Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are given the following information about possible investments a) (5 points) If the market standard deviation is 20% what are the CAPM betas of

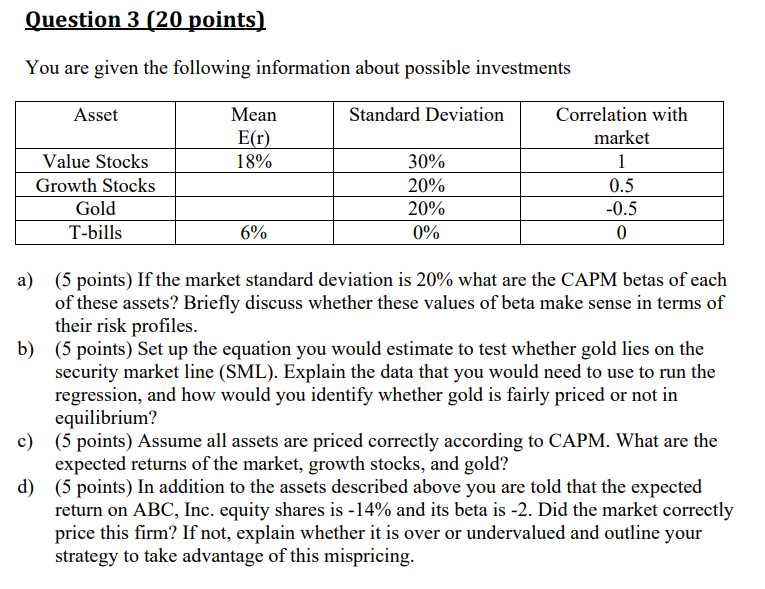

You are given the following information about possible investments a) (5 points) If the market standard deviation is 20% what are the CAPM betas of each of these assets? Briefly discuss whether these values of beta make sense in terms of their risk profiles. b) (5 points) Set up the equation you would estimate to test whether gold lies on the security market line (SML). Explain the data that you would need to use to run the regression, and how would you identify whether gold is fairly priced or not in equilibrium? c) (5 points) Assume all assets are priced correctly according to CAPM. What are the expected returns of the market, growth stocks, and gold? d) (5 points) In addition to the assets described above you are told that the expected return on ABC, Inc. equity shares is 14% and its beta is -2 . Did the market correctly price this firm? If not, explain whether it is over or undervalued and outline your strategy to take advantage of this mispricing

You are given the following information about possible investments a) (5 points) If the market standard deviation is 20% what are the CAPM betas of each of these assets? Briefly discuss whether these values of beta make sense in terms of their risk profiles. b) (5 points) Set up the equation you would estimate to test whether gold lies on the security market line (SML). Explain the data that you would need to use to run the regression, and how would you identify whether gold is fairly priced or not in equilibrium? c) (5 points) Assume all assets are priced correctly according to CAPM. What are the expected returns of the market, growth stocks, and gold? d) (5 points) In addition to the assets described above you are told that the expected return on ABC, Inc. equity shares is 14% and its beta is -2 . Did the market correctly price this firm? If not, explain whether it is over or undervalued and outline your strategy to take advantage of this mispricing Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started