Question

You are helping Kim make projections for a 5-year project in the tech industry. The manufacturingequipment needed for the project costs 1.2 million, and according

You are helping Kim make projections for a 5-year project in the tech industry. The manufacturingequipment needed for the project costs 1.2 million, and according to the tax authority, is depreciatedusing the straight-line method over five years. The pre-tax salvage value of the equipment at the endof the five years is 400,000. The purchase of the equipment is made in year 0 (now). The expected revenues each year from production are expected to be 850,000 in year 1, then 870,000in year 2, then 890,000 in year 3, and so on (20,000 increments until year 5). The expected salesgrowth is an extrapolation from past data on average industry sector sales. The labor required tooperate the equipment will cost 100,000 every year, starting in year 1. Wages are not expected tochange over time due to strict employment regulations. The typical firm in the tech industry faces amarginal tax rate of 25%. Working capital each year is maintained at 10% ofnext year sales (and is fully recovered at the end:i.e. the level of working capital is 0 in year 5). Thus in year 0, the level of working capital will be10% ofsales in year 1 (assume there was no working capital prior to year 0). The cost of financing for the project can be inferred from the following data. The projected beta ofequity for the project is 1.1, and the firm is planning to maintain a constant debt-to-equity ratio (inmarket values) of 0.60 using non-amortized debt. Using expert forecasts for stock market returns.you believe that the annual expected return for the entire market is 8% for the next 5 years, and thatthe risk-free rate will be projected to remain at 4% over the entire life of the project. Analystsestimate that the typical cost of short-term non-amortized debt for tech projects is approximately 5%.

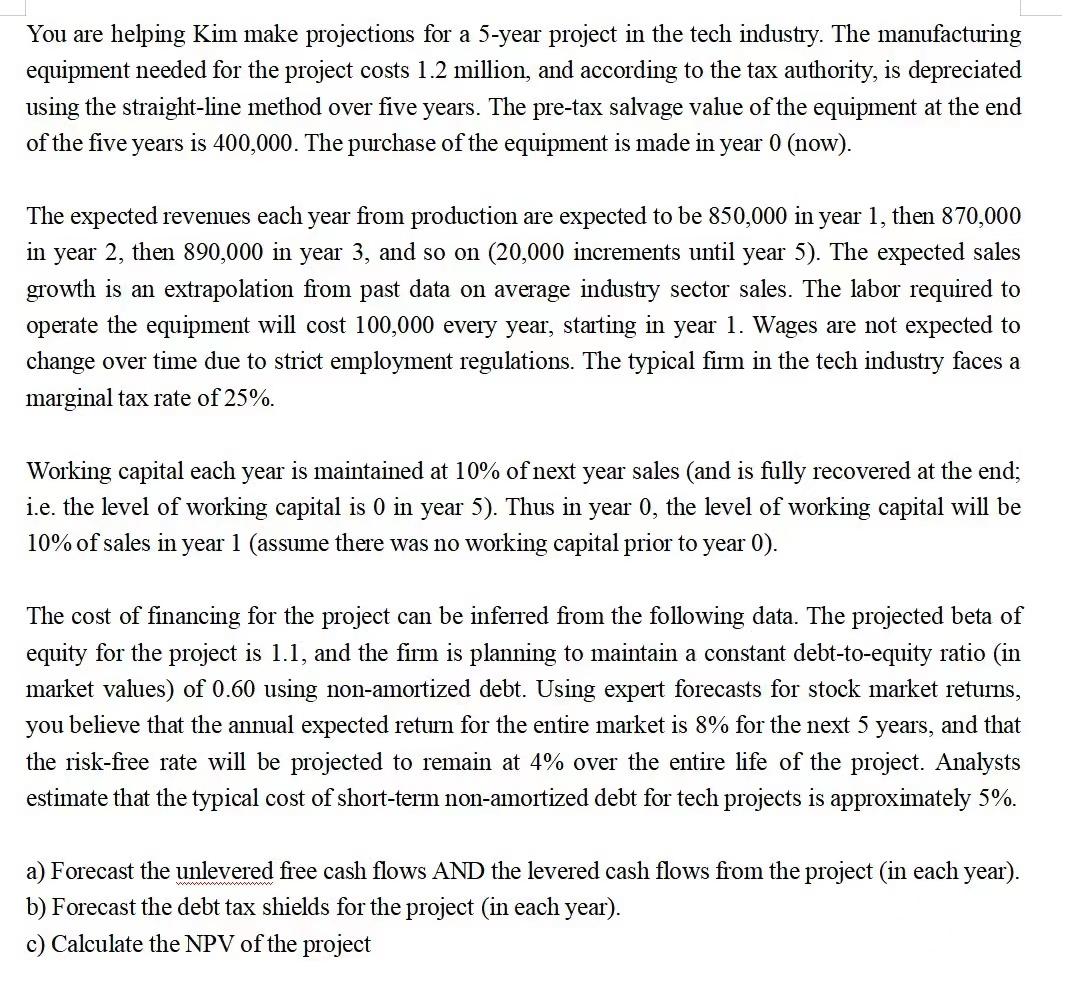

a) Forecast the unlevered free cash flows AND the levered cash flows from the project (in each year)

b) Forecast the debt tax shields for the project (in each year)

c) Calculate the NPV of the project

You are helping Kim make projections for a 5-year project in the tech industry. The manufacturing equipment needed for the project costs 1.2 million, and according to the tax authority, is depreciated using the straight-line method over five years. The pre-tax salvage value of the equipment at the end of the five years is 400,000 . The purchase of the equipment is made in year 0 (now). The expected revenues each year from production are expected to be 850,000 in year 1 , then 870,000 in year 2 , then 890,000 in year 3 , and so on (20,000 increments until year 5). The expected sales growth is an extrapolation from past data on average industry sector sales. The labor required to operate the equipment will cost 100,000 every year, starting in year 1. Wages are not expected to change over time due to strict employment regulations. The typical firm in the tech industry faces a marginal tax rate of 25%. Working capital each year is maintained at 10% of next year sales (and is fully recovered at the end; i.e. the level of working capital is 0 in year 5 ). Thus in year 0 , the level of working capital will be 10% of sales in year 1 (assume there was no working capital prior to year 0 ). The cost of financing for the project can be inferred from the following data. The projected beta of equity for the project is 1.1 , and the firm is planning to maintain a constant debt-to-equity ratio (in market values) of 0.60 using non-amortized debt. Using expert forecasts for stock market returns, you believe that the annual expected return for the entire market is 8% for the next 5 years, and that the risk-free rate will be projected to remain at 4% over the entire life of the project. Analysts estimate that the typical cost of short-term non-amortized debt for tech projects is approximately 5%. a) Forecast the unlevered free cash flows AND the levered cash flows from the project (in each year). b) Forecast the debt tax shields for the project (in each year). c) Calculate the NPV of the project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started