Answered step by step

Verified Expert Solution

Question

1 Approved Answer

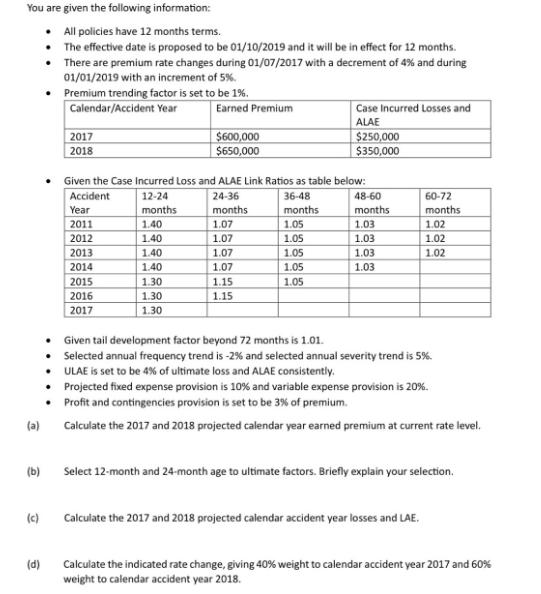

You are given the following information: All policies have 12 months terms. The effective date is proposed to be 01/10/2019 and it will be

You are given the following information: All policies have 12 months terms. The effective date is proposed to be 01/10/2019 and it will be in effect for 12 months. There are premium rate changes during 01/07/2017 with a decrement of 4% and during 01/01/2019 with an increment of 5%. (b) (c) (d) Premium trending factor is set to be 1%. Calendar/Accident Year 2017 2018 2015 2016 2017 Earned Premium 1.40 1.40 1.40 1.40 1.30 1.30 1.30 $600,000 $650,000 Given the Case Incurred Loss and ALAE Link Ratios as table below: Accident 12-24 24-36 36-48 Year months months months 2011 2012 2013 2014 1.07 1.07 1.07 1.07 1.15 1.15 Case Incurred Losses and ALAE 1.05 1.05 1.05 1.05 1.05 $250,000 $350,000 48-60 months 1.03 1.03 1.03 1.03 Given tail development factor beyond 72 months is 1.01. Selected annual frequency trend is -2% and selected annual severity trend is 5%. ULAE is set to be 4% of ultimate loss and ALAE consistently. Projected fixed expense provision is 10% and variable expense provision is 20%. Profit and contingencies provision is set to be 3% of premium. (a) Calculate the 2017 and 2018 projected calendar year earned premium at current rate level. 60-72 months 1.02 1.02 1.02 Calculate the 2017 and 2018 projected calendar accident year losses and LAE. Select 12-month and 24-month age to ultimate factors. Briefly explain your selection. Calculate the indicated rate change, giving 40% weight to calendar accident year 2017 and 60% weight to calendar accident year 2018.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the projected calendar year earned premium at the current rate level for 2017 and 2018 we need to consider the premium rate changes and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started