Answered step by step

Verified Expert Solution

Question

1 Approved Answer

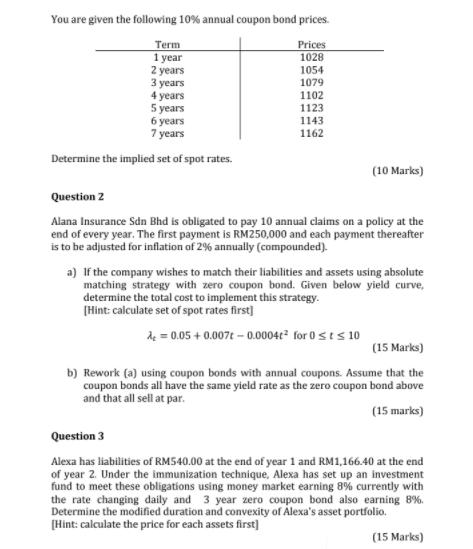

You are given the following 10% annual coupon bond prices. Term Prices 1 year 1028 2 years 1054 3 years 1079 1102 4 years

You are given the following 10% annual coupon bond prices. Term Prices 1 year 1028 2 years 1054 3 years 1079 1102 4 years 5 years 1123 1143 6 years 7 years 1162 Determine the implied set of spot rates. Question 2 (10 Marks) Alana Insurance Sdn Bhd is obligated to pay 10 annual claims on a policy at the end of every year. The first payment is RM250,000 and each payment thereafter is to be adjusted for inflation of 2% annually (compounded). a) If the company wishes to match their liabilities and assets using absolute matching strategy with zero coupon bond. Given below yield curve, determine the total cost to implement this strategy. [Hint: calculate set of spot rates first] =0.05+ 0.007 0.0004c2 for 0sts 10 (15 Marks) b) Rework (a) using coupon bonds with annual coupons. Assume that the coupon bonds all have the same yield rate as the zero coupon bond above and that all sell at par. Question 3 (15 marks) Alexa has liabilities of RM540.00 at the end of year 1 and RM1,166.40 at the end of year 2. Under the immunization technique, Alexa has set up an investment fund to meet these obligations using money market earning 8% currently with the rate changing daily and 3 year zero coupon bond also earning 8%. Determine the modified duration and convexity of Alexa's asset portfolio. [Hint: calculate the price for each assets first] (15 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started