Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are given the following rates of return on two companies, X and Y, for the recent five years. Required: Year X (%) Y

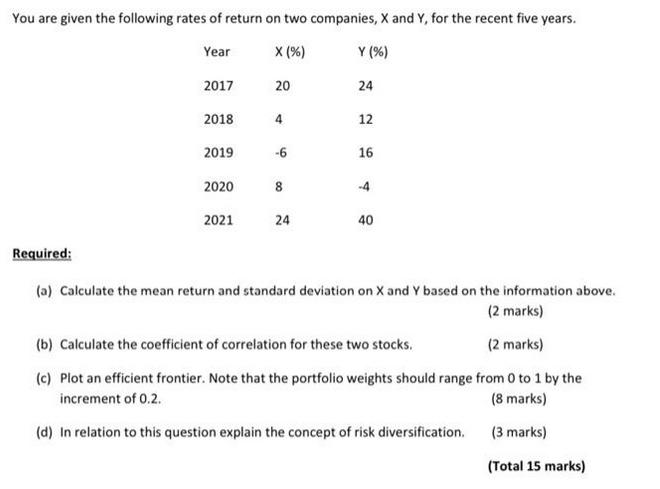

You are given the following rates of return on two companies, X and Y, for the recent five years. Required: Year X (%) Y (%) 2017 20 24 2018 4 12 2019 -6 16 2020 8 -4 2021 24 40 (a) Calculate the mean return and standard deviation on X and Y based on the information above. (b) Calculate the coefficient of correlation for these two stocks. (2 marks) (2 marks) (c) Plot an efficient frontier. Note that the portfolio weights should range from 0 to 1 by the increment of 0.2. (8 marks) (d) In relation to this question explain the concept of risk diversification. (3 marks) (Total 15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started