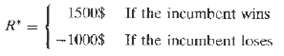

Now place yourself exactly in the same setting as before, where the market quotes the above R.

Question:

Now place yourself exactly in the same setting as before, where the market quotes the above R. It just happens that you have a close friend who offers you the following separate bet, R*:

Note that Tue random event behind this bet is the same as in R. Now consider the following:(a) Using the R and the R*, construct a portfolio of bets such that you gt a guaranteed risk-free return (assuming that your friend or the market does not default).(b) Is the value of the probability p important in selecting this portfolio? Do you care what the p is? Suppose you are given the R, but the payoff of R* when the incumbent wins is an unknown to be determined. Can the above portfolio help you determine this unknown value?(c) What role would a statistician of econometrician play in making all these decisions? Why?

PortfolioA portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

An Introduction to the Mathematics of financial Derivatives

ISBN: 978-0123846822

2nd Edition

Authors: Salih N. Neftci