Answered step by step

Verified Expert Solution

Question

1 Approved Answer

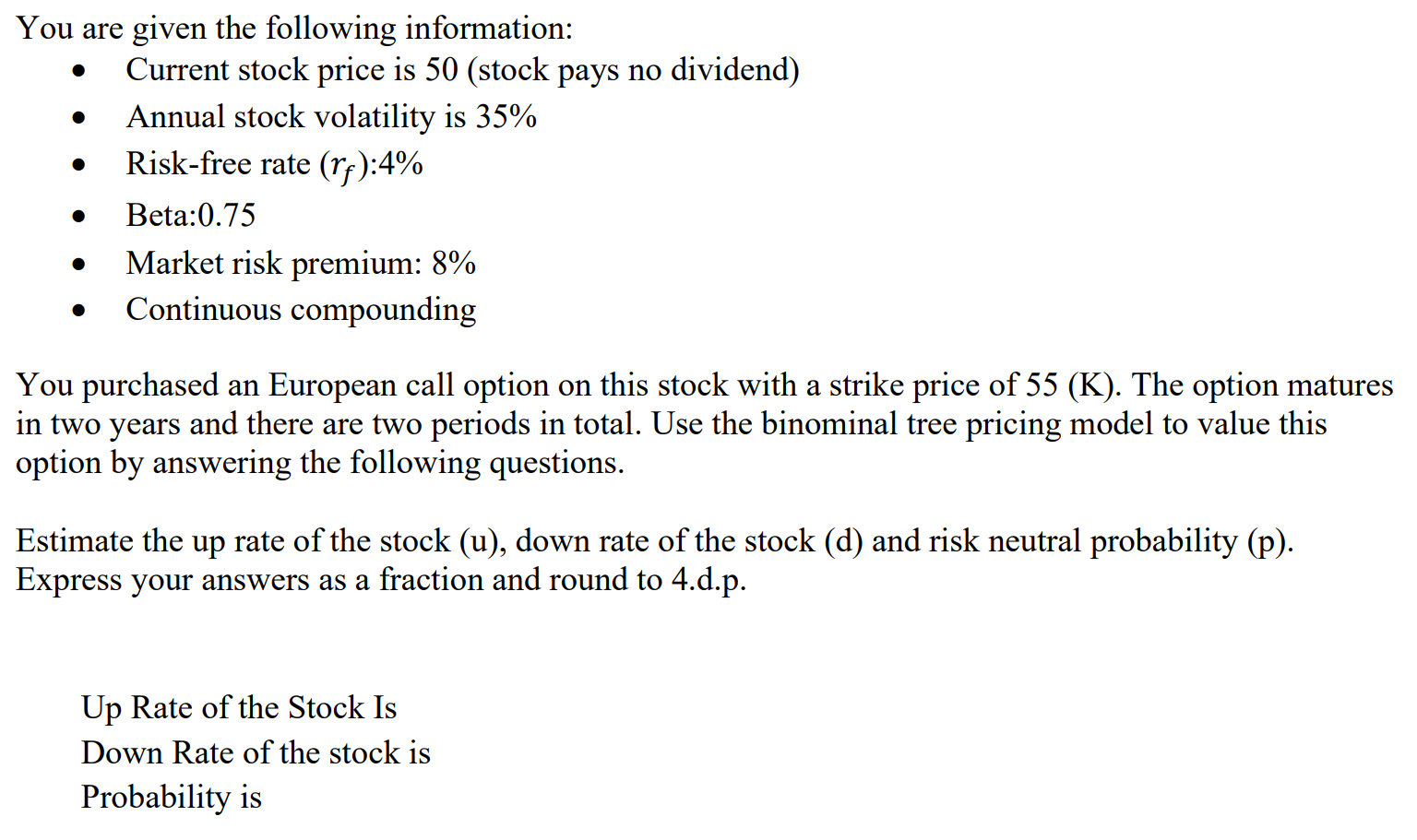

You are given the following information: Current stock price is 50 (stock pays no dividend) Annual stock volatility is 35% Risk-free rate (r):4% Beta:0.75

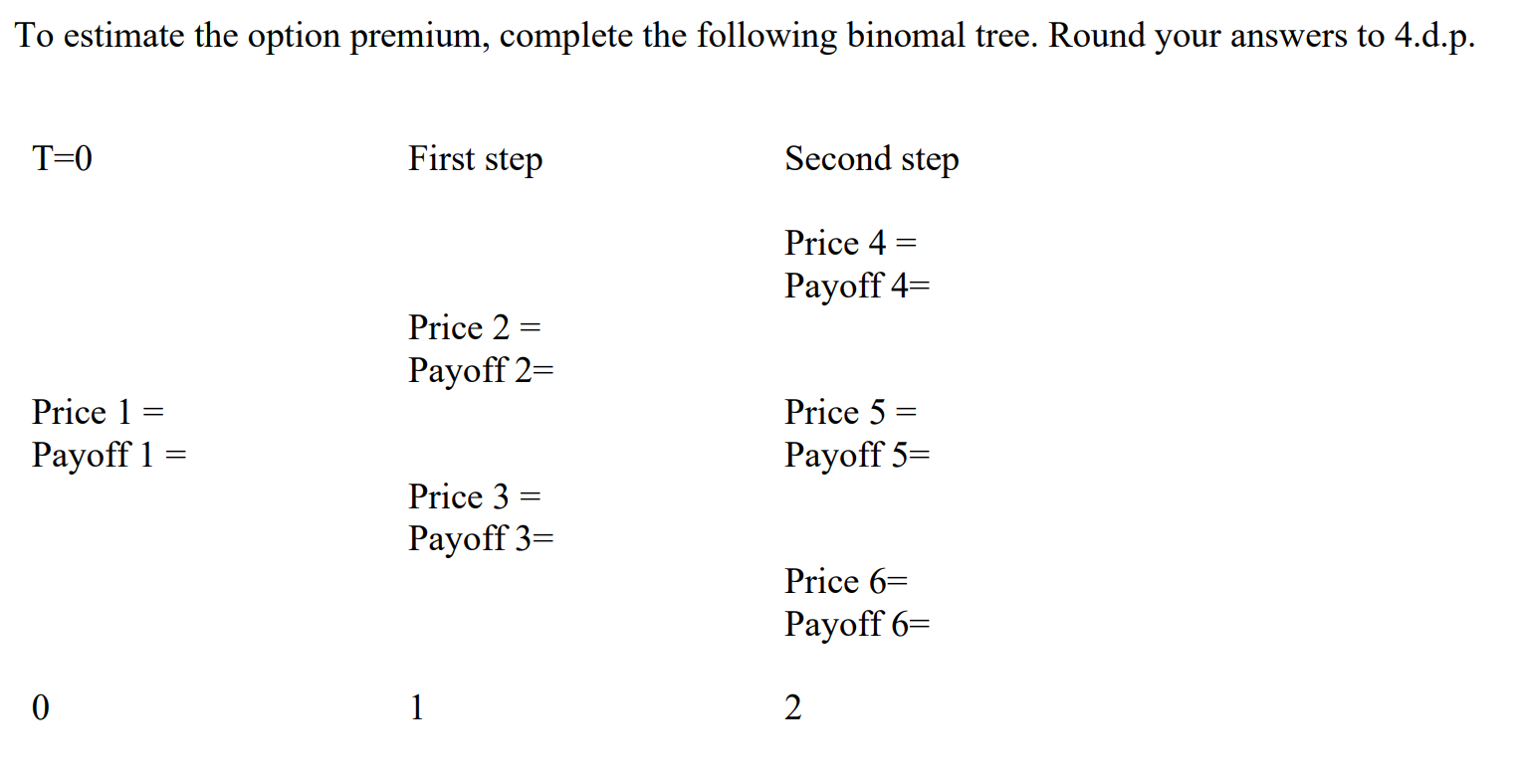

You are given the following information: Current stock price is 50 (stock pays no dividend) Annual stock volatility is 35% Risk-free rate (r):4% Beta:0.75 Market risk premium: 8% Continuous compounding You purchased an European call option on this stock with a strike price of 55 (K). The option matures in two years and there two periods in total. Use the binominal tree pricing model to value this option by answering the following questions. Estimate the up rate of the stock (u), down rate of the stock (d) and risk neutral probability (p). Express your answers as a fraction and round to 4.d.p. Up Rate of the Stock Is Down Rate of the stock is Probability is To estimate the option premium, complete the following binomal tree. Round your answers to 4.d.p. T=0 Price 1 = Payoff 1 0 = First step Price 2 = Payoff 2= Price 3 Payoff 3= 1 Second step Price 4 = Payoff 4= Price 5 = Payoff 5= Price 6= Payoff 6= 2

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To value the European call option using the binomial t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started