Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are given the following returns on the market and Stock F during the last three years. We could calculate beta using data for Years

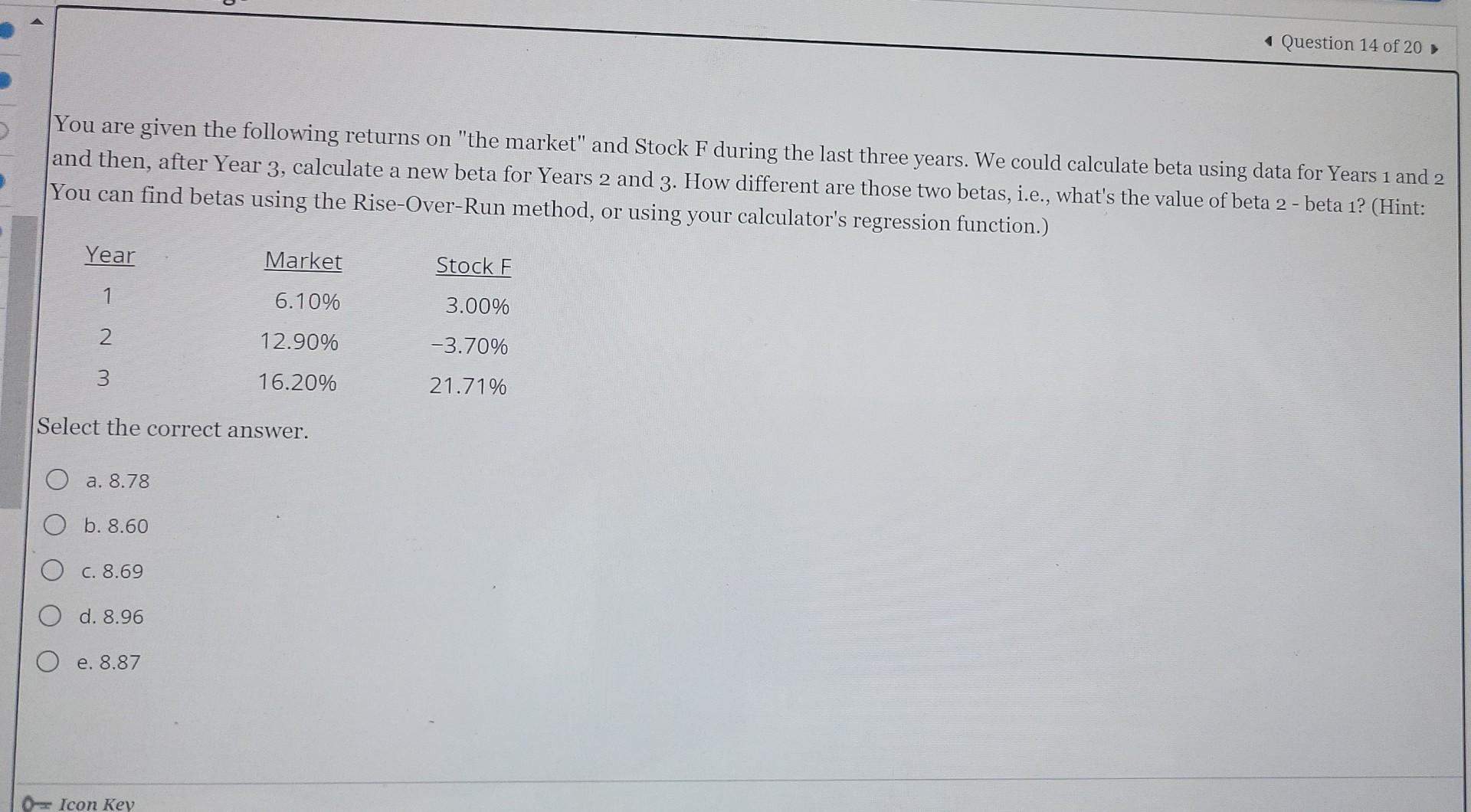

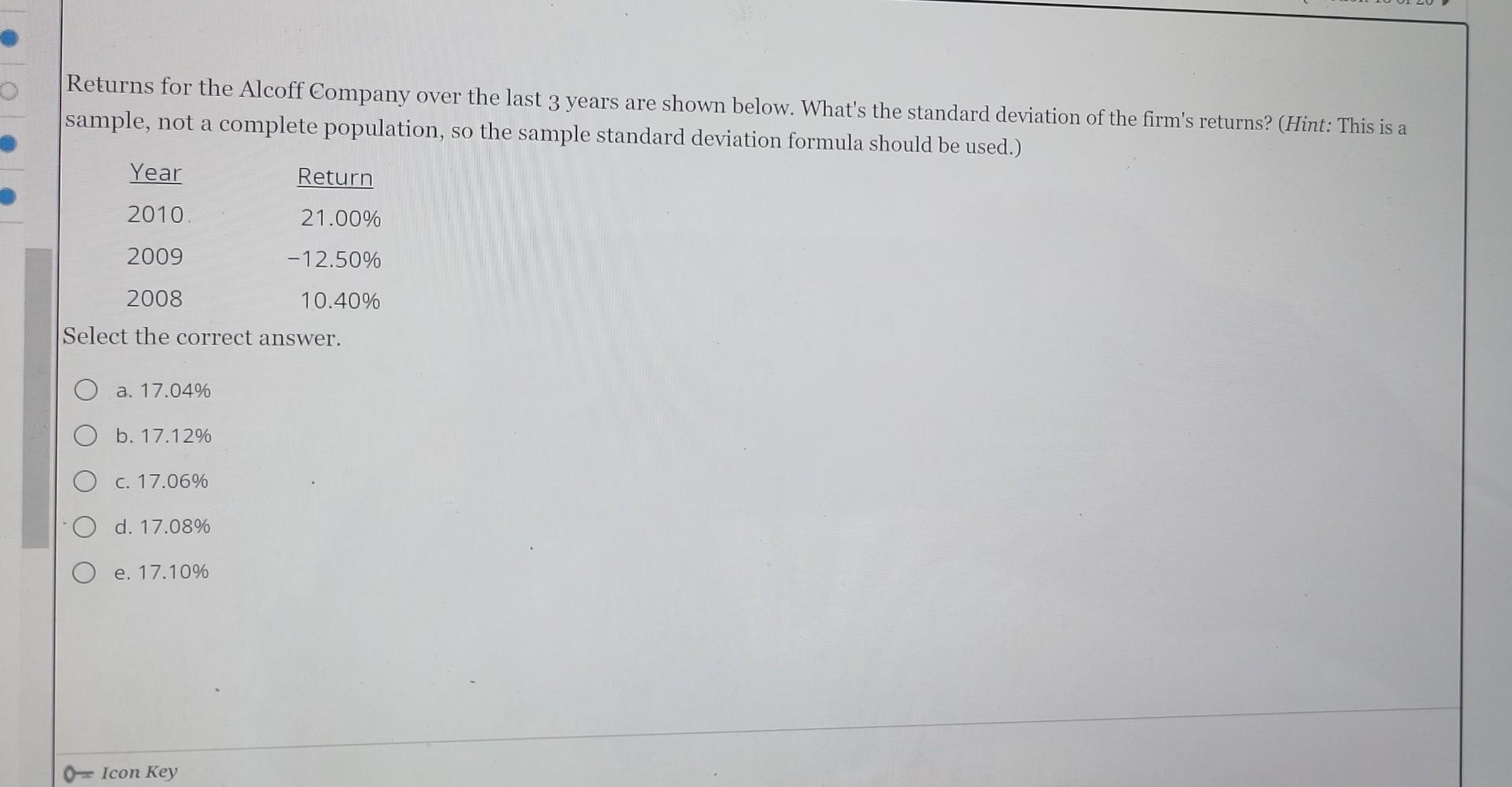

You are given the following returns on "the market" and Stock F during the last three years. We could calculate beta using data for Years 1 and 2 and then, after Year 3, calculate a new beta for Years 2 and 3 . How different are those two betas, i.e., what's the value of beta 2 - beta 1 ? (Hint: You can find betas using the Rise-Over-Run method, or using your calculator's regression function.) Select the correct answer. a. 8.78 b. 8.60 c. 8.69 d. 8.96 e. 8.87 Returns for the Alcoff Company over the last 3 years are shown below. What's the standard deviation of the firm's returns? (Hint: This is a sample, not a complete population, so the sample standard deviation formula should be used.) Select the correct answer. a. 17.04% b. 17.12% c. 17.06% d. 17.08% e. 17.10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started