Answered step by step

Verified Expert Solution

Question

1 Approved Answer

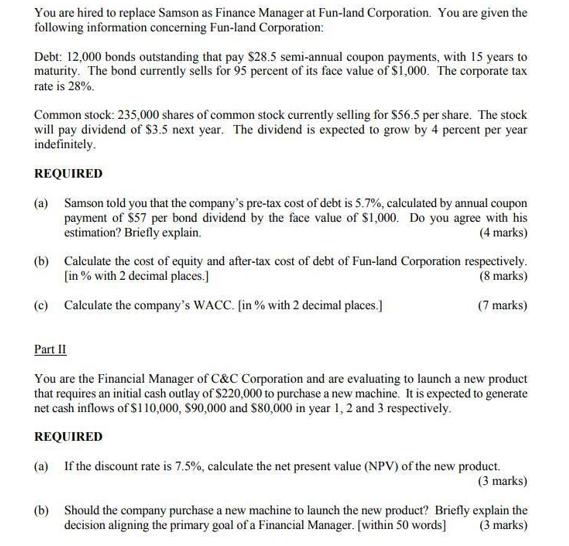

You are hired to replace Samson as Finance Manager at Fun-land Corporation. You are given the following information concerning Fun-land Corporation: Debt: 12,000 bonds

You are hired to replace Samson as Finance Manager at Fun-land Corporation. You are given the following information concerning Fun-land Corporation: Debt: 12,000 bonds outstanding that pay $28.5 semi-annual coupon payments, with 15 years to maturity. The bond currently sells for 95 percent of its face value of $1,000. The corporate tax rate is 28%. Common stock: 235,000 shares of common stock currently selling for $56.5 per share. The stock will pay dividend of $3.5 next year. The dividend is expected to grow by 4 percent per year indefinitely. REQUIRED (a) Samson told you that the company's pre-tax cost of debt is 5.7%, calculated by annual coupon payment of $57 per bond dividend by the face value of $1,000. Do you agree with his estimation? Briefly explain. (4 marks) (b) Calculate the cost of equity and after-tax cost of debt of Fun-land Corporation respectively. [in % with 2 decimal places.] (c) Calculate the company's WACC. [in % with 2 decimal places.] (8 marks) (7 marks) Part II You are the Financial Manager of C&C Corporation and are evaluating to launch a new product that requires an initial cash outlay of $220,000 to purchase a new machine. It is expected to generate net cash inflows of $110,000, $90,000 and $80,000 in year 1, 2 and 3 respectively. REQUIRED (a) If the discount rate is 7.5%, calculate the net present value (NPV) of the new product. (3 marks) (b) Should the company purchase a new machine to launch the new product? Briefly explain the decision aligning the primary goal of a Financial Manager. [within 50 words] (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started