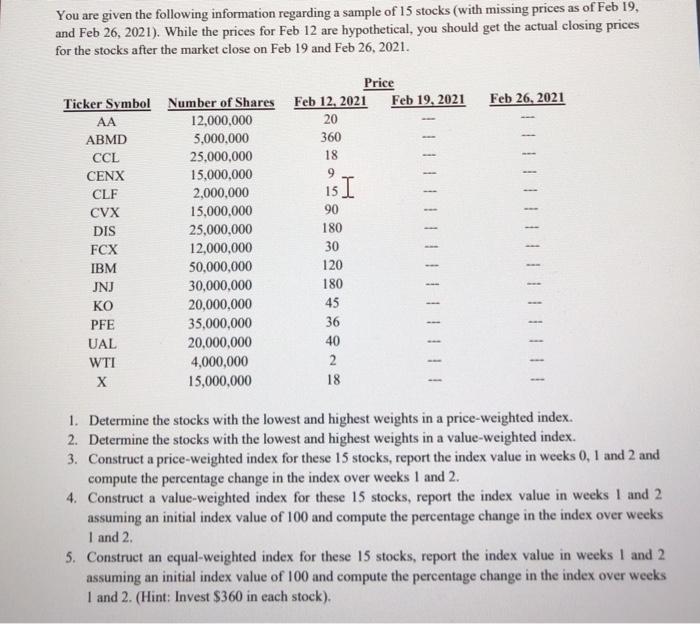

You are given the following information regarding a sample of 15 stocks (with missing prices as of Feb 19, and Feb 26, 2021). While the prices for Feb 12 are hypothetical, you should get the actual closing prices for the stocks after the market close on Feb 19 and Feb 26, 2021. Feb 26, 2021 Price Ticker Symbol Number of Shares Feb 12, 2021 Feb 19, 2021 AA 12,000,000 20 ABMD 5,000,000 360 CCL 25,000,000 18 CENX 15,000,000 9 CLF 2,000,000 15 I CVX 15,000,000 90 DIS 25,000,000 180 FCX 12,000,000 30 IBM 50,000,000 120 JNJ 30,000,000 180 KO 20,000,000 45 PFE 35,000,000 36 UAL 20,000,000 40 WTI 4,000,000 2 X 15,000,000 18 1. Determine the stocks with the lowest and highest weights in a price-weighted index. 2. Determine the stocks with the lowest and highest weights in a value-weighted index. 3. Construct a price-weighted index for these 15 stocks, report the index value in weeks 0, 1 and 2 and compute the percentage change in the index over weeks 1 and 2. 4. Construct a value-weighted index for these 15 stocks, report the index value in weeks 1 and 2 assuming an initial index value of 100 and compute the percentage change in the index over weeks 1 and 2 5. Construct an equal-weighted index for these 15 stocks, report the index value in weeks 1 and 2 assuming an initial index value of 100 and compute the percentage change in the index over weeks I and 2. (Hint: Invest $360 in each stock), You are given the following information regarding a sample of 15 stocks (with missing prices as of Feb 19, and Feb 26, 2021). While the prices for Feb 12 are hypothetical, you should get the actual closing prices for the stocks after the market close on Feb 19 and Feb 26, 2021. Feb 26, 2021 Price Ticker Symbol Number of Shares Feb 12, 2021 Feb 19, 2021 AA 12,000,000 20 ABMD 5,000,000 360 CCL 25,000,000 18 CENX 15,000,000 9 CLF 2,000,000 15 I CVX 15,000,000 90 DIS 25,000,000 180 FCX 12,000,000 30 IBM 50,000,000 120 JNJ 30,000,000 180 KO 20,000,000 45 PFE 35,000,000 36 UAL 20,000,000 40 WTI 4,000,000 2 X 15,000,000 18 1. Determine the stocks with the lowest and highest weights in a price-weighted index. 2. Determine the stocks with the lowest and highest weights in a value-weighted index. 3. Construct a price-weighted index for these 15 stocks, report the index value in weeks 0, 1 and 2 and compute the percentage change in the index over weeks 1 and 2. 4. Construct a value-weighted index for these 15 stocks, report the index value in weeks 1 and 2 assuming an initial index value of 100 and compute the percentage change in the index over weeks 1 and 2 5. Construct an equal-weighted index for these 15 stocks, report the index value in weeks 1 and 2 assuming an initial index value of 100 and compute the percentage change in the index over weeks I and 2. (Hint: Invest $360 in each stock)