Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are given the following information: Risk-free Rate =2.5% / year. Part - I: Compute the following [40 pts.] 1. Expected Return for Securities A

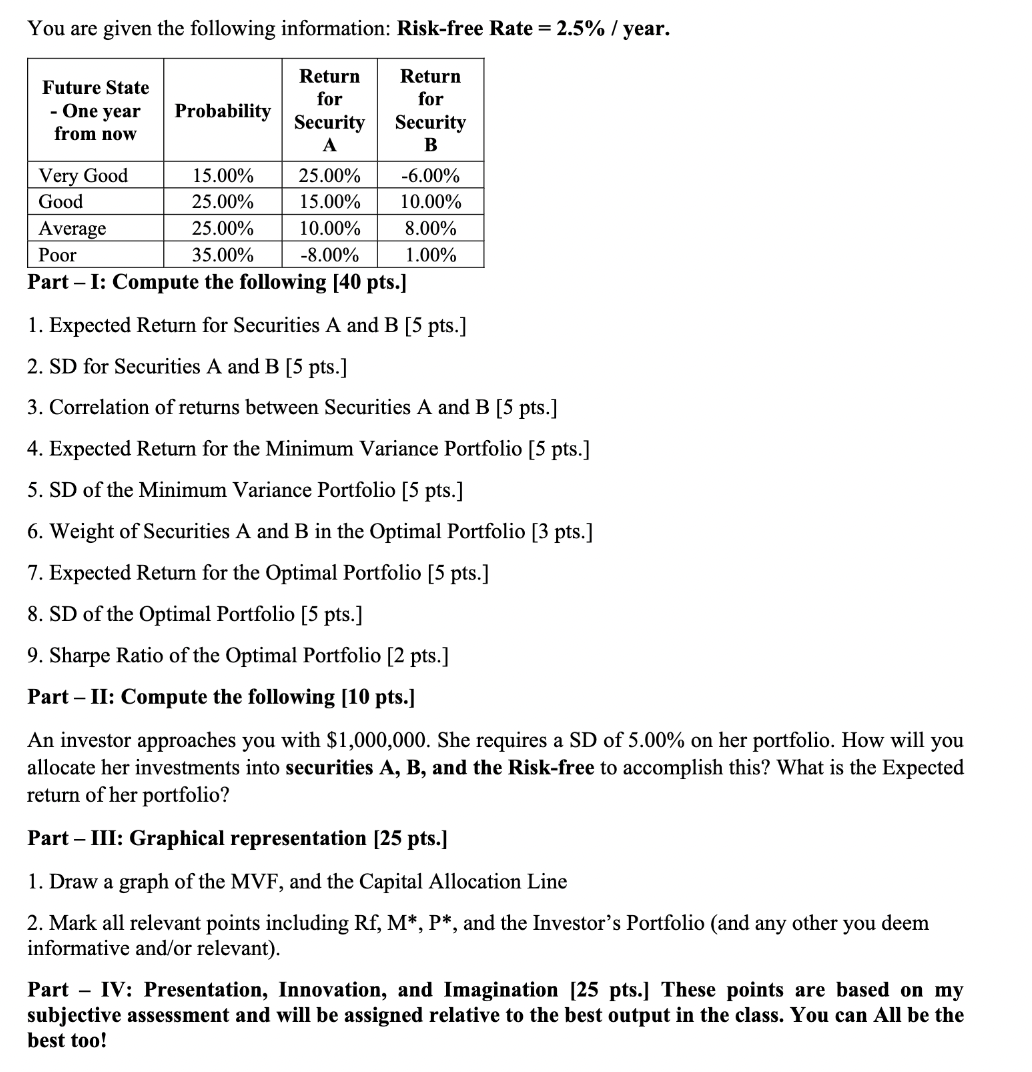

You are given the following information: Risk-free Rate =2.5% / year. Part - I: Compute the following [40 pts.] 1. Expected Return for Securities A and B [5 pts.] 2. SD for Securities A and B [5 pts.] 3. Correlation of returns between Securities A and B [5 pts.] 4. Expected Return for the Minimum Variance Portfolio [5 pts.] 5. SD of the Minimum Variance Portfolio [5 pts.] 6. Weight of Securities A and B in the Optimal Portfolio [3 pts.] 7. Expected Return for the Optimal Portfolio [5 pts.] 8. SD of the Optimal Portfolio [5 pts.] 9. Sharpe Ratio of the Optimal Portfolio [2 pts.] Part - II: Compute the following [10 pts.] An investor approaches you with $1,000,000. She requires a SD of 5.00% on her portfolio. How will you allocate her investments into securities A, B, and the Risk-free to accomplish this? What is the Expected return of her portfolio? Part - III: Graphical representation [25 pts.] 1. Draw a graph of the MVF, and the Capital Allocation Line 2. Mark all relevant points including Rf, M,P, and the Investor's Portfolio (and any other you deem informative and/or relevant). Part - IV: Presentation, Innovation, and Imagination [25 pts.] These points are based on my subjective assessment and will be assigned relative to the best output in the class. You can All be the best too! You are given the following information: Risk-free Rate =2.5% / year. Part - I: Compute the following [40 pts.] 1. Expected Return for Securities A and B [5 pts.] 2. SD for Securities A and B [5 pts.] 3. Correlation of returns between Securities A and B [5 pts.] 4. Expected Return for the Minimum Variance Portfolio [5 pts.] 5. SD of the Minimum Variance Portfolio [5 pts.] 6. Weight of Securities A and B in the Optimal Portfolio [3 pts.] 7. Expected Return for the Optimal Portfolio [5 pts.] 8. SD of the Optimal Portfolio [5 pts.] 9. Sharpe Ratio of the Optimal Portfolio [2 pts.] Part - II: Compute the following [10 pts.] An investor approaches you with $1,000,000. She requires a SD of 5.00% on her portfolio. How will you allocate her investments into securities A, B, and the Risk-free to accomplish this? What is the Expected return of her portfolio? Part - III: Graphical representation [25 pts.] 1. Draw a graph of the MVF, and the Capital Allocation Line 2. Mark all relevant points including Rf, M,P, and the Investor's Portfolio (and any other you deem informative and/or relevant). Part - IV: Presentation, Innovation, and Imagination [25 pts.] These points are based on my subjective assessment and will be assigned relative to the best output in the class. You can All be the best too

You are given the following information: Risk-free Rate =2.5% / year. Part - I: Compute the following [40 pts.] 1. Expected Return for Securities A and B [5 pts.] 2. SD for Securities A and B [5 pts.] 3. Correlation of returns between Securities A and B [5 pts.] 4. Expected Return for the Minimum Variance Portfolio [5 pts.] 5. SD of the Minimum Variance Portfolio [5 pts.] 6. Weight of Securities A and B in the Optimal Portfolio [3 pts.] 7. Expected Return for the Optimal Portfolio [5 pts.] 8. SD of the Optimal Portfolio [5 pts.] 9. Sharpe Ratio of the Optimal Portfolio [2 pts.] Part - II: Compute the following [10 pts.] An investor approaches you with $1,000,000. She requires a SD of 5.00% on her portfolio. How will you allocate her investments into securities A, B, and the Risk-free to accomplish this? What is the Expected return of her portfolio? Part - III: Graphical representation [25 pts.] 1. Draw a graph of the MVF, and the Capital Allocation Line 2. Mark all relevant points including Rf, M,P, and the Investor's Portfolio (and any other you deem informative and/or relevant). Part - IV: Presentation, Innovation, and Imagination [25 pts.] These points are based on my subjective assessment and will be assigned relative to the best output in the class. You can All be the best too! You are given the following information: Risk-free Rate =2.5% / year. Part - I: Compute the following [40 pts.] 1. Expected Return for Securities A and B [5 pts.] 2. SD for Securities A and B [5 pts.] 3. Correlation of returns between Securities A and B [5 pts.] 4. Expected Return for the Minimum Variance Portfolio [5 pts.] 5. SD of the Minimum Variance Portfolio [5 pts.] 6. Weight of Securities A and B in the Optimal Portfolio [3 pts.] 7. Expected Return for the Optimal Portfolio [5 pts.] 8. SD of the Optimal Portfolio [5 pts.] 9. Sharpe Ratio of the Optimal Portfolio [2 pts.] Part - II: Compute the following [10 pts.] An investor approaches you with $1,000,000. She requires a SD of 5.00% on her portfolio. How will you allocate her investments into securities A, B, and the Risk-free to accomplish this? What is the Expected return of her portfolio? Part - III: Graphical representation [25 pts.] 1. Draw a graph of the MVF, and the Capital Allocation Line 2. Mark all relevant points including Rf, M,P, and the Investor's Portfolio (and any other you deem informative and/or relevant). Part - IV: Presentation, Innovation, and Imagination [25 pts.] These points are based on my subjective assessment and will be assigned relative to the best output in the class. You can All be the best too Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started