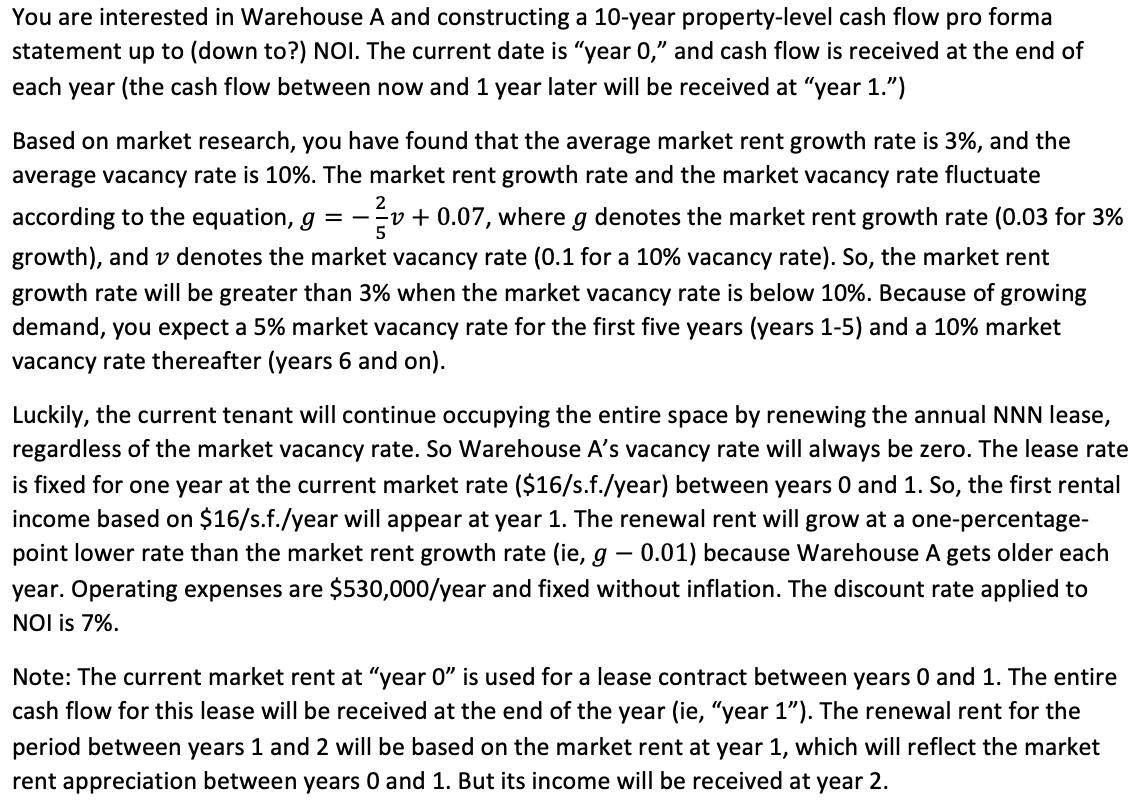

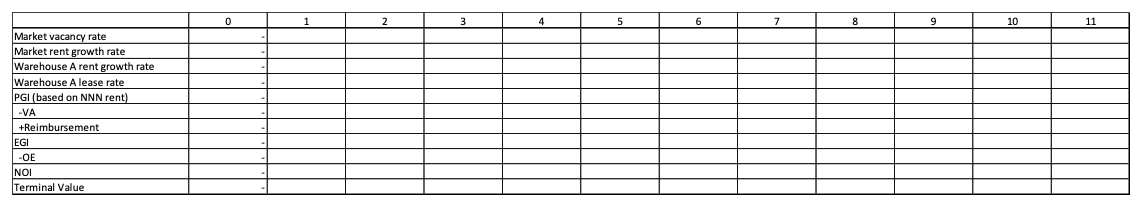

You are interested in Warehouse A and constructing a 10 -year property-level cash flow pro forma statement up to (down to?) NOI. The current date is "year 0 ," and cash flow is received at the end of each year (the cash flow between now and 1 year later will be received at "year 1. ") Based on market research, you have found that the average market rent growth rate is 3%, and the average vacancy rate is 10%. The market rent growth rate and the market vacancy rate fluctuate according to the equation, g=52v+0.07, where g denotes the market rent growth rate 0.03 for 3% growth), and v denotes the market vacancy rate (0.1 for a 10% vacancy rate). So, the market rent growth rate will be greater than 3% when the market vacancy rate is below 10%. Because of growing demand, you expect a 5% market vacancy rate for the first five years (years 1-5) and a 10% market vacancy rate thereafter (years 6 and on). Luckily, the current tenant will continue occupying the entire space by renewing the annual NNN lease, regardless of the market vacancy rate. So Warehouse A s vacancy rate will always be zero. The lease rate is fixed for one year at the current market rate (\$16/s.f./year) between years 0 and 1 . So, the first rental income based on \$16/s.f./year will appear at year 1 . The renewal rent will grow at a one-percentagepoint lower rate than the market rent growth rate (ie, g0.01 ) because Warehouse A gets older each year. Operating expenses are $530,000/ year and fixed without inflation. The discount rate applied to NOI is 7%. Note: The current market rent at "year 0 " is used for a lease contract between years 0 and 1 . The entire cash flow for this lease will be received at the end of the year (ie, "year 1 "). The renewal rent for the period between years 1 and 2 will be based on the market rent at year 1 , which will reflect the market rent appreciation between years 0 and 1 . But its income will be received at year 2 . You are interested in Warehouse A and constructing a 10 -year property-level cash flow pro forma statement up to (down to?) NOI. The current date is "year 0 ," and cash flow is received at the end of each year (the cash flow between now and 1 year later will be received at "year 1. ") Based on market research, you have found that the average market rent growth rate is 3%, and the average vacancy rate is 10%. The market rent growth rate and the market vacancy rate fluctuate according to the equation, g=52v+0.07, where g denotes the market rent growth rate 0.03 for 3% growth), and v denotes the market vacancy rate (0.1 for a 10% vacancy rate). So, the market rent growth rate will be greater than 3% when the market vacancy rate is below 10%. Because of growing demand, you expect a 5% market vacancy rate for the first five years (years 1-5) and a 10% market vacancy rate thereafter (years 6 and on). Luckily, the current tenant will continue occupying the entire space by renewing the annual NNN lease, regardless of the market vacancy rate. So Warehouse A s vacancy rate will always be zero. The lease rate is fixed for one year at the current market rate (\$16/s.f./year) between years 0 and 1 . So, the first rental income based on \$16/s.f./year will appear at year 1 . The renewal rent will grow at a one-percentagepoint lower rate than the market rent growth rate (ie, g0.01 ) because Warehouse A gets older each year. Operating expenses are $530,000/ year and fixed without inflation. The discount rate applied to NOI is 7%. Note: The current market rent at "year 0 " is used for a lease contract between years 0 and 1 . The entire cash flow for this lease will be received at the end of the year (ie, "year 1 "). The renewal rent for the period between years 1 and 2 will be based on the market rent at year 1 , which will reflect the market rent appreciation between years 0 and 1 . But its income will be received at year 2