Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are helping your client to design an investment portfolio. Assuming that the universe of assets consists of three risky assets, whose return and risk

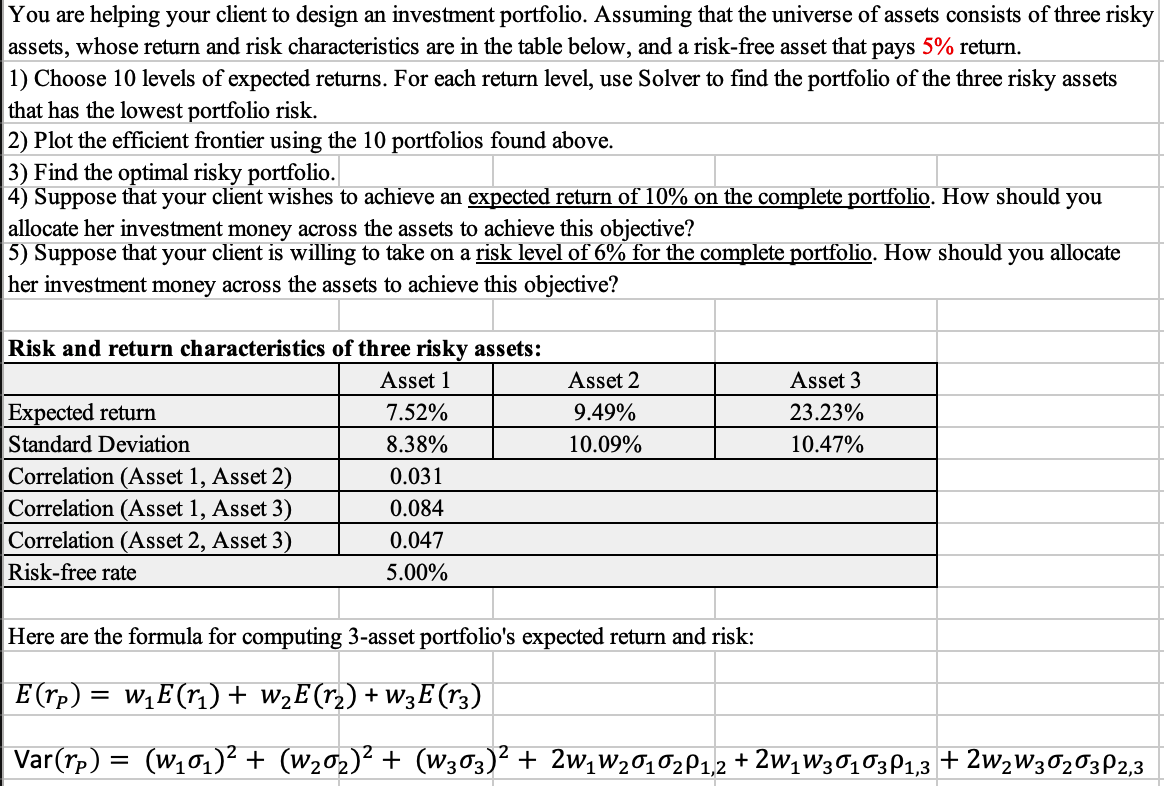

You are helping your client to design an investment portfolio. Assuming that the universe of assets consists of three risky

assets, whose return and risk characteristics are in the table below, and a riskfree asset that pays return.

Choose levels of expected returns. For each return level, use Solver to find the portfolio of the three risky assets

that has the lowest portfolio risk.

Plot the efficient frontier using the portfolios found above.

Find the optimal risky portfolio.

Suppose that your client wishes to achieve an expected return of on the complete portfolio. How should you

allocate her investment money across the assets to achieve this objective?

Suppose that your client is willing to take on a risk level of for the complete portfolio. How should you allocate

her investment money across the assets to achieve this objective?

Risk and return characteristics of three risky assets:

Here are the formula for computing asset portfolio's expected return and risk:

Var

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started