Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are given the following exchange rates for two dates: August 19, 2005 and August 18, 2006: 1 Canadian Dollar buys U.S. Dollar Euro

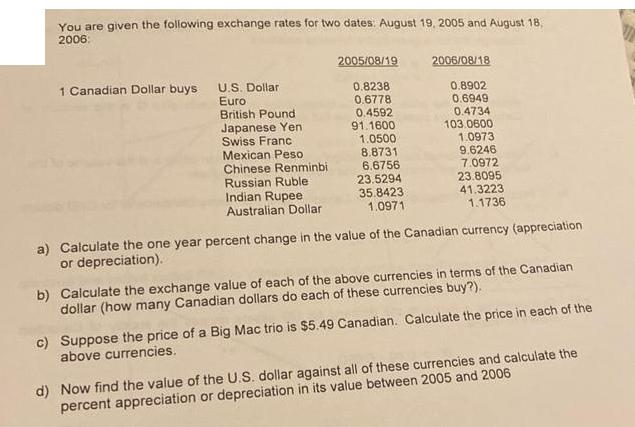

You are given the following exchange rates for two dates: August 19, 2005 and August 18, 2006: 1 Canadian Dollar buys U.S. Dollar Euro British Pound Japanese Yen Swiss Franc Mexican Peso Chinese Renminbi Russian Ruble Indian Rupee Australian Dollar 2005/08/19 0.8238 0.6778 0.4592 91.1600 1.0500 8.8731 6.6756 23.5294 35.8423 1.0971 2006/08/18 0.8902 0.6949 0.4734 103.0600 1.0973 9.6246 7.0972 23.8095 41.3223 1.1736 a) Calculate the one year percent change in the value of the Canadian currency (appreciation or depreciation). b) Calculate the exchange value of each of the above currencies in terms of the Canadian dollar (how many Canadian dollars do each of these currencies buy?). c) Suppose the price of a Big Mac trio is $5.49 Canadian. Calculate the price in each of the above currencies. d) Now find the value of the U.S. dollar against all of these currencies and calculate the percent appreciation or depreciation in its value between 2005 and 2006

Step by Step Solution

★★★★★

3.31 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a The one year percent change in the value of the Canadian currency is 1612 appreciation b Exchange ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started