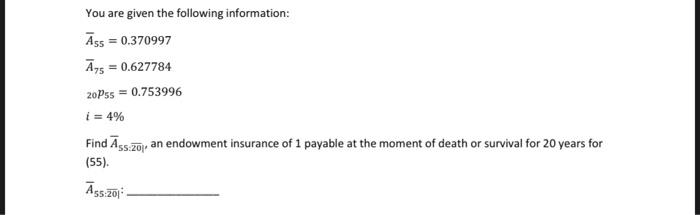

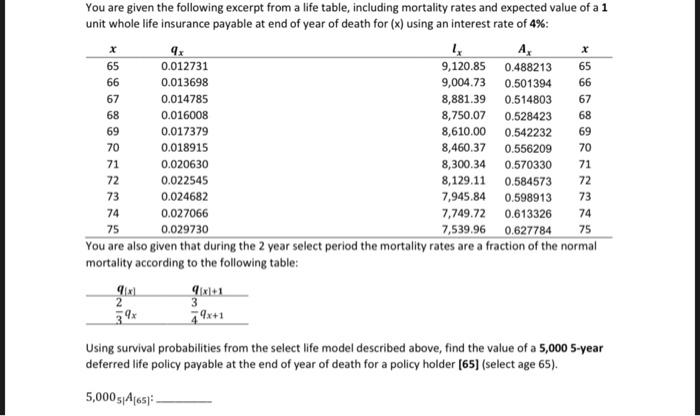

You are given the following information: A55 = 0.370997 75 = 0.627784 20Pss = 0.753996 i = 4% Find gs.zojan endowment insurance of 1 payable at the moment of death or survival for 20 years for (55) Assza: You are given the following excerpt from a life table, including mortality rates and expected value of a 1 unit whole life insurance payable at end of year of death for (x) using an interest rate of 4%: 92 A. x 65 0.012731 9,120.85 0.488213 65 66 0.013698 9,004.73 0.501394 66 67 0.014785 8,881.39 0.514803 67 68 0.016008 8,750.07 0.528423 68 69 0.017379 8,610.00 0.542232 69 70 0.018915 8,460.37 0.556209 70 71 0.020630 8,300.34 0.570330 71 72 0.022545 8,129.11 0.584573 72 73 0.024682 7,945.84 0.598913 73 74 0.027066 7,749.72 0.613326 74 75 0.029730 7,539.96 0.627784 75 You are also given that during the 2 year select period the mortality rates are a fraction of the normal mortality according to the following table: 9x 2 3 49x+1 Using survival probabilities from the select life model described above, find the value of a 5,000 5-year deferred life policy payable at the end of year of death for a policy holder (65) (select age 65). 5,000 5,4165) You are given the following information: A55 = 0.370997 75 = 0.627784 20Pss = 0.753996 i = 4% Find gs.zojan endowment insurance of 1 payable at the moment of death or survival for 20 years for (55) Assza: You are given the following excerpt from a life table, including mortality rates and expected value of a 1 unit whole life insurance payable at end of year of death for (x) using an interest rate of 4%: 92 A. x 65 0.012731 9,120.85 0.488213 65 66 0.013698 9,004.73 0.501394 66 67 0.014785 8,881.39 0.514803 67 68 0.016008 8,750.07 0.528423 68 69 0.017379 8,610.00 0.542232 69 70 0.018915 8,460.37 0.556209 70 71 0.020630 8,300.34 0.570330 71 72 0.022545 8,129.11 0.584573 72 73 0.024682 7,945.84 0.598913 73 74 0.027066 7,749.72 0.613326 74 75 0.029730 7,539.96 0.627784 75 You are also given that during the 2 year select period the mortality rates are a fraction of the normal mortality according to the following table: 9x 2 3 49x+1 Using survival probabilities from the select life model described above, find the value of a 5,000 5-year deferred life policy payable at the end of year of death for a policy holder (65) (select age 65). 5,000 5,4165)