Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are going to make a $70,000 downpayment on a home that costs $450,000 and will borrow the rest via a mortgage. You select

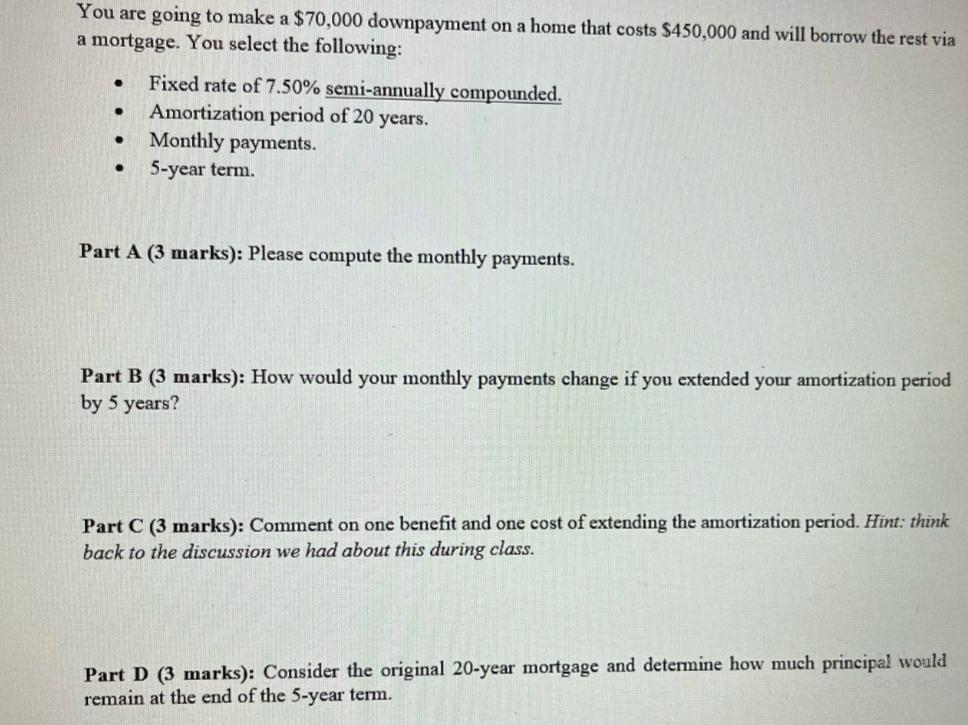

You are going to make a $70,000 downpayment on a home that costs $450,000 and will borrow the rest via a mortgage. You select the following: Fixed rate of 7.50% semi-annually compounded. Amortization period of 20 years. Monthly payments. 5-year term. Part A (3 marks): Please compute the monthly payments. Part B (3 marks): How would your monthly payments change if you extended your amortization period by 5 years? Part C (3 marks): Comment on one benefit and one cost of extending the amortization period. Hint: think back to the discussion we had about this during class. Part D (3 marks): Consider the original 20-year mortgage and determine how much principal would remain at the end of the 5-year term.

Step by Step Solution

★★★★★

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Part A Computing Monthly Payments To calculate the monthly mortgage payments we can use the formula for the monthly payment on a fixedrate mortgage Mo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started