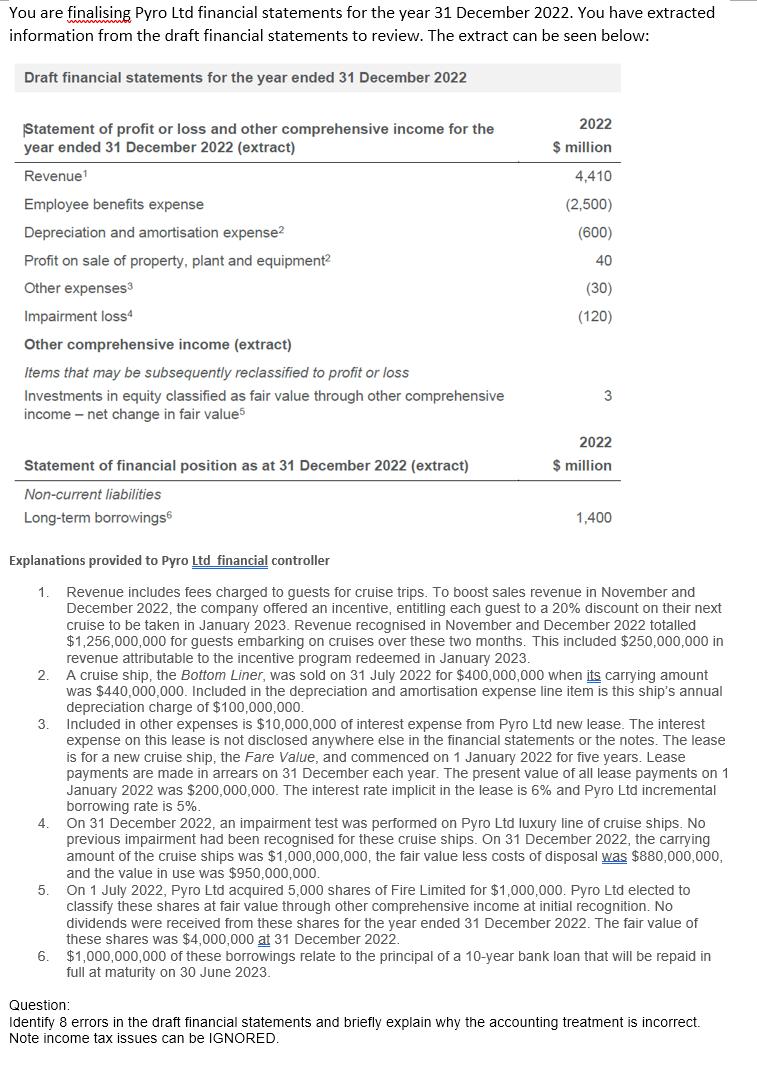

You are finalising Pyro Ltd financial statements for the year 31 December 2022. You have extracted information from the draft financial statements to review.

You are finalising Pyro Ltd financial statements for the year 31 December 2022. You have extracted information from the draft financial statements to review. The extract can be seen below: Draft financial statements for the year ended 31 December 2022 Statement of profit or loss and other comprehensive income for the year ended 31 December 2022 (extract) Revenue Employee benefits expense Depreciation and amortisation expense Profit on sale of property, plant and equipment Other expenses Impairment loss4 Other comprehensive income (extract) Items that may be subsequently reclassified to profit or loss Investments in equity classified as fair value through other comprehensive income net change in fair value5 Statement of financial position as at 31 December 2022 (extract) Non-current liabilities Long-term borrowings 3. 2022 $ million 4,410 (2,500) (600) 40 5. (30) (120) 6. 3 Explanations provided to Pyro Ltd financial controller 1. Revenue includes fees charged to guests for cruise trips. To boost sales revenue in November and December 2022, the company offered an incentive, entitling each guest to a 20% discount on their next cruise to be taken in January 2023. Revenue recognised in November and December 2022 totalled $1,256,000,000 for guests embarking on cruises over these two months. This included $250,000,000 in revenue attributable to the incentive program redeemed in January 2023. 2022 $ million 2. A cruise ship, the Bottom Liner, was sold on 31 July 2022 for $400,000,000 when its carrying amount was $440,000,000. Included in the depreciation and amortisation expense line item is this ship's annual depreciation charge of $100,000,000. 1,400 4. On 31 December 2022, an impairment test was performed on Pyro Ltd luxury line of cruise ships. No previous impairment had been recognised for these cruise ships. On 31 December 2022, the carrying amount of the cruise ships was $1,000,000,000, the fair value less costs of disposal was $880,000,000, and the value in use was $950,000,000. On 1 July 2022, Pyro Ltd acquired 5,000 shares of Fire Limited for $1,000,000. Pyro Ltd elected to classify these shares at fair value through other comprehensive income at initial recognition. No dividends were received from these shares for the year ended 31 December 2022. The fair value of these shares was $4,000,000 at 31 December 2022. $1,000,000,000 of these borrowings relate to the principal of a 10-year bank loan that will be repaid in full at maturity on 30 June 2023. Included in other expenses is $10,000,000 of interest expense from Pyro Ltd new lease. The interest expense on this lease is not disclosed anywhere else in the financial statements or the notes. The lease is for a new cruise ship, the Fare Value, and commenced on 1 January 2022 for five years. Lease payments are made in arrears on 31 December each year. The present value of all lease payments on 1 January 2022 was $200,000,000. The interest rate implicit in the lease is 6% and Pyro Ltd incremental borrowing rate is 5%. Question: Identify 8 errors in the draft financial statements and briefly explain why the accounting treatment is incorrect. Note income tax issues can be IGNORED.

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started