Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are given the three EPS estimates and the following estimates related to the market earnings multiple: a. Based on the three EPS and P/E

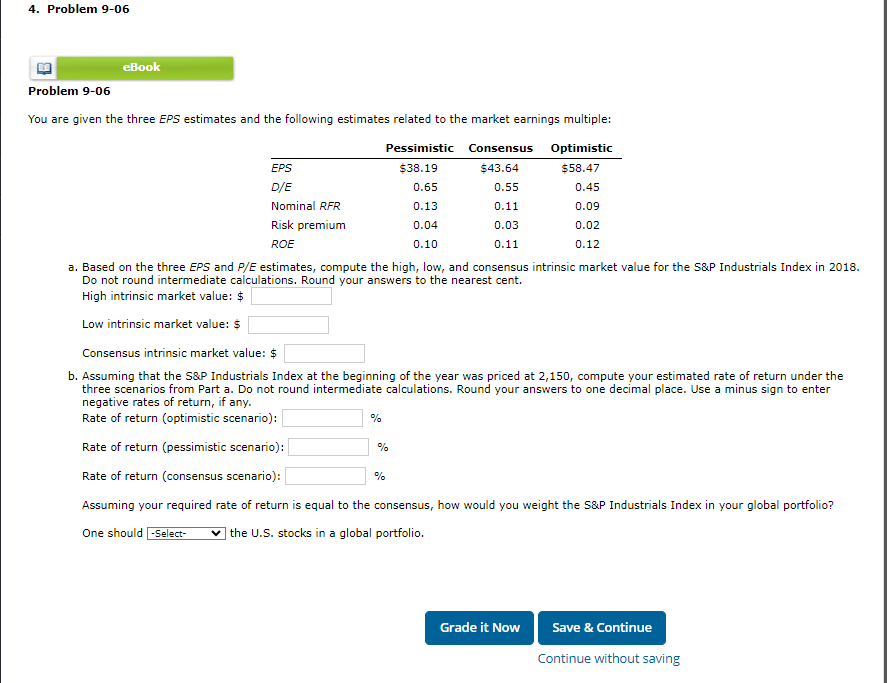

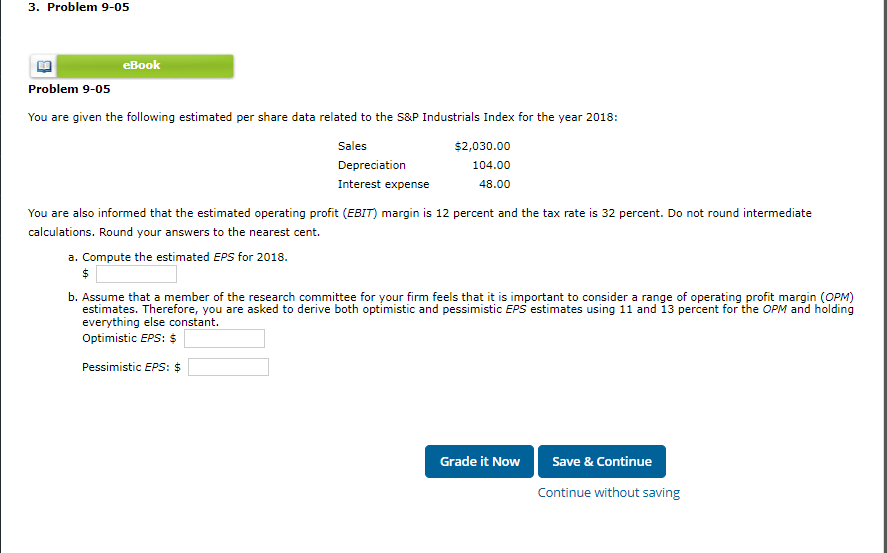

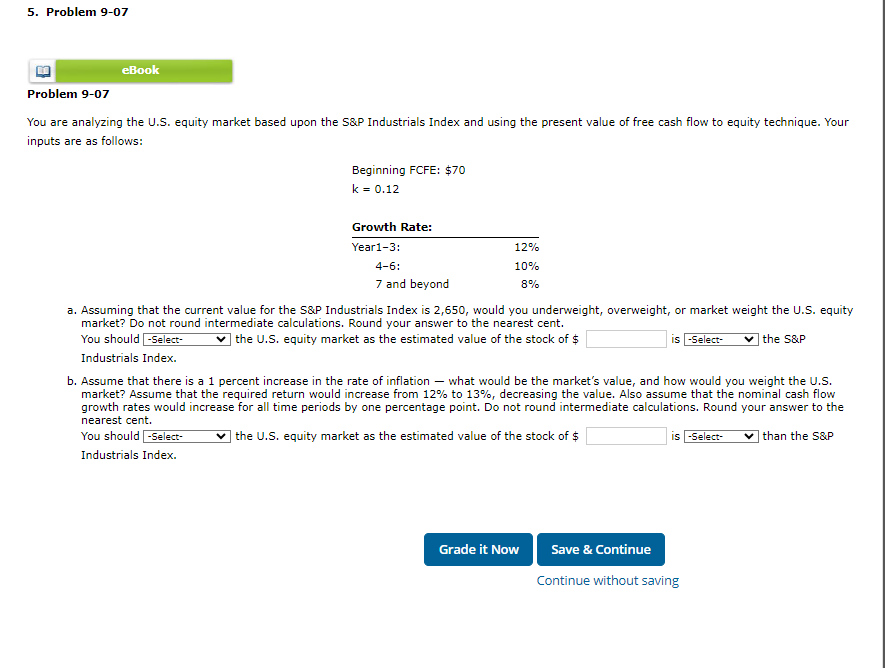

You are given the three EPS estimates and the following estimates related to the market earnings multiple: a. Based on the three EPS and P/E estimates, compute the high, low, and consensus intrinsic market value for the S\&P Industrials Index in 2018. Do not round intermediate calculations. Round your answers to the nearest cent. High intrinsic market value: $ Low intrinsic market value: $ Consensus intrinsic market value: \$ b. Assuming that the S\&P Industrials Index at the beginning of the year was priced at 2,150, compute your estimated rate of return under the three scenarios from Part a. Do not round intermediate calculations. Round your answers to one decimal place. Use a minus sign to enter negative rates of return, if any. Rate of return (optimistic scenario): % Rate of return (pessimistic scenario): % Rate of return (consensus scenario): % Assuming your required rate of return is equal to the consensus, how would you weight the S\&P Industrials Index in your global portfolio? One should the U.S. stocks in a global portfolio. You are given the following estimated per share data related to the S\&P Industrials Index for the year 2018: You are also informed that the estimated operating profit (EBIT) margin is 12 percent and the tax rate is 32 percent. Do not round intermediate calculations. Round your answers to the nearest cent. a. Compute the estimated EPS for 2018 . $ b. Assume that a member of the research committee for your firm feels that it is important to consider a range of operating profit margin (OPM estimates. Therefore, you are asked to derive both optimistic and pessimistic EPS estimates using 11 and 13 percent for the OPM and holdin everything else constant. Optimistic EPS: $ Pessimistic EPS: \$ You are analyzing the U.S. equity market based upon the S\&P Industrials Index and using the present value of free cash flow to equity technique. Your inputs are as follows: Beginning FCFE: $70 k=0.12 a. Assuming that the current value for the S\&P Industrials Index is 2,650, would you underweight, overweight, or market weight the U.S. equity market? Do not round intermediate calculations. Round your answer to the nearest cent. You should the U.S. equity market as the estimated value of the stock of $ is the S&P Industrials Index. b. Assume that there is a 1 percent increase in the rate of inflation - what would be the market's value, and how would you weight the U.S. market? Assume that the required return would increase from 12% to 13%, decreasing the value. Also assume that the nominal cash flow growth rates would increase for all time periods by one percentage point. Do not round intermediate calculations. Round your answer to the nearest cent. You should the U.S. equity market as the estimated value of the stock of $ is than the S\&P Industrials Index

You are given the three EPS estimates and the following estimates related to the market earnings multiple: a. Based on the three EPS and P/E estimates, compute the high, low, and consensus intrinsic market value for the S\&P Industrials Index in 2018. Do not round intermediate calculations. Round your answers to the nearest cent. High intrinsic market value: $ Low intrinsic market value: $ Consensus intrinsic market value: \$ b. Assuming that the S\&P Industrials Index at the beginning of the year was priced at 2,150, compute your estimated rate of return under the three scenarios from Part a. Do not round intermediate calculations. Round your answers to one decimal place. Use a minus sign to enter negative rates of return, if any. Rate of return (optimistic scenario): % Rate of return (pessimistic scenario): % Rate of return (consensus scenario): % Assuming your required rate of return is equal to the consensus, how would you weight the S\&P Industrials Index in your global portfolio? One should the U.S. stocks in a global portfolio. You are given the following estimated per share data related to the S\&P Industrials Index for the year 2018: You are also informed that the estimated operating profit (EBIT) margin is 12 percent and the tax rate is 32 percent. Do not round intermediate calculations. Round your answers to the nearest cent. a. Compute the estimated EPS for 2018 . $ b. Assume that a member of the research committee for your firm feels that it is important to consider a range of operating profit margin (OPM estimates. Therefore, you are asked to derive both optimistic and pessimistic EPS estimates using 11 and 13 percent for the OPM and holdin everything else constant. Optimistic EPS: $ Pessimistic EPS: \$ You are analyzing the U.S. equity market based upon the S\&P Industrials Index and using the present value of free cash flow to equity technique. Your inputs are as follows: Beginning FCFE: $70 k=0.12 a. Assuming that the current value for the S\&P Industrials Index is 2,650, would you underweight, overweight, or market weight the U.S. equity market? Do not round intermediate calculations. Round your answer to the nearest cent. You should the U.S. equity market as the estimated value of the stock of $ is the S&P Industrials Index. b. Assume that there is a 1 percent increase in the rate of inflation - what would be the market's value, and how would you weight the U.S. market? Assume that the required return would increase from 12% to 13%, decreasing the value. Also assume that the nominal cash flow growth rates would increase for all time periods by one percentage point. Do not round intermediate calculations. Round your answer to the nearest cent. You should the U.S. equity market as the estimated value of the stock of $ is than the S\&P Industrials Index Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started