Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are helping Charlotte and Lorenzo value a company that is expected to operate for three years, from today, January 1, 2024, to December

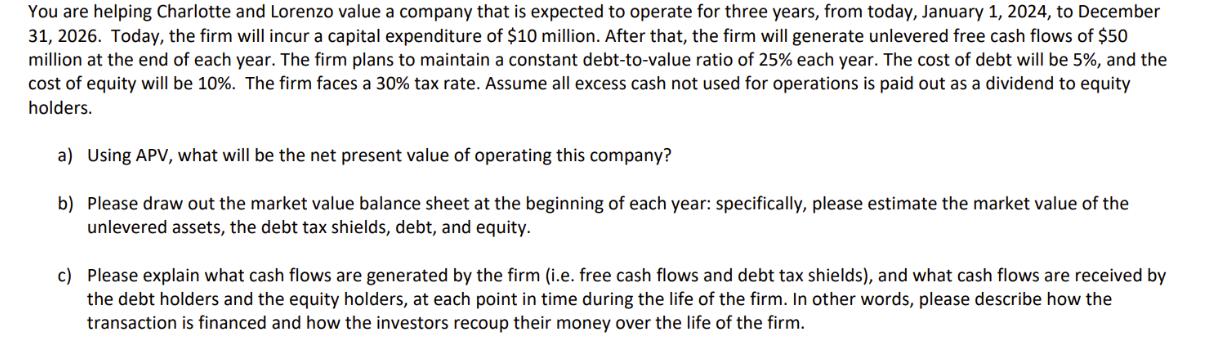

You are helping Charlotte and Lorenzo value a company that is expected to operate for three years, from today, January 1, 2024, to December 31, 2026. Today, the firm will incur a capital expenditure of $10 million. After that, the firm will generate unlevered free cash flows of $50 million at the end of each year. The firm plans to maintain a constant debt-to-value ratio of 25% each year. The cost of debt will be 5%, and the cost of equity will be 10%. The firm faces a 30% tax rate. Assume all excess cash not used for operations is paid out as a dividend to equity holders. a) Using APV, what will be the net present value of operating this company? b) Please draw out the market value balance sheet at the beginning of each year: specifically, please estimate the market value of the unlevered assets, the debt tax shields, debt, and equity. c) Please explain what cash flows are generated by the firm (i.e. free cash flows and debt tax shields), and what cash flows are received by the debt holders and the equity holders, at each point in time during the life of the firm. In other words, please describe how the transaction is financed and how the investors recoup their money over the life of the firm.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started