Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are financial managers of a company which makes printers. Currently you are using NPV method to evaluate a 10- year project that produces

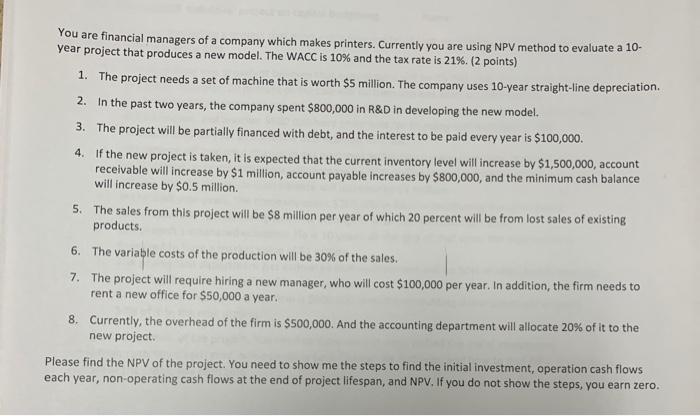

You are financial managers of a company which makes printers. Currently you are using NPV method to evaluate a 10- year project that produces a new model. The WACC is 10% and the tax rate is 21%. (2 points) 1. The project needs a set of machine that is worth $5 million. The company uses 10-year straight-line depreciation. 2. In the past two years, the company spent $800,000 in R&D in developing the new model. 3. The project will be partially financed with debt, and the interest to be paid every year is $100,000. 4. If the new project is taken, it is expected that the current inventory level will increase by $1,500,000, account receivable will increase by $1 million, account payable increases by $800,000, and the minimum cash balance will increase by $0.5 million. 5. The sales from this project will be $8 million per year of which 20 percent will be from lost sales of existing products. 6. The variable costs of the production will be 30% of the sales. 7. The project will require hiring a new manager, who will cost $100,000 per year. In addition, the firm needs to rent a new office for $50,000 a year. 8. Currently, the overhead of the firm is $500,000. And the accounting department will allocate 20% of it to the new project. Please find the NPV of the project. You need to show me the steps to find the initial investment, operation cash flows each year, non-operating cash flows at the end of project lifespan, and NPV. If you do not show the steps, you earn zero.

Step by Step Solution

★★★★★

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started