Question

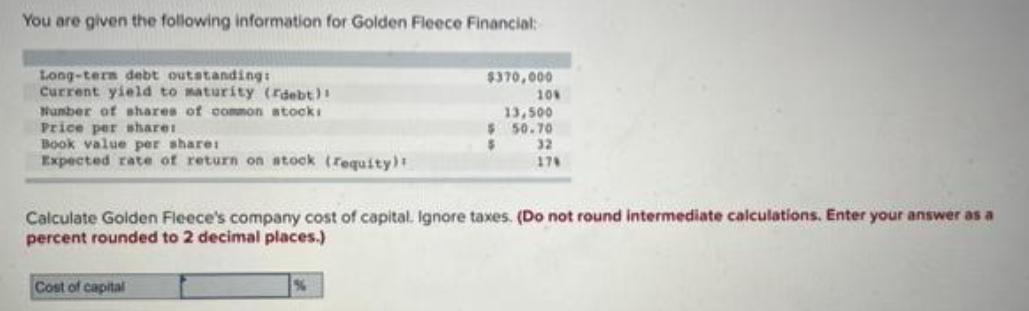

You are given the following information for Golden Fleece Financial: Long-term debt outstanding: Current yield to maturity (debt) $370,000 10% Number of shares of

You are given the following information for Golden Fleece Financial: Long-term debt outstanding: Current yield to maturity (debt) $370,000 10% Number of shares of common stocki 13,500 Price per share: $ 50.70 Book value per share: 32 Expected rate of return on stock (requity): 179 Calculate Golden Fleece's company cost of capital. Ignore taxes. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Cost of capital %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

AI ChatAI Image Generator Login AI Chat AI Chat is an AI chatbot that writes text You can use it to write stories messages or programming code You can use the AI chatbot as a virtual tutor in almost a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Corporate Finance

Authors: Richard A. Brealey, Stewart C. Myers, Franklin Allen

10th Edition

9780073530734, 77404890, 73530735, 978-0077404895

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App