Answered step by step

Verified Expert Solution

Question

1 Approved Answer

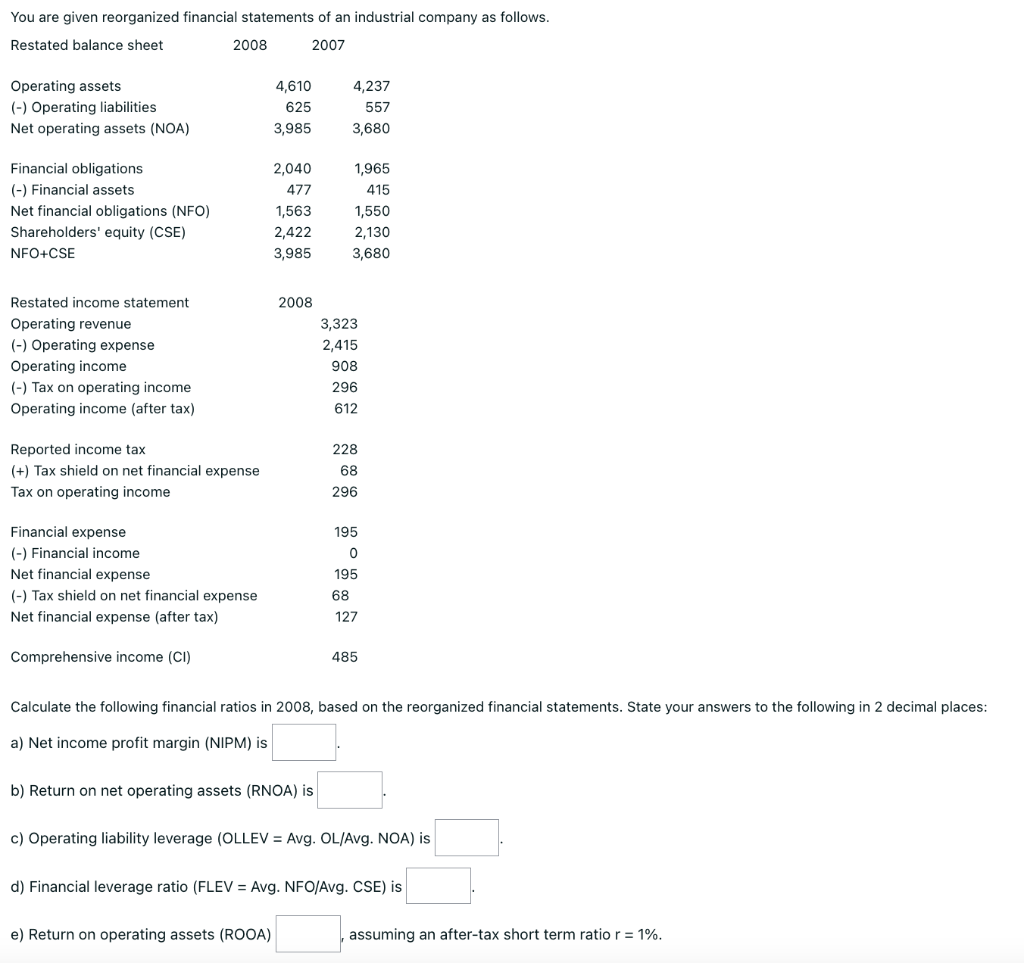

You are given reorganized financial statements of an industrial company as follows. Restated balance sheet 2008 2007 Operating assets 4,610 4,237 (-) Operating liabilities

You are given reorganized financial statements of an industrial company as follows. Restated balance sheet 2008 2007 Operating assets 4,610 4,237 (-) Operating liabilities 625 557 Net operating assets (NOA) 3,985 3,680 Financial obligations 2,040 1,965 (-) Financial assets 477 415 Net financial obligations (NFO) 1,563 1,550 Shareholders' equity (CSE) 2,422 2,130 NFO+CSE 3,985 3,680 Restated income statement 2008 Operating revenue 3,323 (-) Operating expense 2,415 Operating income 908 (-) Tax on operating income 296 Operating income (after tax) 612 Reported income tax 228 (+) Tax shield on net financial expense 68 Tax on operating income 296 Financial expense 195 (-) Financial income Net financial expense 195 (-) Tax shield on net financial expense 68 Net financial expense (after tax) 127 Comprehensive income (CI) 485 Calculate the following financial ratios in 2008, based on the reorganized financial statements. State your answers to the following in 2 decimal places: a) Net income profit margin (NIPM) is b) Return on net operating assets (RNOA) is c) Operating liability leverage (OLLEV = Avg. OL/Avg. NOA) is d) Financial leverage ratio (FLEV = Avg. NFO/Avg. CSE) is e) Return on operating assets (ROOA) assuming an after-tax short term ratio r = 1%.

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Part A Net Income Profit Margin Net IncomeRevenue ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started