Answered step by step

Verified Expert Solution

Question

1 Approved Answer

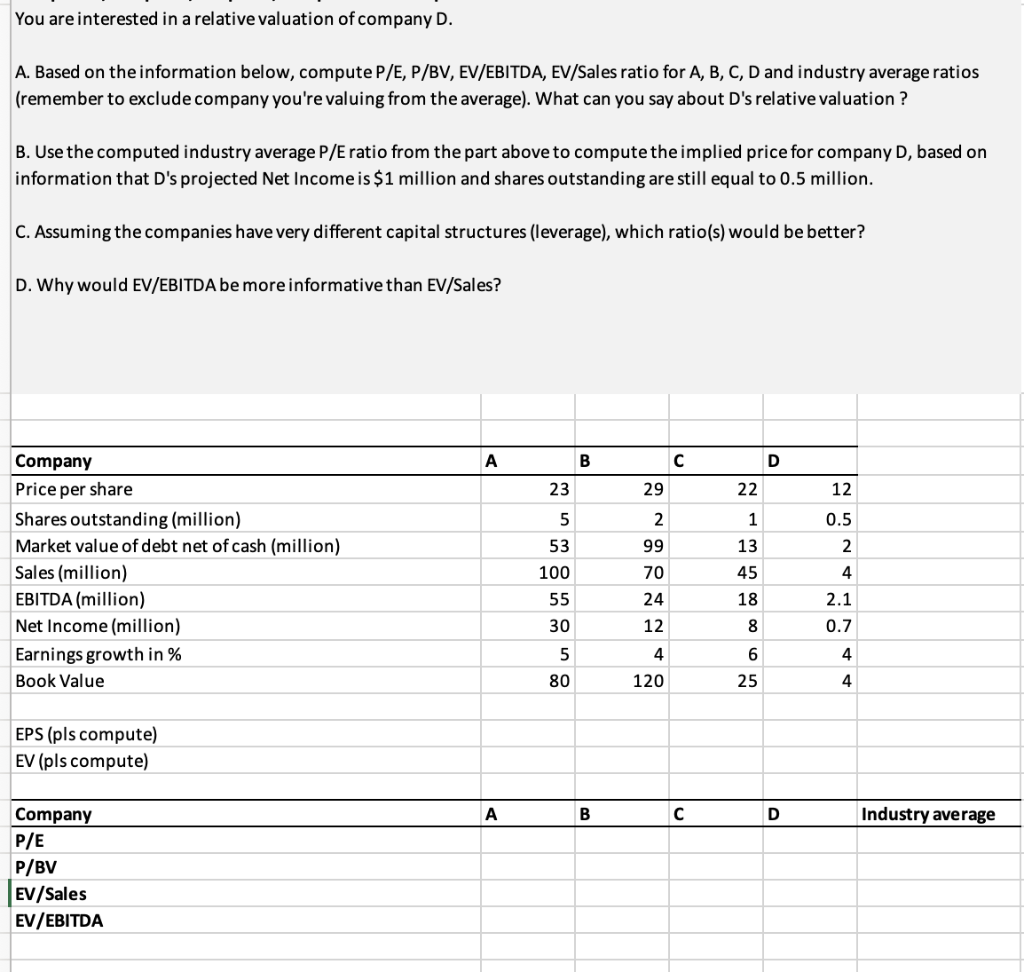

You are interested in a relative valuation of company D. A. Based on the information below, compute P/E,P/BV,EV/EBITDA,EV/Sales ratio for A,B,C,D and industry average ratios

You are interested in a relative valuation of company D. A. Based on the information below, compute P/E,P/BV,EV/EBITDA,EV/Sales ratio for A,B,C,D and industry average ratios (remember to exclude company you're valuing from the average). What can you say about D's relative valuation ? B. Use the computed industry average P/E ratio from the part above to compute the implied price for company D, based on information that D's projected Net Income is $1 million and shares outstanding are still equal to 0.5 million. C. Assuming the companies have very different capital structures (leverage), which ratio(s) would be better? D. Why would EV/EBITDA be more informative than EV/Sales? You are interested in a relative valuation of company D. A. Based on the information below, compute P/E,P/BV,EV/EBITDA,EV/Sales ratio for A,B,C,D and industry average ratios (remember to exclude company you're valuing from the average). What can you say about D's relative valuation ? B. Use the computed industry average P/E ratio from the part above to compute the implied price for company D, based on information that D's projected Net Income is $1 million and shares outstanding are still equal to 0.5 million. C. Assuming the companies have very different capital structures (leverage), which ratio(s) would be better? D. Why would EV/EBITDA be more informative than EV/Sales

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started