Answered step by step

Verified Expert Solution

Question

1 Approved Answer

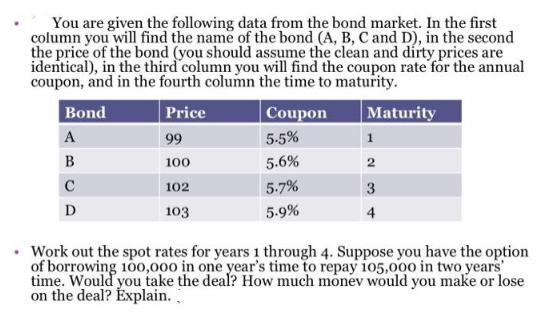

You are given the following data from the bond market. In the first column you will find the name of the bond (A, B,

You are given the following data from the bond market. In the first column you will find the name of the bond (A, B, C and D), in the second the price of the bond (you should assume the clean and dirty prices are identical), in the third column you will find the coupon rate for the annual coupon, and in the fourth column the time to maturity. Price 99 100 102 103 Bond A B D Coupon 5.5% 5.6% 5.7% 5.9% Maturity 1 2 3 4 Work out the spot rates for years 1 through 4. Suppose you have the option of borrowing 100,000 in one year's time to repay 105,000 in two years' time. Would you take the deal? How much money would you make or lose on the deal? Explain.

Step by Step Solution

★★★★★

3.31 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To work out the spot rates for years 1 through 4 we can use the data provided and the formula for ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started