Question

You are informed as follows: i) The cost of inventory in hand was identified on 5th April 2017 as 348,000. During the five days after

You are informed as follows:

i) The cost of inventory in hand was identified on 5th April 2017 as 348,000. During the five days after 31st March 2017 purchases and sales amounted to 28,000 and 45,000 respectively. Omnibus effects its sales at cost plus 25%.

ii) Rent account includes 18,000 paid on 1st December 2016 as rent for six months commencing on that date; while salaries amounting to 74,000 and advertising amounting to 7,000 remain unpaid as at the year-end. Omnibus plc treats rent and salary as administrative expenses.

iii) A trade debt of 4,000 should be written off and the Allowance adjusted to cover 4% of remaining trade receivables.

iv) The only movement of non-current assets during the year was acquisition of a new set of boardroom furniture on 1st July 2016 for 120,000. Companys policy is to depreciate its furniture as well as motor vehicles at 20% per annum, using the reducing balance method for furniture and straightline method for vehicles. Brand names, acquired on 1st April 2015, are expected to have a useful life of five years and are depreciated using the sum of the digits method. Omnibus regards the amortisation of brand name as part of its cost of sales. All motor cars are used by the company salesmen.

v) Reported as investments are the cost of shares acquired in Enterprise plc, a listed company. At acquisition these shares were irrevocably designated as held at fair value through profit and loss. The market value of these shares on 31st March 2017 was 418,000.

vi)Tax on current years profit, at 20%, is estimated at 34,000.

REQUIRED: Prepare for publication:

(a) the Statement of income for the year ended 31st March 2017; (12 marks)

(b) the Statement of changes in equity; and (1 mark)

c) the Statement of financial position as at 31st March 2017. (12 marks)

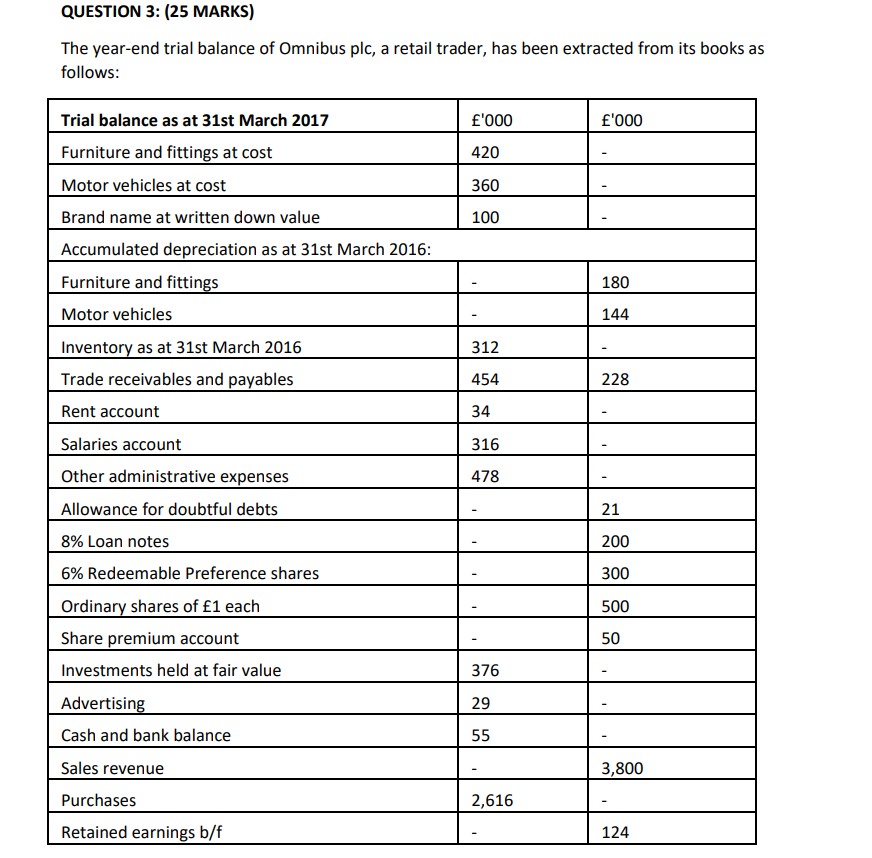

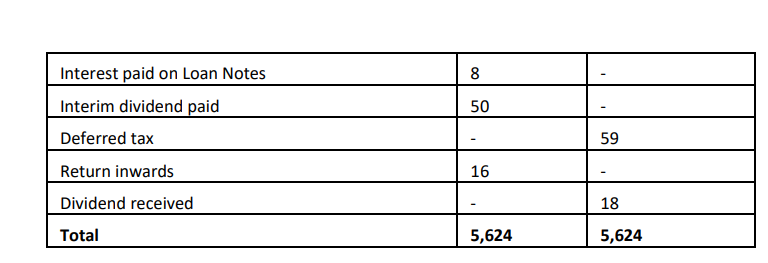

QUESTION 3: (25 MARKS) The year-end trial balance of Omnibus plc, a retail trader, has been extracted from its books as follows: '000 '000 420 360 100 Trial balance as at 31st March 2017 Furniture and fittings at cost Motor vehicles at cost Brand name at written down value Accumulated depreciation as at 31st March 2016: Furniture and fittings Motor vehicles Inventory as at 31st March 2016 Trade receivables and payables 180 144 312 454 228 Rent account 34 316 478 21 200 300 Salaries account Other administrative expenses Allowance for doubtful debts 8% Loan notes 6% Redeemable Preference shares Ordinary shares of 1 each Share premium account Investments held at fair value Advertising Cash and bank balance 500 50 376 29 55 Sales revenue 3,800 Purchases 2,616 Retained earnings b/f 124 8 Interest paid on Loan Notes Interim dividend paid Deferred tax 50 59 16 Return inwards Dividend received 18 Total 5,624 5,624Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started