Question

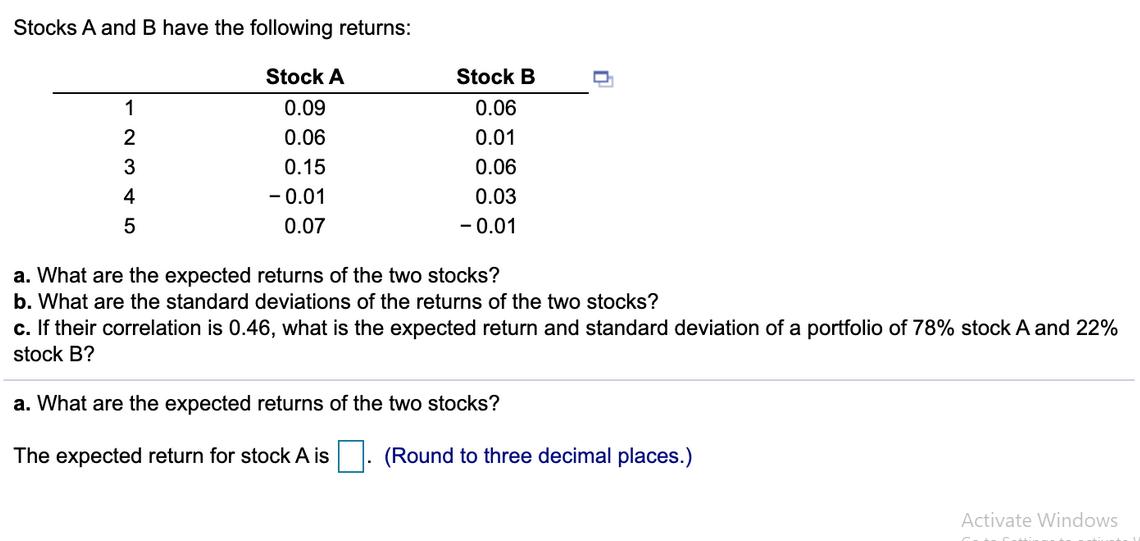

Stocks A and B have the following returns: Stock A Stock B 1 0.09 0.06 2 0.06 0.01 3 0.15 0.06 4 5 -0.01

Stocks A and B have the following returns: Stock A Stock B 1 0.09 0.06 2 0.06 0.01 3 0.15 0.06 4 5 -0.01 0.07 0.03 -0.01 a. What are the expected returns of the two stocks? b. What are the standard deviations of the returns of the two stocks? c. If their correlation is 0.46, what is the expected return and standard deviation of a portfolio of 78% stock A and 22% stock B? a. What are the expected returns of the two stocks? The expected return for stock A is 1. (Round to three decimal places.) Activate Windows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Understanding Basic Statistics

Authors: Charles Henry Brase, Corrinne Pellillo Brase

6th Edition

978-1133525097, 1133525091, 1111827028, 978-1133110316, 1133110312, 978-1111827021

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App