Answered step by step

Verified Expert Solution

Question

1 Approved Answer

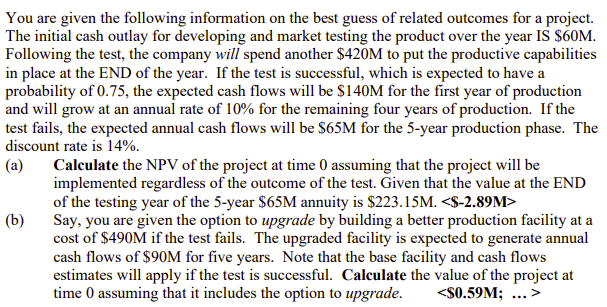

You are given the following information on the best guess of related outcomes for a project. The initial cash outlay for developing and market testing

You are given the following information on the best guess of related outcomes for a project.

The initial cash outlay for developing and market testing the product over the year IS $

Following the test, the company will spend another $ to put the productive capabilities

in place at the END of the year. If the test is successful, which is expected to have a

probability of the expected cash flows will be $ for the first year of production

and will grow at an annual rate of for the remaining four years of production. If the

test fails, the expected annual cash flows will be $ for the year production phase. The

discount rate is

a Calculate the NPV of the project at time assuming that the project will be

implemented regardless of the outcome of the test. Given that the value at the END

of the testing year of the year $M annuity is $

b Say, you are given the option to upgrade by building a better production facility at a

cost of $ if the test fails. The upgraded facility is expected to generate annual

cash flows of $ for five years. Note that the base facility and cash flows

estimates will apply if the test is successful. Calculate the value of the project at

time assuming that it includes the option to upgrade.

$;dotsYou are given the following information on the best guess of related outcomes for a project. The initial cash outlay for developing and market testing the product over the next year IS $M Following the test, the company will spend another $M to put the productive capabilities in place at the END of the year. If the test is successful, which is expected to have a probability of the expected annual cash flows will be $M for five years. If the test fails, the expected annual cash flows will be $M for five years. The discount rate is a Compute the NPV of this project at time assuming that the project will be implemented regardless of the outcome of the test. Given that the value at the END of the testing year of the year $M annuity is $M and that of the year $M annuity is $M b Say, you are given the option to upgrade by building a better production facility at a cost of $M if the test fails. The upgraded facility is expected to generate annual cash flows of $M for five years. Note that the base facility and cash flows estimates will apply if the test is successful. Compute the value of the option to upgrade at time

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started