Answered step by step

Verified Expert Solution

Question

1 Approved Answer

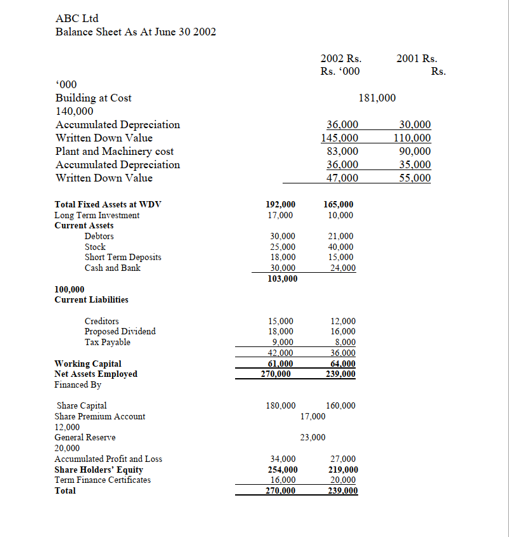

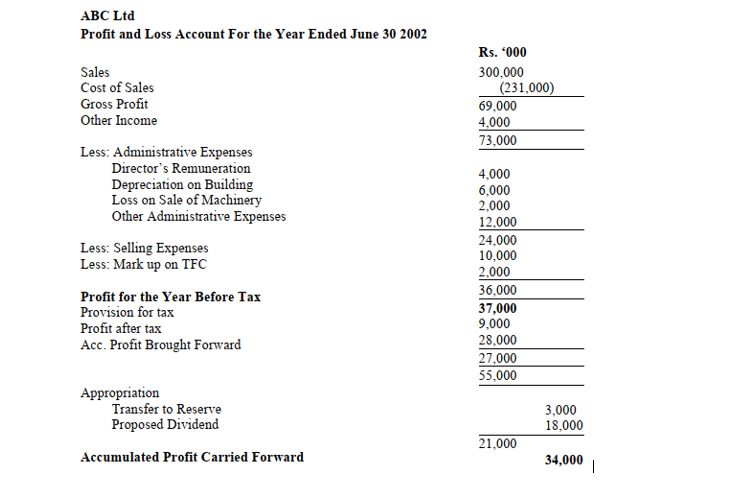

You are given the Balance Sheet of ABC Limited as at June 30, 2001 and June 30, 2002 and its Profit and Loss Account for

You are given the Balance Sheet of ABC Limited as at June 30, 2001 and June 30, 2002 and its Profit and Loss Account for the year ended June 30 2002.

Required Check the balance amount of each section is correct:

Additional Information 1. Other income include dividend on Long Term Investment 2. Cost of goods sold includes depreciation for the year on machinery Rs. 5,000. 3. Accumulated Depreciation on the machine disposed off amounts to Rs. 4,000.

Please need answer asap. and need perfect annswer. Thanks

ABC Ltd Balance Sheet As At June 30 2002 2002 Rs. Rs. 1000 2001 Rs. Rs. *000 Building at Cost 140,000 Accumulated Depreciation Written Down Value Plant and Machinery cost Accumulated Depreciation Written Down Value 181,000 36.000 30.000 145.000 110,000 83.000 90,000 36.000 35,000 47,000 55,000 192,000 17,000 165,000 10,000 Total Fixed Assets at WDV Long Term Investment Current Assets Debtors Stock Short Term Deposits Cash and Bank 30,000 25,000 18.000 30.000 103,000 21,000 40,000 15,000 24.000 100,000 Current Liabilities Creditors Proposed Dividend Tax Payable 15,000 18.000 9.000 42.000 61.000 270,000 12.000 16.000 8.000 36.000 64.000 239.000 Working Capital Net Assets Employed Financed By 180.000 160.000 17.000 23.000 Share Capital Share Premium Account 12.000 General Reserve 20.000 Accumulated Profit and Loss Share Holders' Equity Term Finance Certificates Total 34.000 254,000 16.000 270.000 27,000 219,000 20.000 239.000 ABC Ltd Profit and Loss Account For the Year Ended June 30 2002 Rs. 6000 300,000 (231,000) 69,000 4.000 73,000 Sales Cost of Sales Gross Profit Other Income Less: Administrative Expenses Director's Remuneration Depreciation on Building Loss on Sale of Machinery Other Administrative Expenses Less: Selling Expenses Less: Mark up on TFC Profit for the Year Before Tax Provision for tax Profit after tax Acc. Profit Brought Forward 4,000 6,000 2,000 12.000 24,000 10,000 2.000 36,000 37,000 9,000 28.000 27,000 55,000 Appropriation Transfer to Reserve Proposed Dividend Accumulated Profit Carried Forward 3,000 18,000 21,000 34,000 | ABC Ltd Balance Sheet As At June 30 2002 2002 Rs. Rs. 1000 2001 Rs. Rs. *000 Building at Cost 140,000 Accumulated Depreciation Written Down Value Plant and Machinery cost Accumulated Depreciation Written Down Value 181,000 36.000 30.000 145.000 110,000 83.000 90,000 36.000 35,000 47,000 55,000 192,000 17,000 165,000 10,000 Total Fixed Assets at WDV Long Term Investment Current Assets Debtors Stock Short Term Deposits Cash and Bank 30,000 25,000 18.000 30.000 103,000 21,000 40,000 15,000 24.000 100,000 Current Liabilities Creditors Proposed Dividend Tax Payable 15,000 18.000 9.000 42.000 61.000 270,000 12.000 16.000 8.000 36.000 64.000 239.000 Working Capital Net Assets Employed Financed By 180.000 160.000 17.000 23.000 Share Capital Share Premium Account 12.000 General Reserve 20.000 Accumulated Profit and Loss Share Holders' Equity Term Finance Certificates Total 34.000 254,000 16.000 270.000 27,000 219,000 20.000 239.000 ABC Ltd Profit and Loss Account For the Year Ended June 30 2002 Rs. 6000 300,000 (231,000) 69,000 4.000 73,000 Sales Cost of Sales Gross Profit Other Income Less: Administrative Expenses Director's Remuneration Depreciation on Building Loss on Sale of Machinery Other Administrative Expenses Less: Selling Expenses Less: Mark up on TFC Profit for the Year Before Tax Provision for tax Profit after tax Acc. Profit Brought Forward 4,000 6,000 2,000 12.000 24,000 10,000 2.000 36,000 37,000 9,000 28.000 27,000 55,000 Appropriation Transfer to Reserve Proposed Dividend Accumulated Profit Carried Forward 3,000 18,000 21,000 34,000 |Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started