Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are hoping to implement a project to distribute free fertilizer to farmers. In the current year (year 0), there will be an upfront

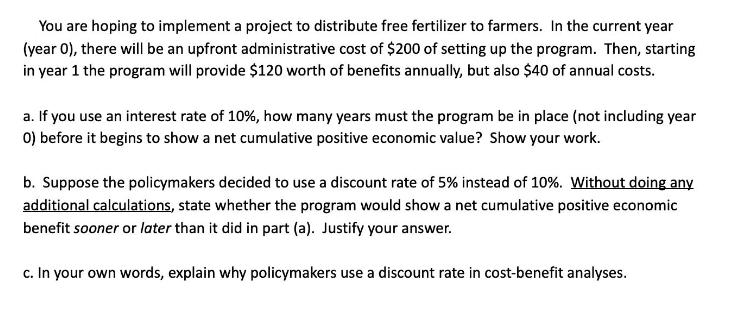

You are hoping to implement a project to distribute free fertilizer to farmers. In the current year (year 0), there will be an upfront administrative cost of $200 of setting up the program. Then, starting in year 1 the program will provide $120 worth of benefits annually, but also $40 of annual costs. a. If you use an interest rate of 10%, how many years must the program be in place (not including year 0) before it begins to show a net cumulative positive economic value? Show your work. b. Suppose the policymakers decided to use a discount rate of 5% instead of 10%. Without doing any additional calculations, state whether the program would show a net cumulative positive economic benefit sooner or later than it did in part (a). Justify your answer. c. In your own words, explain why policymakers use a discount rate in cost-benefit analyses.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine how many years must the program be in place before it begins to show a net cumulative positive economic value we need to calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started