Answered step by step

Verified Expert Solution

Question

1 Approved Answer

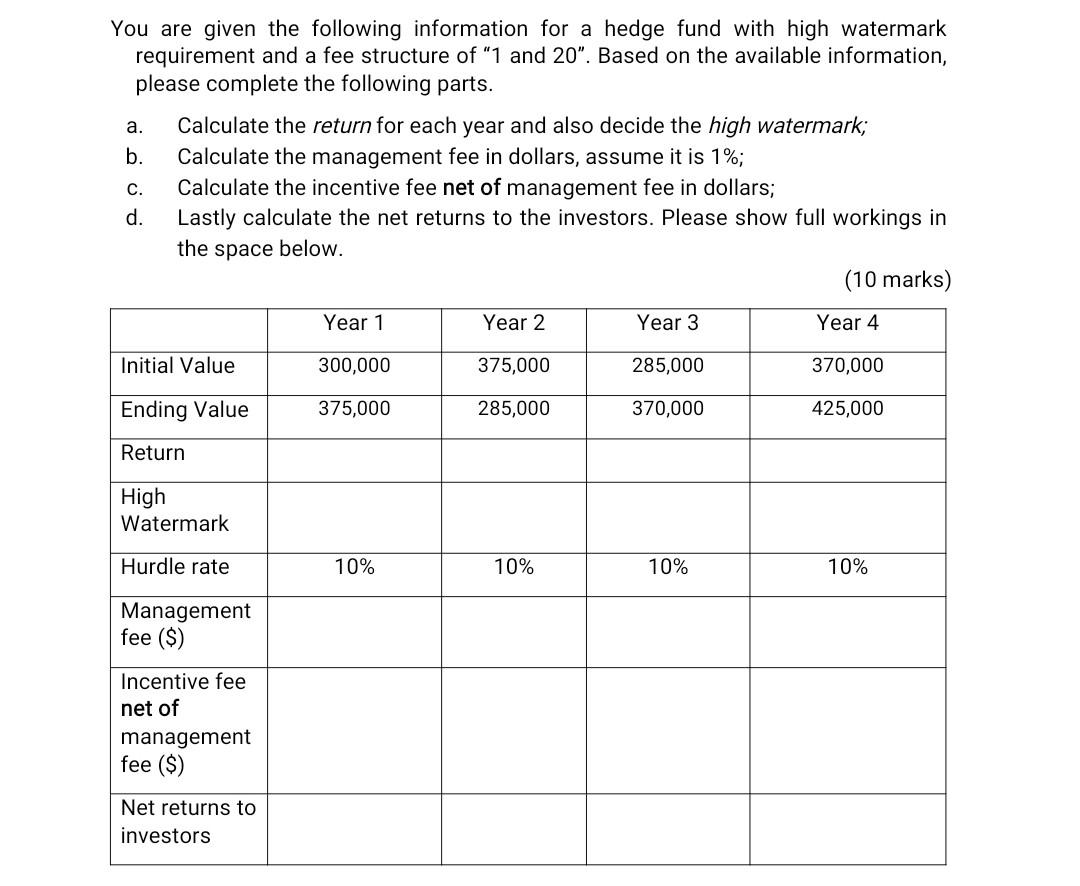

You are given the following information for a hedge fund with high watermark requirement and a fee structure of 1 and 20. Based on the

You are given the following information for a hedge fund with high watermark requirement and a fee structure of "1 and 20". Based on the available information, please complete the following parts. a. b. C. Calculate the return for each year and also decide the high watermark; Calculate the management fee in dollars, assume it is 1%; Calculate the incentive fee net of management fee in dollars; Lastly calculate the net returns to the investors. Please show full workings in the space below. (10 marks) d. Year 1 Year 2 Year 3 Year 4 Initial Value 300,000 375,000 285,000 370,000 Ending Value 375,000 285,000 370,000 425,000 Return High Watermark Hurdle rate 10% 10% 10% 10% Management fee ($) Incentive fee net of management fee ($) Net returns to investors

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started