Answered step by step

Verified Expert Solution

Question

1 Approved Answer

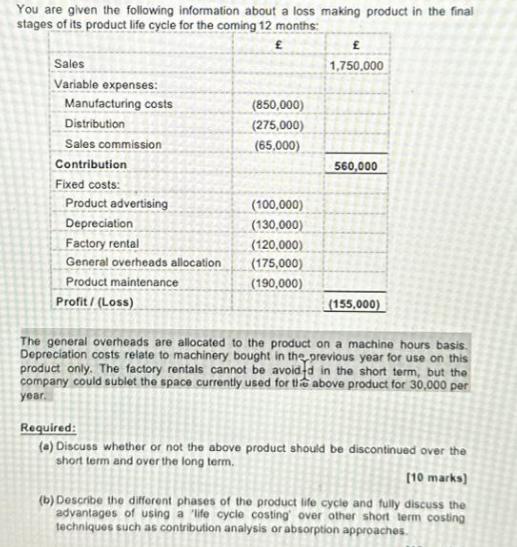

You are given the following information about a loss making product in the final stages of its product life cycle for the coming 12

You are given the following information about a loss making product in the final stages of its product life cycle for the coming 12 months: Sales 1,750,000 Variable expenses: Manufacturing costs (850,000) Distribution (275,000) Sales commission (65,000) Contribution 560,000 Fixed costs: Product advertising (100,000) Depreciation (130,000) Factory rental (120,000) General overheads allocation (175,000) Product maintenance (190,000) Profit/(Loss) (155,000) The general overheads are allocated to the product on a machine hours basis. Depreciation costs relate to machinery bought in the previous year for use on this product only. The factory rentals cannot be avoided in the short term, but the company could sublet the space currently used for the above product for 30,000 per year Required: (a) Discuss whether or not the above product should be discontinued over the short term and over the long term. [10 marks] (b) Describe the different phases of the product life cycle and fully discuss the advantages of using a life cycle costing over other short term costing techniques such as contribution analysis or absorption approaches.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started