Question

You are interested in acquiring a multi-family rental property. After closing costs and property improvements, the total cost of the property is $64,374,000. For this

You are interested in acquiring a multi-family rental property. After closing costs and property improvements, the total cost of the property is $64,374,000. For this transaction, your loan-to-value is 70%. To improve your leverage, you negotiate with the bank to let you finance 70% with them and 10% with another lender that the bank approves and that is 100% subordinate to the bank. Because youd rather use external capital than finance all of the equity yourself, you also find an equity partner who agrees to an 85/15.

What are the amounts of the Senior debt, Mezzanine debt, Preferred equity, and Common equity?

A) Senior debt: $45,061,800, Mezzanine debt: $6,437,400, Common equity: $1,931,220, Preferred equity: $10,943,580

B) Senior debt: $45,061,800, Mezzanine debt: $6,437,400, Common equity: $10,943,580, Preferred equity: $1,931,220

C) Senior debt: $44,561,800, Mezzanine debt: $6,437,400, Common equity: $5,930,099, Preferred equity: $6,437,400

D) Senior debt: $45,761,800, Mezzanine debt: $6,537,400, Common equity: $1,961,220, Preferred equity: $11,113,580

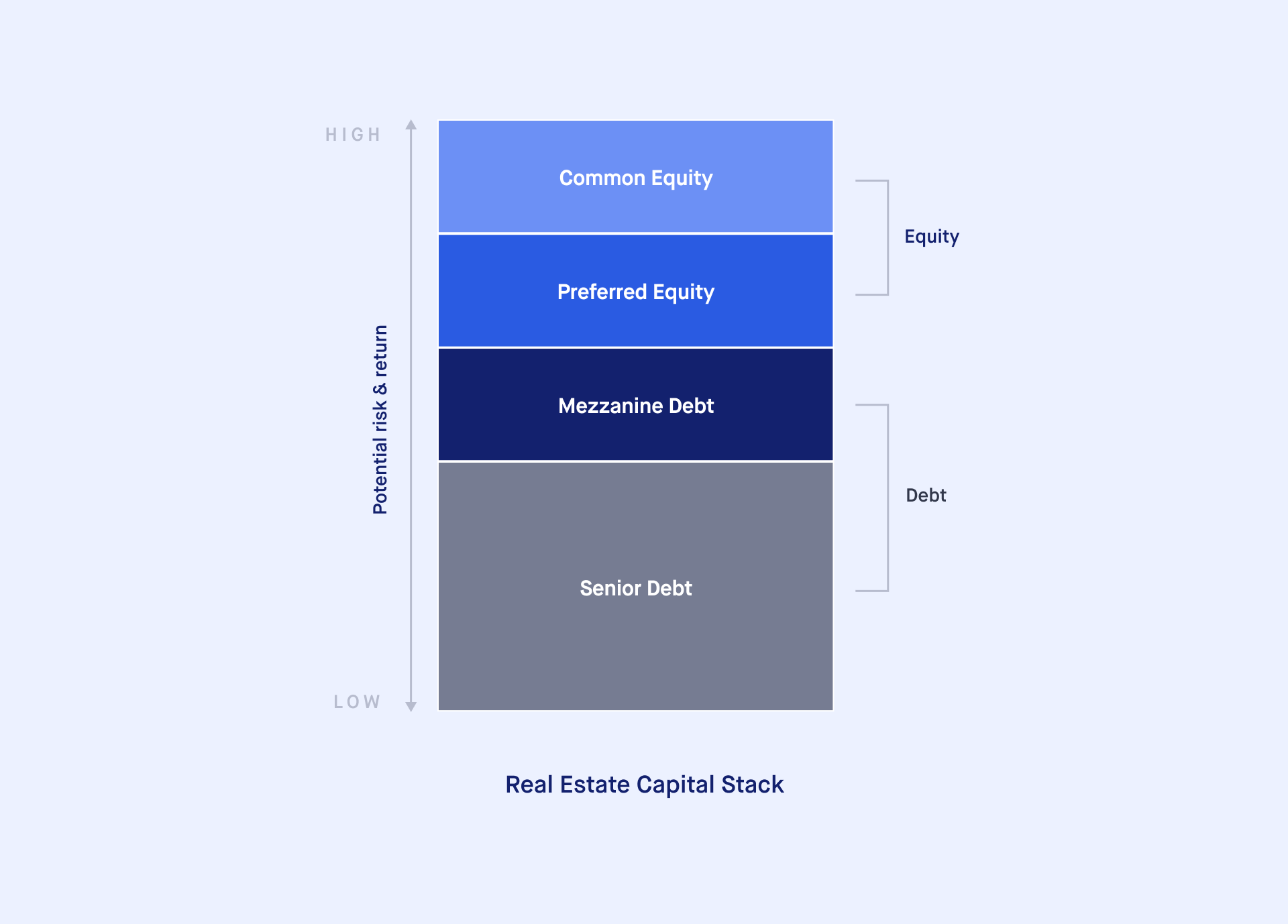

Real Estate Capital Stack

Real Estate Capital Stack Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started